India's share of global ad spends expected to reach 1.3% in 2023-24

Reports say, more than 50% of worldwide advertising spending is captured by a combination of Alibaba, Alphabet, Amazon, Bytedance, and Meta.

25 Aug 2023 | By PrintWeek Team

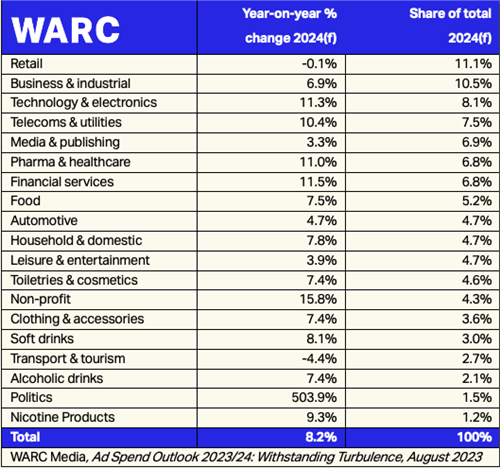

Global ad spend is forecast to rise 4.4% this year to a total of USD 963.5 billion and then 8.2% in 2024 to a total of USD 1.04 trillion according to a report by Warc.

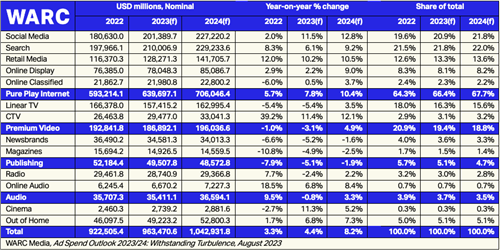

Social media will be the fastest-growing medium, with spend rising to a total of USD 227.2 billion next year, more than a fifth of the total ad spends. Meta will garner 64.4% of this and is supposed to get ad revenue of around USD 146.3 billion. Bytedance will follow in second place.

Outdoor (+7.3%), cinema (+5.2%), and audio (+3.3%) are also set to see advertiser spend increase next year, though losses are expected among publishing media (-1.9%), including a 1.6% dip for newsbrands and 2.5% fall for magazines.

The report further stated that the increased spending on connected TV (CTV) will not be enough to offset declining spend on linear TV which will fall by 5.4% this year. Next year, linear TV advertising will grow globally because of political elections and sporting events. Linear TV is still the world’s third-largest advertising medium, with an expected share of 15.6% equating to advertiser spend of $163.0bn in 2024.

Growth by region

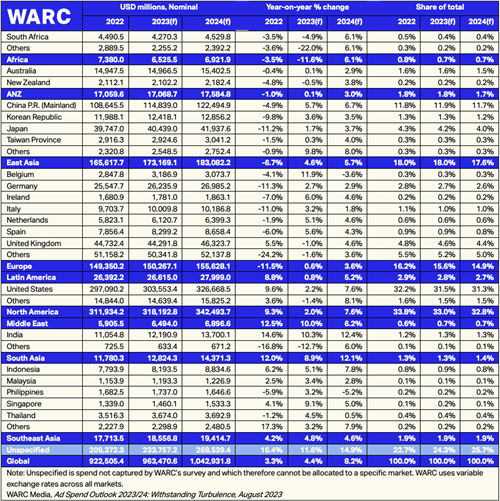

Spends in South Asia are set to grow rapidly with growth of 8.9% in 2023 and 12.1% in 2024. This is attributed to a strong Indian market. Ad spend in India is forecast to grow by double digits over the next 18 months to reach a total of USD 13.7 billion in 2024 which is 1.3% of global spend.

Advertiser spend across North America is forecast to rise 2% this year and 7.6% next year, in line with the largest market – the US.

Advertising spend in Europe is set to rise just 0.6% this year. Next year, events like Euro 2024 (football) are set to help advertising spend grow by 3.6%.

The Middle East is among the smallest regions (just 0.7% of global spend) but is set to be the fastest-growing over the forecast period, with spend up 10% in 2023 and 6.2% in 2024, by when the ad market will be worth USD 6.9 billion.

Southeast Asia is forecast to grow 4.8% this year and 4.6% in 2024, with Singapore (+9.1% in 2023 and +5% in 2024) and Indonesia (+5.1% and +7.8%, respectively) growing fastest in the region. Thailand (+4.5% in 2023), Malaysia (+3.4%) and the Philippines (+3.2%) are also seeing growth.

Africa will see a 11.6% reduction in ad spends in 2023. Growth should return in 2024 though.

Source: Campaign India

See All

See All