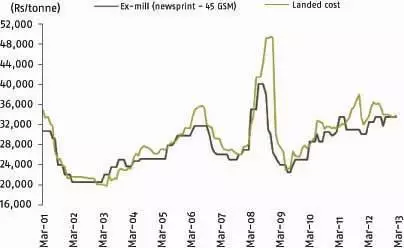

With Indian paper mills feigning helplessness at the soaring paper prices, print firms across the country are contemplating ways to limit their shrinking bottomline, finds Anand Srinivasan.

The fiscal year of 2013 has seen print companies being burdened with price revisions announced by most paper manufacturers, which has resulted in massive increases of 20–30% within a year. Printers are now voicing their dismay at the rising cost of paper and paperboard, which has hurt their bottomline.

Paper manufacturers blame the revisions on the increasing cost of domestic wood as well as of imported materials such as pulp and coal, due to Rupee’s depreciation. The paper manufacturers state that the rising cost of pulp had a trickling effect on the prices of paper and paperboard, and it was inevitable that it be passed on to the printers.

Double whammy

The domestic paper industry, which is struggling to cope with high input costs and chronic shortage of wood pulp, will face a new challenge in 2014 – duty-free import of paper from Southeast Asian countries.

India’s 2.5% duty on paper imports has come down to zero as on 1 January 2014, as per the terms of the free trade agreement signed with the Association of Southeast Asian Nations (ASEAN). Although the duty waiver, by itself, is not a concern, but in the context of the weakening competitiveness of paper mills, imports will aggravate the situation, opine industry representatives.

According to a media report published by The Hindu Business Line on 2 January, senior executives of leading paper mills who are part of the Indian Paper Manufacturers Association (IPMA) feel, the depreciation in the Rupee has so far been a barrier against imports. But with the prevailing wood pulp shortage, large paper manufacturers have resorted to importing costly pulp wood. This has culminated in increase in the cost of production. The industry raised paper prices by an average of 10–15% in 2013.

Paper mills are importing pulp wood, even if it is costlier by 30–40%, as domestic stocks are scanty. JK Papers cite the reason for this to be a disease outbreak that hit tree plantations in Andhra Pradesh three years ago; and because of this, the gross tonnage of wood availability has taken a nosedive. Though companies have stepped up farm forestry, it will take another couple of years before normalcy can be restored.

Speaking of statistics, JK Papers has twice increased prices of its three major paper categories of printing and writing grades of paper, by 7% in the last quarter of 2013. JK Papers is contemplating another revision by the end of FY2013–14.

Correspondingly, for Ballarpur Industries the effective rise was 5–8% on all varieties of paper, and for Tamil Nadu Newsprint and Papers (TNPL) 5–8% on maplitho stocks. “There is a cost push that has to be passed on to consumers. Therefore, we have also raised paper prices from the first of September 2013,” a TNPL official says.

Manufacturers face a Catch-22 situation

Most of the manufacturers claim that the paper price had so far been well absorbed. A recent survey conducted by India Ratings & Research (Ind-Ra) claims that even though paper manufacturers have recently hiked prices, the profits margins might not improve. A critical reason for this is that the manufacturers have been unable to offload the increased input costs to customers due to competition from international manufacturers and increased supply via import channels. Both have negatively impacted the profitability.

As per a report published by Emkay Research, the Indian paper sectors have been adding capacities in the past few years to overcome the excessively accrued loss. This means, the aggregate capacity of the peer set of paper producers analysed by it increased at a compounded annual growth rate (CAGR) of 11% between FY09 and FY14, far higher than the 3.6% CAGR recorded between FY03 and FY08. The paper-producing heavy weights include Ballarpur Industries, JK Paper, TNPL, International Paper APPM, Seshasayee Paper and Boards, and West Coast Paper Mills.

