Colours, green tech, and bright ideas — The Noel D’Cunha Sunday Column

The wide-format printing industry is at a crossroads, driven by technological advancements, shifting consumer expectations, and a push for sustainability. At Media Expo 2025, the INR 4,150-crore sector revealed a vibrant landscape. Prabhat Prakash and Noel D’Cunha uncover the tech-trends India’s wide-format printing scene is powered by a USD four-trillion economy, the world’s fifth-largest.

18 May 2025 | By Noel D'Cunha

It’s not just big signs, but colours that make brands unforgettable, printers that race ahead, and green ideas that save the planet. At Media Expo 2025, six leaders shared their visions for a fast-growing INR 4,300-crore market.

Pantone nails every hue, Avery Dennison recycles tonnes, HP and Epson launches cutting-edge machines, Kromodyne Digital Solutions transforms decor, and Apsom keeps it affordable. With India’s GDP projected to hit USD seven-trillion by 2030 — potentially USD nine-trillion or more — making it the third-largest economy, wide-format printing is set to paint a bold future from metros to small towns.

Bold brands through colour

Colour is the magic that makes a Pepsi sign pop from miles away. Pantone’s regional sales and marketing manager, SS Shalgaonkar, says that the system, with 2,390 colours for signs and 15,000 total shades, keeps hues consistent worldwide. “A brand’s red stays red, no matter where,” he explains. Big players like Coca-Cola use Pantone 98% of the time, but smaller Indian firms are at 10–20%. The company’s Connect app, which costs about INR 7,000 a year, ties colour to design tools like Adobe, cutting errors from screen to print by 90%. “It’s like handing designers a perfect recipe,” he adds.

