Inkmakers are looking ahead to the gen-next as a catalyst that will spur newspaper industry’s growth in India.

The last year has been a tough year with industrial growth slowing to a 20-year low raising worries about the health of crucial sector. The growth is estimated to have slowed to 5% in 2012-13. There are some segments of print which has had to put up with enormous pressure, which in turn put pressure on the ink market. But despite this bleak outlook, India’s newspaper print circulation has continued to grow. According to reports, the regional daily circulation is up 12%, English newspapers are up 3%, and Hindi plus regional circulation are up 15.8%.

“It has been a tough year. I have been in this industry since more than 30 years and I haven’t seen such a slow and difficult year in my entire span. The volumes are low, the costs are high; everything is against profitability,” says Samir Bhaumik, managing director, DIC India. He adds, “Newspapers, since the last seven to eight years are doing really well. Only, last year in 2012, and this time in 2013, the growth figure has come down slightly. The circulation is high but if you notice, the number of pages has reduced.”

But despite this bleak outlook, newspaper ink manufacturers are still hopeful about the future of newspaper. According to Bhaumik, DIC’s growth is not stagnant, but it is definitely much lower than our expectations. The company’s double digit growth has now been reduced to a single-digit growth. “But I think newspapers will spring back to the double-digit growth,” he says. “The reason I say so is, newspaper penetration in India is very low. If you take a look at India’s demographics, more than 50% of the population is the younger generation. That means, only 50% people are reading the newspaper as compared to the 80-90% in a developed country. Hence, there is scope.”

Newspaper ink market

BS Kampani, president and managing director at Toyo Ink India, quotes PRIMIR, worldwide market for print, 2006, to indicate India produces 2,50,000 tonnes of ink valued at 700-million USD. Acording to him the newspaper ink, including heatset would be 42% approximately and by value it would be approximately36%. Toyo Ink’s share though is very negligible. “Our investment strategy is in the high technology and innovation part of printing inks, and we consider newspaper inks in India to be mass volume low price,” says Kampani. “We are still to build capacities to cater to this market in India.”

DIC on the other hand is one of the dominant players along with Micro Inks, Sakata Inks and to some extent Organic Coating. “Our production, all put together, is about 24,000 tons per year, about 40% share in the market,” says Bhaumik. DIC has four active plants in Gujarat, Kolkatta, Noida, Mumbai and a recently setup plant in Bengaluru.

Organic Coatings has been manufacturing inks since the last 50 years, 70% of which is newspaper inks. The company operated from two plants, one in Mumbai and another in Vadodara, Gujarat. “We recently closed down the Mumbai unit and shift our Mumbai operations to Vadodara,” says RK Shah, chairman of Organic Coatings. The unit in Vadodra is semi-automatic and has the permission to produce 800 tons of sheetfed and newspaper ink. Currently, Organic Coatings is producing 250 tons of ink each month.

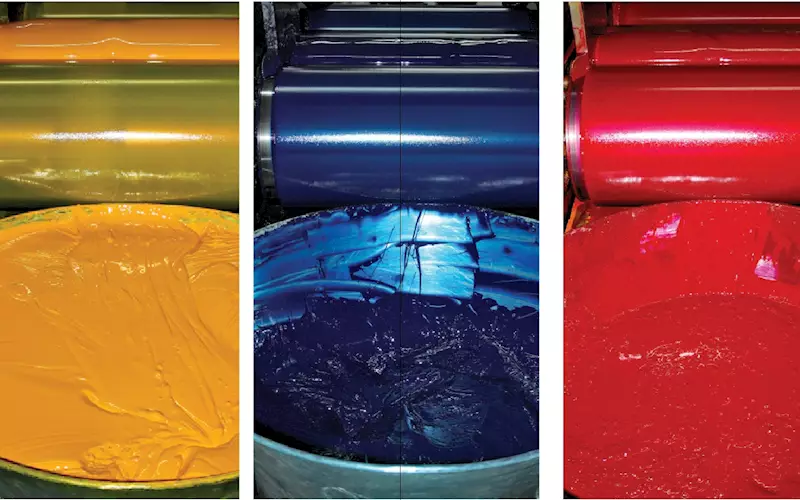

Production and quality

In newspaper production, best quality can be achieved when newsprint and news ink interact successfully. How does on select the right kind of ink to achieve efficient production? BSKampani says, “To select the right kind of ink for newsprint, the universal rule of the thump would be the ink water balance and the yield of the ink. Besides of course, the buffer of the fountain solution, the machine configuration, plates and the blankets.”

According to Bhaumik, DIC India has positioned itself well in the market, defining its strength.” This is quite evident from the number of news houses that are associated with us. We do numerous activities and work jointly with the newspaper houses. They have a very clear picture DIC’s strength, which they try to take leverage of.” DIC’s strength in the newspaper segment is not confined to DIC India’s performance alone; globally DIC is one of the leaders in the newspaper segment. Thus, the technology also flows in India, bringing along value additions that we can offer to the newspaper houses. “As a printer one expects to be able to replicate the settings he runs the previous day on his equipment for the next day. Our job is to meet that expectation,” says Bhaumik.

DIC achieves that with the equipments, which according to Bhaumik are almost a replication of the ones overseas. “About the quality of inks manufactured, I can say it cannot be 100% similar. With the differences of the place, the operator, and to some extent, the raw materials, cent percent quality replication is not possible. But it is close to the global quality standards,” he says.

RK Shah too says that the quality of the ink Organic Coatings manufacturers is on par with the best in India. Organic Coatings had embarked on a project of manufacturing green, and are now manufacturing it. “It has been widely accepted in India and overseas. The inks, 100% solvent-free, are widely used in the food packaging segment.”