Several paper mills are taking up various initiatives to reduce the cost of pulp-import. In a first of its kind initiative, TNPL has commissioned aRs 164-crore project at its Karur plant to produce recycled pulp, and another Rs 164 crore in its pulping line. According to the officials at TNPL, this machinery would produce 300 tonnes of paper pulp a day and discharge usage burden of 100 tonnes of wood paper pulp from the company.

JK Paper has also invested Rs 1,750 crore in expanding its Rayagada plant in Orissa; adding nearly 60% (2.15 lakh tonnes) to its annual pulping and paper capacity of 1.65 lakh tonnes. The expansion comes at a time when the general economic scene has faced a dent, and the costs are on the rise.

Printers look for corrective measures

“The cost impact on coated paper is slightly more than that on copier paper,” says a JK Paper official. Thus, signalling at an intransigent price surge in the coated paper segment in next few months. Not to mention, packaging boards too are expected to face a similar treatment.

Coated papers and packaging boards faced price hike in last financial year. Since in the printing industry, the paper and boards form the most critical part in the input cost, constituting 70% of the total value of the printed material, the hike has landed printing industry in an unprecedented crisis.

“The issue is very important and needs to be brought to the attention of all concerned departments in government bodies and associations,” says Bhuvnesh Seth, managing director, Replika Press. The concern is shared by printers across the nation.

The printer strikes back

The Sivakasi Master Printers’ Association (SMPA) under the presidentship of A Marirajan has issued an open letter to the chairman of the Competition Commission of India (CCI) in New Delhi, requesting its attention on the unfair trade practices being opted by the paper mills.

The letter issued on 1 July, 2013 states that the regular monthly increase in ex-mill paper prices is sans rhyme or reason. “The print industry needs to be protected from the clutches of paper mills which are into the process of making print industry a scapegoat at the altar of price increase, leading to the question of survival in the future,” the letter states.

The letter from the SMPA has asked the CCI to take appropriate steps by directing the paper mills to stop this unfair trade practice and substantially reduce the arbitrarily increased prices, as well as direct the mills to maintain prices at least for a period of four months. The letter also recommends that printers should be informed about the increase at least one month prior to any increase in the subsequent quarter. It goes on further, asking the paper mills to compensate for the loss incurred by printers and refund them the excess amount collected during 2012–13 period.

Ludhiana’s Offset Printers Association too has raised similar concerns and in turn requested its members to pass on the cost to the end customer by increasing the prices by 20%. According to an estimate, on an average, an established book manufacturer consumes approximately 1,500 tonnes of wood-free coated (80–130gsm) and folding boxboard (250gsm) for book production in a month.

Huge concerns for 2014

Vasant Goel, director, Gopsons Papers, says, “The price has increased twice or thrice in the last two quarters of 2013, taking the landed prices up by 20–30%. It has hit the bottomline, as the cost cannot be passed on to the customers in near terms.”

“The price increase affects our working capital and cash flows. There has also been a significant impact on order booking due to higher paper cost projections. Price increase is imminent; however, I request paper mills to keep us informed of the price movements. This will help us in planning and informing the customers well in advance. Erratic and sudden increases cause a lot of problems,” adds Goel.

“Printers will struggle to pass on these rises to their customers and the price hikes will hit the industry,” argues K Selvakumar of Lovely Offset in Sivakasi.

“Most of the contracts we have with our customers are annual contracts and we can’t go back and ask for a price increase like the paper mills. We do inform the customers about indicative price increases well in advance. Many of them take steps to counter this in various ways,” he says.

But there are instances which do not always favour the printing firm. A New Delhi-based printing firm has claimed that after passing the cost on to the customer, they have faced "hostility" on many occasions which has even led to the customer dropping the idea of incurring expense on the print medium.

While trading conditions favour the mills, many printers are resorting to cheaper mills or are considering importing paper stocks despite the Rupee’s depreciation. Some like The Hindu has resorted to 42gsm imported recycled newsprint, instead of 45 gsm.

See All

See All