SS Shalgaonkar, regional sales and marketing manager, Pantone

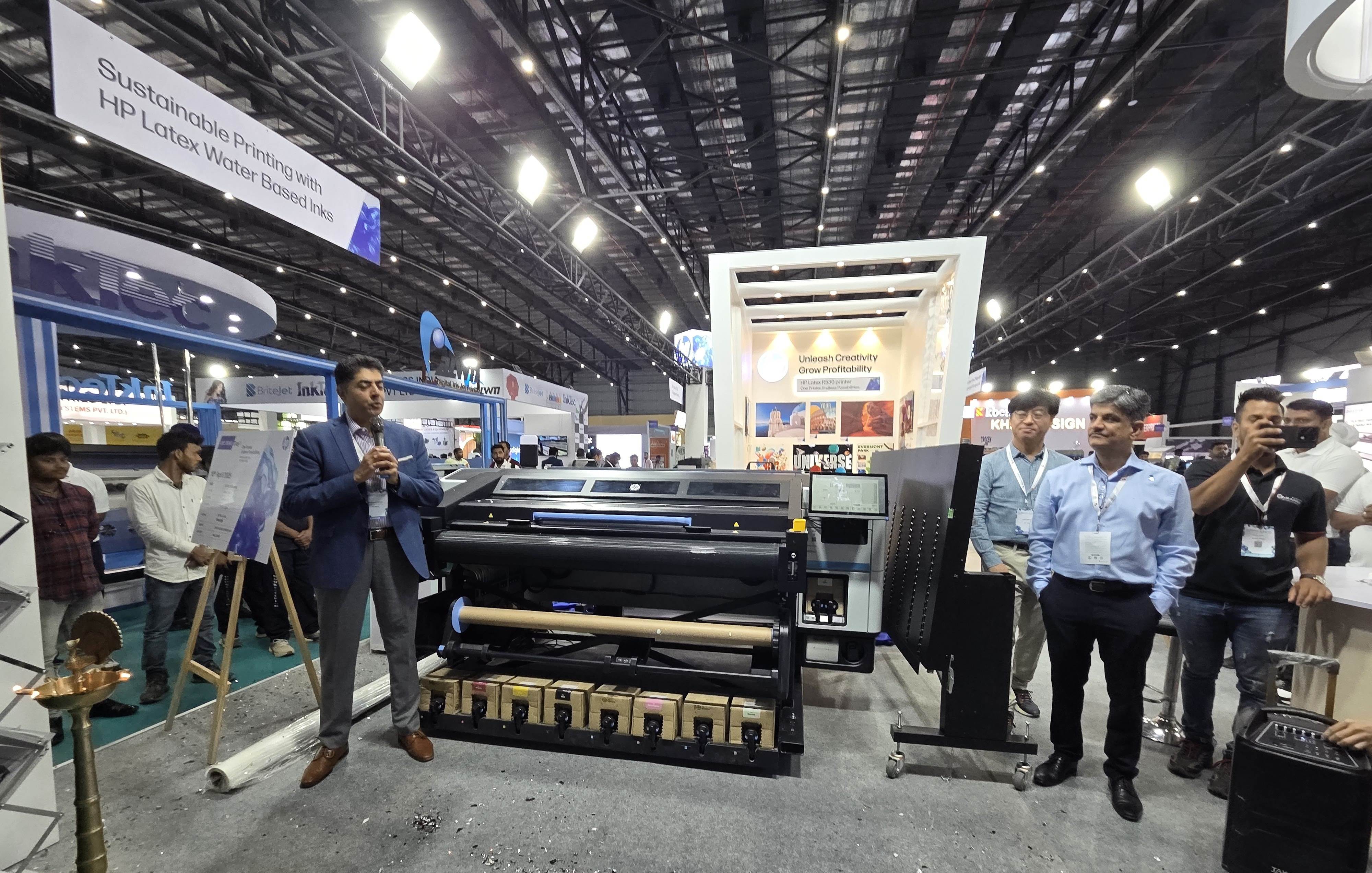

HP India launched its latest HP Latex Series, the Latex R530 large-format printer, marking its India debut at Media Expo Mumbai 2025. HP’s country head for India, Bangladesh, and Sri Lanka for the large-format printing business, Vitesh Sharma, boasts the Latex R530’s colours checker hits Pantone shades dead-on, with an accuracy score (Delta E) under 2 — too close for the eye to notice.

“Pepsi’s blue is always Pepsi’s blue,” he says. Kromodyne Digital Solution’s director, Santosh Nair, is launching India’s first G7-certified colours lab, aiming for Delta E below 1.5. “Wallpapers can’t be off even by a smidge,” he notes, with 30% of clients rejecting mismatched prints.

