There is a new generation of literate Indians in the interiors of the country who are propelling newspaper sales, Mihir Joshi looks at the trends from a market that is defying global trends

While addressing the gathered delegates at Publishing Asia 2012 Jacob Mathew, executive editor and publisher, Malayala Manorama Group

“Three-quarters of the world’s top 100 largest newspapers are published in Asia. A majority of those are in India and China. Print circulations are growing, a fact that is not easily explained away by those who insist on predicting the death of newspapers.”

It sums up the astonishing rise of the newspaper industry in Asia in general and India in particular. In 1976, India’s population was 775 million with our literacy rate tottering at 34.45%. Back in the day one copy of a newspaper was produced for every 80 people. Fast forward three and a half decade and the population has exploded to 1.2 billion literacy rate has risen to 74.04% (still a good 10% below the world average) and the newspaper to people ratio has been bettered to 1:20. Today the total number of registered newspapers stands at 82,237, with growth in registered publications over the previous year at 6.25 %.

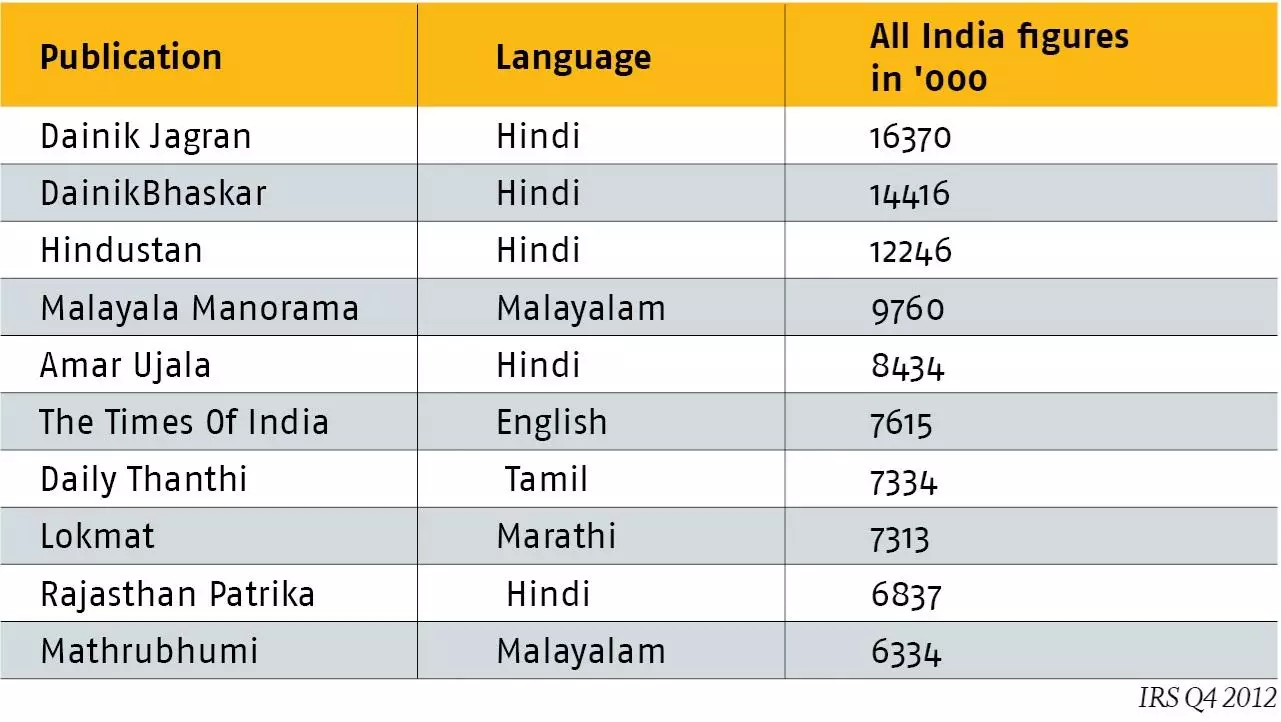

The Indian newspaper industry today is “guesstimated” to be at Rs 19,700-crore in mid-2012, according to the Federation of Indian Chambers of Commerce and Industry (FICCI) and a KPMG joint-report. Registrar of Newspapers for India (RNI) in his annual report ‘Press in India’ to the Ministry of Information & Broadcasting (I&B) stated that the RNI approved 13, 229 titles for the year 2010. The largest number of newspapers and periodicals registered in any Indian language was in Hindi (32, 793) followed by English with 11, 478 newspapers and periodicals. The total circulation of newspapers stood at 32, 92, 04, 841 as against 30, 88, 16, 563 copies in 2009-10. The number of annual statements received in RNI for the year was 14,508 against 13,134 in the previous report. As per data from the annual statements, the highest number of newspapers were published in Hindi (7,910), followed by English (1,406), Urdu (938), Gujarati (761), Telugu (603), Marathi (521), Bengali (472), Tamil (272), Oriya (245), Kannada (200) and Malayalam (192).