Efficiency is not restricted to excellence in printing quality. It is about the environment as well. Are inks produced in an environment-friendly manner? Shah however, says that there are safer and greener inks for newspapers available overseas and can also be made in India but “news houses do not demand or opt for green inks due to the high costs involved”. Further, though the technology exists, our country does not have the equipment to run that particular ink. “In India, the thinnest paper one can print on is a 55gsm paper while overseas, they can print even on a 35gsm paper,” says Shah.

Bhaumik is a bit cautious. “If you compare with the international standards of environment, I would definitely confess, no. The customer is not ready to bear the cost of the environment-friendly production. I do not claim we (DIC India) are an environment-friendly company. However, being a global organisation, we do have restrictions on using certain kind of materials which are hazardous. This is the fundamental step towards environment friendly ink manufacturing. I do advocate India to move in that direction, too.”

Kampani agrees. “Yes! The inks by players – be it large or medium are being manufactured and handled in an environment friendly way.”

The components are generally pigments, resins, oil distillates with few additives to improve the performance of the inks, and contains volatile organic compounds, which are very negligible and within limits. However, newspapers are often used to wrap eatables resulting in ink getting transferred to the wrapped item, while many a times reading a newspaper means getting your hands darkened, making it unsafe for the handler of newspaper. “The petroleum oil distillates used to manufacture newspaper inks, when transferred to the food stuff can pose long term health problems to the individuals,” says Kampani.

Cost issues

The inkmakers have always said that they did not have the benefit of raising ink prices, despite the fact that high competition and higher raw material and manufacturing costs have continued to keep the prices under pressure. And the fluctuation in currency and the current rupee fall have nearly evaporated margins for the inkmakers.

Kampani explains that in a very specialised chemical industry like printing inks there are no short cuts as the options on cost reduction globally are very limited for the formulations. The main cost reductions come internally by manufacturing the inks more efficiently - reducing wastage, seeing that the cost of manpower, finance and consumables for running the factory are bare minimal without having negative impact on world class manufacturing standards.

“In-spite of best efforts, there are times when manufacturer has no choice but pass on increase in cost to the printer. Profits are decreasing rapidly on the balance sheet, which is an area of concern as the industry would have very little to spend on R&D. Moreover, the recent cost escalation owing to the US $ strengthening and the increase in raw material cost; the industry would have to pass on a substantial portion to the customers. Otherwise, there is a danger of the industry becoming sick and investments would elude growth” he says.

But there’s optimism about the newspaper segment among the inkmakers. They believe that in a country like India, the situation for newspaper is emerging. Bhaumik says, “Television in India is not a threat to the newspaper. In India, 70% of the population is rural. How many rural areas have uninterrupted electricity supply? How are they going to gain access to the television or any other digital media, per se? They rely on newspapers. It will take a long time for the television or the digital media to pose a threat to the newspapers.”

Looking at the regional growth and the penetration of the newspapers in regional markets, Kampani feels that the future in India is still safe and bright. “The advertisement spends and the classified advertisements in the regional newspapers are still showing reasonable resilience.”

“Internal efficiency is the key,” says Bhaumik. “This is the time when each one will prove how efficient are they. It is a challenge. Every industry, every firm will pave their own way to tackle the issue.”

Kampani sums up by saying, “It’s not how good you are in the good times, but how good you are in the bad times that will get you through.”

Samir Bhaumik - DIC |

|

Factfile: Established in 1978, DIC India has plants in Gujarat, Kolkata, Noida, Mumbai and Bengaluru. It specialises in manufacturing of inks for all segments of printing. The company manufacturers 24,000 tons of ink per year with an annual turnover or Rs 712-crore.

On the falling rupee: A 20-25% rupee weakening means higher input costs for imported raw material and increase of and transportation cost. Had I been able to estimate the impact of the falling rupee, I would have made a million. To give an assessment, the impact will tend to continue till 2014. Why 2014? If the results of the elections are positive and in favour of the industry, one will take about six to eight months to settle in the newer scenario. Possibly, we will see better times. But it’s a challenge. Internal efficiency is the key. This is the time when each one will prove how efficient are they. It is a challenge. Every industry, every firm will pave their own way to tackle the issue.

|

|

BS Kampani - Toyo Ink |

|

Factfile: Toyo Ink, the Japanese ink manufacturer was established in 1896. It’s Indian operation was founded in 2006 and the factory in Greater Noida inaugurated in 2008. The company is setting up an ink plant in Dahej, Gujarat with a Rs 150 crore investment. The company specialises in gravure and offset inks.

On the falling rupee: The fall would have multi-dimensional inflationary pressures. With the rupee weakening by 24% from a base of 54 to 67, the existing formulations in inks, which are approximately 50 to 60% dependent on imported raw materials directly would be impacted. Titanium dioxide manufactured in the country is not suitable for high-end gravure inks, are generally imported, so up goes the price of Titanium and some solvents and pigments not manufactured in the country by 24%. As the phenomena is universal for the ink industry, others inkmakers too would have inflationary pressures.

|

|

RK Shah - Organic Coatings |

|

Factfile: Organic Coatings is a five decade old company. It produces 250 tonnes of inks for commercial, packaging and newspapers per month, 70% of which is for newspapers. The company has moved from Mumbai to Vadodara and has permission to produce 800 tonnes per month. It hopes to produce more in coming months to reach 750 tonnes, while taking its present turnover from 45-crore to Rs 55-crore in 2014.

On the falling rupee: The effects are being felt. Our profit margins have been reduced to five to seven percent and will eventually become negative. In the ink industry, the manufacturers are competing among themselves. If they decide and collaborate, we could share share the entire business, rather than slash prices to hold market share. A single player cannot cater to the entire ink demand of the country. At some point in time, the business does get divided and in that case, why not keep healthier profit margins.

|

See All

See All