Santosh Nair, director, Kromodyne Digital Solution

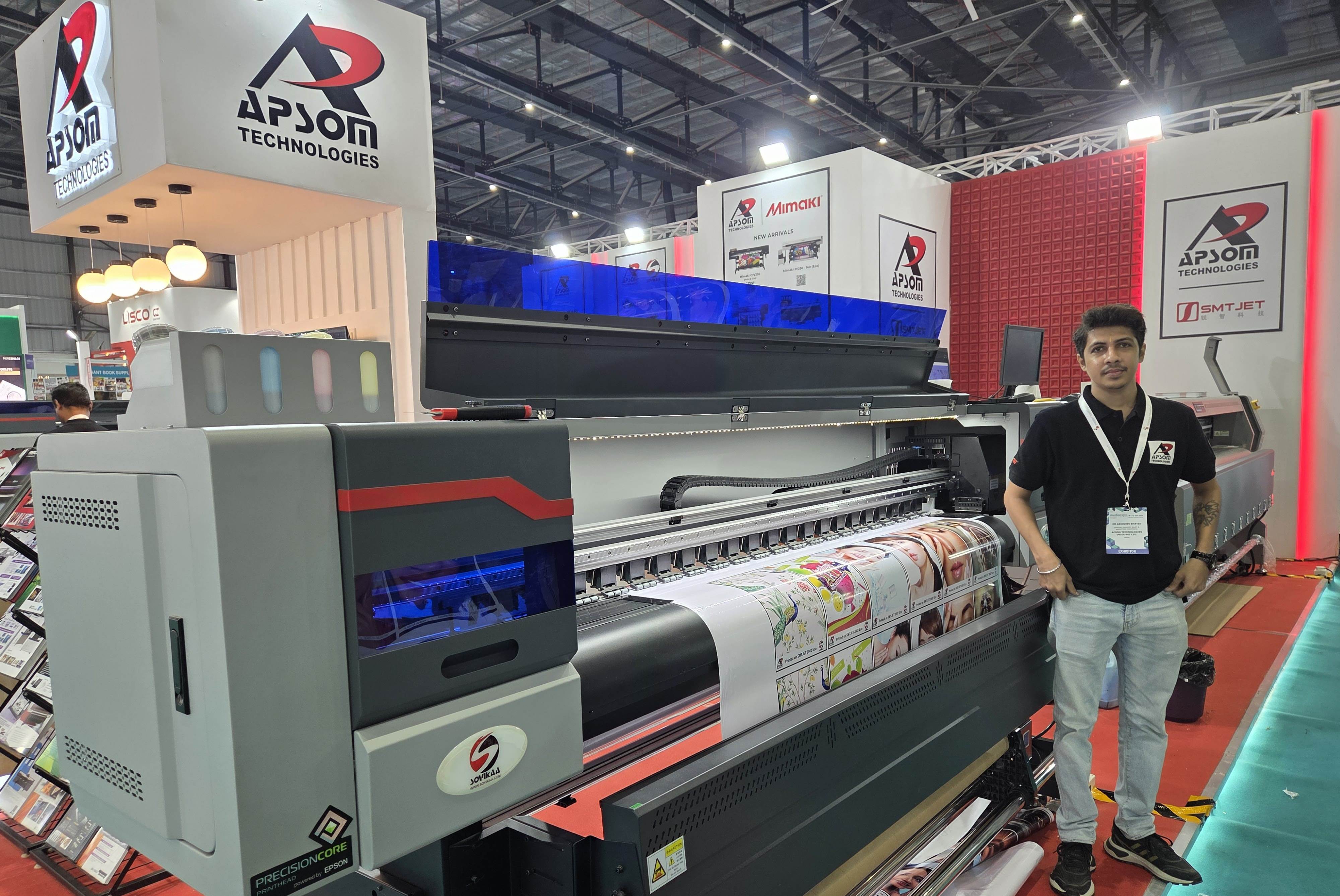

Apsom Technologies’ director Abhishek Mahajan uses Pantone with Mimaki printers to lock in Vodafone’s red for 1.8-meter indoor signs, speeding setup by 20% and cutting reprints by 10%. Apsom handles Mimaki’s sales in Maharashtra. The company’s Suvika machines, tested in China, nail colours 85% right for billboards. “Banks demand perfect logos,” he says, with one in five jobs needing that precision.

Epson India’s theme at Media Expo Mumbai was to build “the future of high-performance printing and explore the new standard in commercial printing.” Epson India’s large format printing business manager, Amit Sehgal, ups the eco-solvent game with the SureColour SC-S9130, packing 11 colours, including red, orange, and a new green. “We hit 99% colour accuracy,” he claims, perfect for vibrant signs where green-like forest shades stand out. The SC-P7530, a 24-inch photo printer, also delivers razor-sharp hues for art studios, matching Pantone with ease.

Why it matters? Colours are a brand’s handshake — get it wrong, and trust fades. Pantone sets the bar, HP, Kromodyne, and Epson bring the tech, and Apsom make it work for everyone. With 5,000 Indian print shops still learning. There’s INR 830-crore in untapped print jobs for those who get it right.

Eco-friendly printing boosts business

Going green is non-negotiable, and the numbers prove it’s paying off. Avery Dennison’s country manager for graphics in South Asia, Nitin Mittal, speaking at the Media Expo Industry Talks, says they’ve recycled 100-tonnes of sign liners since 2023, turning them into notebooks and crafts. Their Noida factory’s solar panels churn out enough power for 800 homes yearly, saving 700 tonnes of carbon dioxide, like planting 28,000 trees. Their SP 1504 film skips toxic PVC, cutting emissions by 53% and chemicals by 80%, backed by global tests.

HP’s Latex R530 runs on inks that are 70% water, safe for schools, hospitals, and operators, says Sharma of HP. He also adds that the water used in inks is reclaimed water. Up to 40-45% (some models) of its parts are recycled plastic. Their take-back programme grabbed 500 tonnes of cartridges (Some HP large-format printers, like the Latex 700 and 800 series and the newly launched printer at Media Expo, the R530, use HP eco-carton ink cartridges, which are specifically designed to be recycled). HP also runs a planet partner programme under which HP collects used cartridges for recycling. Users can also return their old printer hardware for recycling in some cases.