India has more daily newspaper than any other nation and out of world’s 100 largest newspapers 20 are Indian. The demand of newsprint in India is expected to grow at a rate of 9% and India’s paper consumption is expected to increase to three million tons in 2015-16.

This growth in Indian newspaper readership figures becomes much more impressive when we take in to account the global trends in the newspaper industry, all developed countries have seen a gradual decline in the newspaper readership figures largely because was the phenomenal technological advancement in electronic media. The Internet has been somewhat of a ‘final nail in the coffin’ for the printed newspaper in the west, as people can access the online newspapers and get real time news as it happens.

The same is not true for the Indian market as the electricity and internet infrastructure in the country has not developed enough to support mass use of online newspapers. Broadband penetration in India in 2009 was about 4%, and concentrated in major cities. A large part of the country still doesn’t have round the clock electricity supply and load-shedding is common occurrence especially in the rural areas. Hence, people still rely on their dailies for daily doses of information.

Another major reason propelling the growth of newspaper is the cost of the newspaper. Indian newspapers unlike their western counter parts sell their newspapers at a price which is much lower than the actual production cost. Indian newspapers generate a major chunk of their revenue from print advertising. The English media forms only 15% of the total newspaper market and has seven times lesser readership than its Hindi counter parts. Despite the numbers, it claims more than half the share of total advertising pie of the print space. The higher ad rates come into play in the greater revenue generation witnessed in English media. The perception that the purchasing power of the English newspaper reader is much higher than that of their Hindi newspaper counterparts is the reason for the higher ad rates. A rise in the ad rates of newspapers published in regional languages and Hindi is expected as advertisers are turning their attention to rural areas and small towns in search of generating more demand for their products and services. According to a report by PricewaterhouseCoopers states that the steep difference in the share is partially due to the fact that most of the business newspapers (in which the ad rates are even higher than general newspapers) have been mostly in English till now.

But, recent Indian Readership Survey (IRS) Q4 2012 numbers point towards stagnating readership figures. Seven of the top 10 dailies have seen a decline in readership number, though the decline is marginal and nothing compared to the growth numbers posted by the industry over the past decade. Many insiders from the industry firmly believe that this stagnating numbers are signalling the beginning of the ‘consolidation phase’.

There was a time when select group of newspapers were ruling a particular region and they all were self-contained and did not wish to foray into other regions. For example, Hindustan Times was confined to Delhi region, The Hindu in Chennai region, while Tribune was dedicated to Ambala (later Chandigarh), Anandabazar Patrika was confined in West Bengal and Bhaskar in Gujarat and so on.

Change is being ushered, Bigger publications which primarily catered to metropolitan cities are trying to make inroads in the interior parts of country in search of newer readers. This in turn has led to region specific editions all across the country and acquisitions. Dainik Jagran, Dainik Bhaskar, Rajasthan Patrika, Amar Ujala, etc have also started spreading their hold over tier II cities by bringing out city-specific editions.

Times of India group acquired Bangalore-based publishing house, Vijayanand Printers to tap the southern market, and used the recently acquired apparatus to launch ‘Times of India Kannada’. Jagran Prakashan acquired Suvi Info Management (Indore) which publishes the NaiDunia daily in March last year.

India has around 79 newsprint mills among which four are in the public sector. According to INMA, the paper mills in India produced around one million tonnes of newsprint. The rest is imported from North America, Europe, Russia and the Scandinavian countries. Large newspaper publishing establishments generally opt for a mix of domestic and imported newsprint. English dailies use an 80:20 mix in favour of imported newsprint, regional language dailies employ the same ratio with priority assigned to Indian newsprint. The global price volatility has its influence on the ratio as well.

The Indian newspaper industry sees no threat to its survival in the foreseeable future from the digital media. India has the second largest print market in the world with a readership base of over 350 million. The influx of digital media penetration, market saturation and changing media consumption habits has led to decelerating circulation and readership in the once developed international markets. The Indian market, however, continues to hold its ground and expand due to the low level of digital media penetration.

With the economy growing by leaps and bounds and a major focus being on upgrading the infrastructure will definitely lead to increased internet connectivity and in the future print supremacy will be challenged. A July 2009 report from Forrester Research estimated that about 2.2 billion people worldwide would be online by 2013 – a global increase of 45 percent. Almost half of those new users would be in the emerging countries of Asia.

See All

See All