Print needs a collective response to the Coronavirus crisis

There is cash crunch; no jobs in the market and with little help from the government, the print companies are left with drawing up their own strategies to lift themselves from effects of the coronavirus pandemic, a PrintWeek survey found

14 Aug 2020 | By PrintWeek Team

The big question is: how long will this go on? It could be more than a year, and the longer it goes on, the more the devaluation and bigger the trouble. A senior CEO told PrintWeek quite plainly, “Our industry must not expect miracles to emerge once the lockdown is lifted. There are no ready-made utopias. We must not expect help from other industries or the government. We have to work out our own strategy for 2020.”

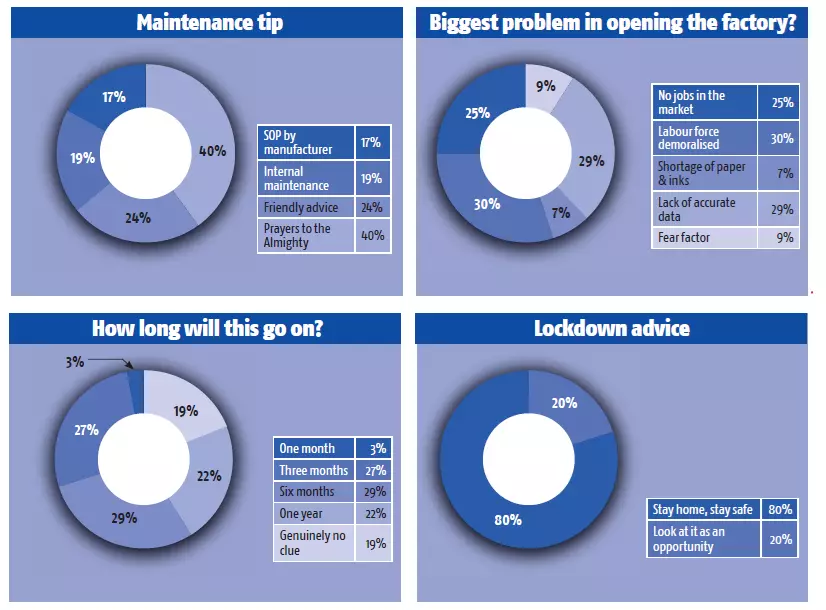

Perhaps the CEO is right. When we asked companies to describe the cash flow situation after two months of lockdown? The results were: On the verge of closure (25%); Could be better (40%); Had saved for a crisis (15%) and All is well (20%). When we asked what has been the biggest problem in opening up your factory? The responses were: No jobs in the market (25%); Labour force demoralised (30%); Shortage of paper, inks (7%) and lack of accurate data (29%).

There are other concerns too. Walrus ran a research study of over 1000 people in the US. The highlights: 69% - worried about contracting the virus; 54% - being ostracised; 61% - moving too quickly back into public life; 51% - buy brands they’re used to; and 39% since quarantine began purchasing new brands. Even as we were crunching numbers, we got to hear of a newspaper company that has furloughed 50% of the staff after seeing profits evaporate and much of the usual business vanish. Meanwhile, due to the curbs on everyday activities as the government attempts to control the Covid-19 pandemic in India, airlines are close to bankruptcy, hotels are empty, and mass unemployment and joblessness are imminent. It is true that demand has been steady - and packaging and labels print has held up reasonably well – understandable due to the spike in demand for certain products, for commercial printers the picture is of a more or less universal collapse in demand.

The 123 interviews examined the effects of the economic lockdown, and were conducted from 25 March to 30 April. Ideally we would have liked to rely on solid data. For example, Heidelberg has collated performance data from thousands of presses worldwide which also details that during April, activity among commercial printers crashed to the most serious impact level, classified as “severe impact: multiple print shops stop production completely” and with productivity expected to drop to below 40% of normal levels. Unfortunately, this sort of data capture is “incomplete” for India.

Vinay Kaushal, director, Provin Technos, says, “It’s not that the print industry has so many pain points. Perhaps we feel this more since most of the presses are driven by a single person. Also, other industries have pain points, but they are in the organised sector. Coved-19 has made every person on this planet rethink. Our industry is not different from them. In fact, our industry has a lot more to think as we are quite unorganised. Going forward, a lot of areas in the work process will need to be redefined.” Datta Deshpande, managing director, Pratham Technologies, adds, “A CEO has multiple roles to play: leader, policymaker, manager, businessman, spokesperson or communicator. There are different aspects of each role, and each of them is important. But yes, 75% of his time should be devoted to drive strategy rather than managing processes.”

There is hope. The global adspend slump is expected to be less severe than the 2009 crash. Research organisation WARC’s report says global ad spend will fall by 8.1% in 2020, with US and Asia- Pacific predicted to have the lowest declines.

WARC’s report says global ad spend will fall by 8.1% this year to USD 563-bn, compared with the 12.7% contraction in 2009. Before the global pandemic took hold and caused economies and societies to go into varying degrees of lockdown, Warc had forecast in February that global ad spend would grow by 7.1% this year. In real terms, Indian growth will ease to 0.7% to USD9.4bn in 2020.

WARC has said traditional media will fare far worse than online, with ad investment set to fall by USD 51.4-bn (down 16.3%) this year. Declines will be recorded across cinema (-31.6%), out-of-home (-21.7%), magazines (-21.5%), newspapers (-19.5%), radio (-16.2%) and TV (-13.8%).

Meanwhile, in terms of sectors, the travel and tourism category is expected to record the steepest decline, with a forecast of -31.2% for 2020 representing a USD 7.2-bn reduction in spend compared with 2019 to a total of USD 16.0-bn. Leisure and entertainment (-28.7% to USD 16.4-bn), financial services (-18.2% to USD-39.2bn), retail (-15.2% to USD- 57.2bn) and automotive (-11.4% to USD- 57.6bn) are all set to witness sharp declines this year.

In most of the 123 interactions, one message is clear. New technologies and new solutions is the only way to provide a cutting edge solution.

However, the consequences are wideranging. One obvious result is that technologies are never static: there are Versions 3.0 and 4.0, and even those quickly become obsolete. Catching up with the latest technology can be stressful and costly. Accelerating obsolescence can be disastrous for existing firms.

Also, whole sectors of society — electronics, pharmaceuticals, food packaging, bioengineering and the like — are given over to creating innovations for the sake of innovation. Whichever print or packaging firm that can create the technological innovation that is going to capture the imagination, like the cell phone or the tablet, or have the most varied applications, like the computer chip, is likely to win out. But to reap long term benefits technology itself has to become the business.

This means to really think about the dynamism and the possibilities for construction of an alternative society. But in order to get onto such a path, our industry and its industry leaders will have to emancipate themselves and create a new print and packaging reality. Are we ready?

See All

See All