Kromodyne’s Nair teams with JC Media for a material that’s 85% recyclable, halving a campaign’s carbon footprint. They strip inks chemically, reusing 90% in car dashboards.

Apsom’s Mahajan loves UV inks that last three to five years, reducing reprints by 20%. “Longer life means less waste,” he says. Mimaki printers save 15% on materials, but Suvika’s budget models don’t recycle yet. Mahajan’s betting on service to keep clients loyal. Pantone helps by nailing colours first try, avoiding extra runs. Their plant-based ink guides cut chemical use by 25%, meeting Europe’s strict rules.

Abhishek Mahajan, director, Apsom Technologies

Epson India’s Sehgal says all their inks are eco-friendly. The SureColour SC-S9130’s eco-solvent inks have just 3% solvents, and their resin inks for the SC-R5030L are water-based and odourless, slashing emissions. “Sustainability’s in our DNA,” Sehgal notes, with the SC-G6030’s textile prints lasting years, cutting fabric waste by 10–15%.

Saving 700-tonnes of carbon dioxide or recycling 85% of materials isn’t just planet-friendly—it’s smart business. Avery Dennison and Kromodyne reuse champs, HP, and Epson cut waste early, Apsom stretches life spans, and Pantone keeps it lean. Eco-tech makes up INR 430-crore of the INR 4,150-crore wide format printing industry and has the potential to hit INR 3,010-crore by 2030.

Tech-packed printers deliver power

Today’s printers are like superheroes — fast, sharp, and versatile. HP’s Latex R530, a 1.6-meter machine, prints 50-sqm an hour on rolls and 20 on stiff boards, with crisp 1,200-dpi images. It switches jobs in two minutes, and its inks dry instantly, saving two to three hours per run. “Small shops cut up to 30% off labour,” Sharma says.

Kromodyne’s Kaleido 3.2-metre giant pumps out 80-sqm an hour at 1,200 dpi, adding varnish or white ink for flair. The company’s 1.9-meter model, under INR 20 lakh, hits 30-sqm at 600-dpi for small-town decor, targeting 500 sales by 2027. Apsom’s Mimaki UJV100-160 does 65-sqm an hour at 1,200-dpi with UV inks, breaking down just 1% of the time. Suvika’s 3.2-m models crank 90-sqm at 720 dpi, 30% cheaper but needing 10% more fixes. Mahajan sells 30 to 45 Mimaki and 30 to 70 Suvika units yearly.

Epson India’s Sehgal showcased a fleet at Media Expo. The SureColour SC-S9130, with 11 colours and a PrecisionCore MicroTFP printhead with 9,600 nozzles, prints at a maximum print speed of 119.4-sqm per hour at 300-dpi, replacing older models with slicker tech. The SC-G6030, their first direct-to-film (DTF) textile printer, spans 35-inch and hits 40-sqm an hour for fabrics. The SC-R5030L, a 64-inch, six-colour, dual printhead signage beast, uses resin inks for indoor/outdoor signages, wallpapers and more, ready to laminate right away.

Amit Sehgal, large format printing business manager, Epson India

Pantone’s Connect app tracks 15,000 colours, scanning 10-million global searches monthly to spot trends, saving designers 15% of their time. Avery Dennison’s SP 1504 film works on UV or latex printers at 1,200-dpi, lasting five years without fading.

Why it matters? Machines dishing out 40- to 90-sqm an hour with razor-sharp images let shops do more with less. HP, Kromodyne, and Epson make it user-friendly, Apsom offers options, and Avery Dennison ensures quality. Pantone keeps designs tight. With 30% of India’s 15,000 printers ageing out, shops will drop INR 2,580-crore on these powerhouses.

Prints personality with embellishment

Shiny varnish or sparkly foil makes signs leap off the wall, stealing attention from digital screens. Kromodyne’s Nair demos varnish on its Kaleido 3.2-m printer, boosting murals’ richness by 30%. “A jewellery sign looked 3D with foil,” saying, “Inline foiling is coming in 2026, saving 40% of the time.” The company’s Kaleido 1.9-m machine coats 20- to 50-inch wallpapers, with 70% of decor clients hooked.

HP’s Latex R530 uses white ink to make colours 25% bolder on dark backgrounds, says Sharma — about 15% of jobs use this trick. Apsom’s Mimaki printers add white ink for signs, but Mahajan says only 5% of Suvika clients want varnish — it costs more. Epson’s currently available 10 colour, 4x8-ft bed size model, SC-V7000 and the upcoming SureColour SC-V1030, a compact A4 size, UV printers, can print directly on any substrates like wood, metal, glass, plastic, canvas, and textile, and can add glossy layers as well, as per Sehgal. Avery Dennison’s films take glossy topcoats — 15% of orders ask for it, says Mittal. Pantone’s sparkly colour guides inspire 20% of global sign designs.

The hot stamping foils market in India is part of a larger global market estimated at over USD 1.91-billion in 2024. While specific data for India is not available, India is part of the larger Asia Pacific market, which is a significant growth area for hot stamping foils.

The Indian overprint varnishes market was valued at USD 3.42-billion in 2024 and is expected to grow to USD 5.07-billion by 2034, with a compound annual growth rate of around 4%. Varnish and foil are expected to add significant volumes to the Indian market, making prints feel alive.

Kromodyne’s out front, HP, Epson, and Apsom are growing, and Avery Dennison and Pantone spark ideas. With 40% of retail brands craving that touchy-feely vibe, this could hit USD 100-million by 2028.

Growth that roars louder

India’s INR 4,150-crore wide-format market is soaring in a USD four-trillion economy, with 6.5% growth eyed for 2025. Non-metros fuel 70% of eCommerce’s USD 60-billion market, needing 10-million sqft signs for metros and airports. “Infrastructure’s driving print,” HP’s Sharma says, pointing to retail and transit growth.

Kromodyne’s Nair sees 1,500–2,000 decor printers, with wallpapers up 12% and taking 35% of big jobs. “Decor has gone mainstream,” Nair says, targeting 500 budget-machine sales in small towns. Apsom’s Mahajan says that Surat’s textiles are exploding. “It is a key market, with over 100 installations since our partnership with Mimaki began in 2009,” he says.

Epson’s Sehgal notes the SC-G6030’s 20% shift to direct-to-film textiles. “Garment makers want fast, vivid prints,” he says. The SC-S9130’s green ink drives 15% signage growth. “Clients love the vibrancy,” Sehgal adds. Avery Dennison’s Mittal forecasts 8% green printing growth. “By 2026, 30% of brands will go eco,” he says. Pantone ties INR 430-crore in IPL ads to colour. “Sports branding thrives on bold hues,” Shalgaonkar says.

Projects (40%), retail (30%), and decor (20%) will push the market toward INR 6,880-crore by 2030, but 20% of small shops need funds to compete.

Regional dynamics: Small towns, big plans

Smaller cities are stealing the show. HP’s Sharma says 70% of online shopping money comes from places like non-metro cities. Kaleido 1.9-m machine targets 1,000 shops in Uttar Pradesh and Bihar, where decor jobs grow 15%. “They want quality, not just cheap,” Nair says.

Apsom’s Mahajan is scouting the North, with a Delhi team pitching to 200 printers. “Mumbai’s packed — Patna pays 20% more,” he says, with 30% of Suvika sales in small cities. Epson’s Sehgal notes Tier-2 demand for the SC-G6030, with the city’s estimated projections of an investment exceeding Rs 600 crore in digital printing and advanced embroidery machines. The SC-V1030’s compact size fits small shops. Avery Dennison recycles liners in 10 smaller towns, grabbing 20 tonnes in 2024.

Why it matters: Small cities, with 40% of India’s 15,000 print shops, are a USD 1,660-crore market, growing 10% faster than big hubs. HP, Kromodyne, Epson, and Apsom’s affordable gear fits the vibe, Avery Dennison’s recycling helps, and Pantone spreads know-how. But 50% of these shops need USD 20-million in training to compete.

Static vs digital: Lasting vs flashy

Printed signs still outshine digital screens, with numbers backing them up. Kromodyne’s Nair points to LIC topping the advertising chart in print, remembered by 80% of folks versus 20% for a 10-second digital ad. “Print builds trust,” he says—Colgate’s signs last six months. HP’s Sharma sees a mix, with 90% of 1,500 new bus stops blending both, their Latex signs holding up to three years.

Apsom’s Mimaki signs keep colours true 90% of the time, beating digital’s 70% under weird lights, says Mahajan. Suvika’s billboards last two years, with 60% of clients picking print to save cash.

Epson’s SC-S9130 & SC-R5030L prints signs ready to use instantly, says Sehgal. Avery Dennison’s green films win 25% of clients who want eco-signs. Pantone’s colours light up 60% of IPL’s printed ads.

Why it Matters: According to IMARC Group’s report, the Indian print advertising market size reached USD 1.04-billion in 2024. “A good part of it banks on signages lasting 3–5 years, says Apsom. Kromodyne, HP, and Epson mix print with digital for projects, while Avery Dennison and Pantone make signs greener and bolder. Digital’s growing 15%, but print’s got staying power.

Future Outlook: teamwork makes the dream work

The future’s about joining hands. Pantone wants half of India’s brands to use their colours, with 10,000 app users. Avery Dennison aims to recycle 500 tonnes a year and go 100% green. HP targets to be a leader in this segment. Kromodyne’s colours lab seeks 200 clients, plus 10% growth in special fabrics. Apsom plans 100 North India sales, with UV signs hitting 15% of the market. Epson eyes a good SC-G6030 unit sale for textiles and SC-S9130S for signage by 2028, says Sehgal, absorbing global tariffs to stay competitive.

Why it matters: The large-format market could hit INR-6,640 with 20,000 print shops by 2030. HP, Kromodyne, and Epson’s tech, Avery Dennison’s recycling, Apsom’s deals, and Pantone’s colours tie it together. A boost for training and green gear could make India a global print star.

Wrapping it up: India’s print party

India’s wide-format world’s future is set to be electric—printers jetting out crisp 1,200 dpi images, materials recycling 85% of waste, and colours hitting the mark every time. Pantone keeps brands sharp, Avery Dennison goes green, HP builds fast machines, Kromodyne dreams big for decor, Apsom brings signs everywhere, and Epson weaves textiles into the mix. Cutting 700 tonnes of CO2 and covering 10-million square feet of signs, this industry’s got heart and hustle. With small towns jumping in and print-digital combos popping off, India’s print shops are set to dazzle the world.

HP bets on PrintOS to digitise PSP operations

HP is focusing on simplifying wide-format print operations with its PrintOS Production Hub, a cloud-based solution aimed at modernising workflow management for print service providers (PSPs), particularly in the MSME segment.

Vitesh Sharma, country manager for large-format printing at HP India, Bangladesh, and Sri Lanka, said, “Many PSPs still rely on pen and paper. This is a business issue, not just a printing one.” He added that PrintOS offers end-to-end tracking—from order intake to delivery—on a single screen and can be accessed remotely via phone.

The cloud-based tool allows users to monitor machines, reprioritise orders, and manage production in real time. It is compatible with HP and non-HP equipment, targeting especially MSME print firms expanding into both roll-to-roll and rigid applications.

Sharma noted that with short-run demands from eCommerce and boutique brands, speed and control are essential. “With PrintOS and our instant-dry Latex technology, PSPs can deliver faster, with greater consistency,” he said.

HP believes the shift towards digital workflows will become essential as regulatory and client expectations around sustainability and traceability increase. Sharma added that PrintOS can also support remote monitoring, enabling owners and managers to view production status from outside the facility—even while sleeping, “you can check what’s happening at your factory.”

Pantone’s colours of the year: Mocha Mousse vibes Pantone’s 2025 colour, Mocha Mousse, is a warm brown, says SS Shalgaonkar. Picked after scanning 5 million mood trends worldwide, it’s on Motorola phones that sold out in a day in India, boosting sales 5%. With 30% of signs using these hot shades, Mocha’s worth USD 10-million already.

Kromodyne’s G7 colours lab: Colours done right

Kromodyne is starting, what Nair of Kromodyne claimed, is India’s first G7colours lab in 2025, aiming for super-accurate colours (Delta E under 1.5) for 200 brands. It’ll check 1,000 colours a month, fixing 40% of wallpaper rejections. At INR five-lakh a year, it could bring INR 166-crore to top-tier printing.

Epson’s SureColours SC-G6030: Textile game-changer Epson India’s Amit Sehgal calls the SC-G6030 a textile revolution, printing 14-sqm an hour on fabrics with vibrant, long-lasting colours. Launched at Media Expo 2025, it’s the company’s first direct-to-film model, with 20% of garment jobs shifting to it. Priced for growth, it’s set to sell 500 units by 2028, adding INR 1,245-crore to India’s textile print market.

Kromodyne brings Agfa and Xeikon’s print tech to India

Santosh Nair, director of Kromodyne Digital Solutions, highlights Agfa’s disruptive potential. “We’re bringing Agfa into India’s premium segment to compete directly with screen printing—offering 6,000-sqft per hour output, spot varnish capabilities, and sustainable media options. This is for brands that refuse to compromise on quality but need industrial-scale efficiency.” The machines excel in retail signage, corporate branding, and government projects, with variable data support for personalised campaigns.

On Xeikon’s role in transforming India’s decor space, Nair notes, “Xeikon’s toner-based system delivers the lowest cost per copy in digital printing — 20 metres per minute speeds and zero VOC emissions make it the safest, most scalable solution for wallpaper and murals. We’re helping manufacturers shift from analogue bulk runs to on-demand digital production.” The technology targets paint companies and wallpaper brands seeking to reduce waste while expanding design possibilities.

Kromodyne positions Agfa for high-value graphics and Xeikon for volume-driven decor, creating a complete ecosystem for India’s print industry. Nair adds, “Agfa wins on embellishment brilliance; Xeikon on cost-per-unit economics. Together, they cover what Indian clients demand today—premium quality and scalable affordability.”

Nair says, “India’s print market is bifurcating between luxury retail demands and industrial decor needs — Agfa and Xeikon, through Kromodyne, we address both with targeted innovations.”

How Unidos is redefining point-of-sale displays

At Media Expo Mumbai 2025, Soham Gujral, partner at Unidos, introduced the New Delhi-based company that is a force to reckon with in the point-of-sale (POS) display space. “Everything we do revolves around foldability — that’s our core strength,” Gujral says. Unidos operates out of a 40,000-square-foot facility in Delhi and leads a team of 85 people.

Soham Gujral, partner at Unidos

At Unidos, each product focuses on structural and design engineering. Whether it’s a rack for Coca-Cola or a promo table for a new skincare line, the focus is threefold: foldability, ease of assembly, and strength. “If Coca-Cola wants to display 96 cans, I need to ensure that the unit can support that weight for at least two years,” Gujral explains.

This approach has allowed Unidos to drastically reduce logistical and manpower costs for its clients. Its displays come in flat packs — often just 1 to 1.5-inches thick — and can be assembled on-site without tools, tape, or skilled labour.

When Fujifilm needed 400 displays rolled out pan-India under tight timelines, they faced the risk of inconsistent quality and spiralling logistics costs if they opted for regional vendors. Unidos stepped in with a single, centralised solution — a unit that fit in a 3.5-inch-thick box and could be assembled in under seven minutes. Fujifilm reported a 50% reduction in expected logistics expenses.

Traditional display materials like medium-density fibreboard (MDF) and metal are increasingly falling out of favour, and Unidos is taking full advantage of that shift. Its displays are lighter, less expensive, fully recyclable, and more sustainable than conventional options. Their ISO 9001:2015 certification and ZED Sustainability Silver rating only add weight to this claim.

Tasked with a deployment in Kerala — far from its North India base — Unidos delivered a five-by-six-foot display for Pringles across multiple stores. The project, impossible with bulky MDF or metal units, became feasible thanks to Unidos’ foldable, lightweight solution. This resulted in a regionally executed campaign with national-level efficiency, without the logistical headaches.

See All

See All