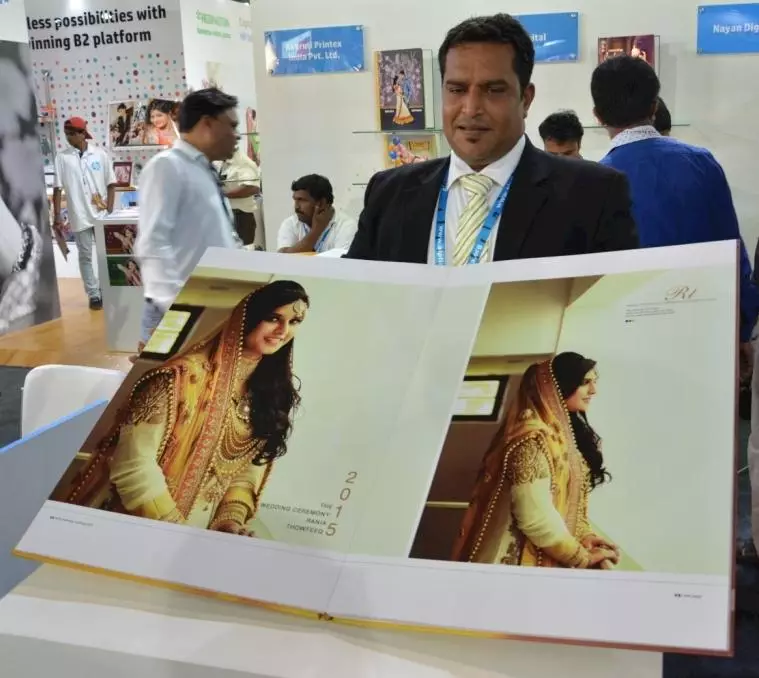

With HP being the largest single exhibitor at Drupa 2016, the Israel-based digital print giant is expected to make good uproar with all the print power at its disposal. HP's Indigo man, A Appadurai met up with the PrintWeek India team during the super busy CEIF show in Mumbai, where the HP stall (with the PageWide, three Indigos (10000, 7600, 5600), and the other DesignJet and Latex printers was an indicator that Drupa will not be about "Druck and Papier" anymore.

Appadurai says, “We will have a very serious offering around packaging and in this regard we have a fantastic Indian case study with a top brand. This is very much aligned with HP India's ambitions about a genuine innovation and a genuine Indian case-study.”

Appadurai mentions, it is too early to share the specifics about what HP has planned to exhibit at Drupa or announce the Indian case study, but he adds, it involves “a lot of innovation not seen before in India.”

Tete a tete on the sidelines of the CEIF show in January.

Ramu Ramanathan (RR): What should we expect from HP at Drupa?

A Appadurai (AA): We are humbled by the fact that we are the largest exhibitor at Drupa 2016. It also signifies the commitment that HP has towards the graphic art industry and our customers. This Drupa, in my mind, is going to be a very important milestone for digital print. After May 2016, digital print is going to be considered as a mainstream business.

RR: From a products perspective, will HP be launching anything new?

RR: From a products perspective, will HP be launching anything new?

AA: All of it, new products and enhancements will be announced in February and March, during the pre-Drupa session. Our pre-Drupa event will be in Israel towards the end of March. We will announce the new products and product enhancements then. We will also keep the momentum of DScoop going by holding smaller, in-country Dscoop events. Here, we will provide a platform to our customers by organising brand owner events.

RR: Any hint about Drupa?

AA: We believe on the principles on which we have built our business of giving upgrade powers to the existing customers. Plus there will be innovations in terms of features and products. For example, the Indigo 7000 that was launched in 2008 is upgradable to 7800 that we launched a year ago. The investments of customers are protected by these upgrade paths; the gamut of application is constantly increasing. There are constant advancements in the presses. For instance, there is a colour management package that simplifies managing colour across the job, presses and sites; an optimiser that recognises print queue in the most efficient way; and the HP Indigo ElectroInk Pink which glows under UV light. So, this Drupa in my mind, is going to be an important milestone for digital.

RR: How so?

AA: The response we are getting from the commercial printers is different from what we got in the last year. Now, printers are talking about ROI and the production numbers. This indicates the acceptance of digital print. Even today, in the commercial printing market, HP Indigo presses continue on a high growth trajectory.

RR: Will digital print replace offset print in the B2 space?

RR: Will digital print replace offset print in the B2 space?

AA: At this point, I don’t see digital devices as a competition to the offset printers. In some cases it is. But I believe it is more complementing. What I’m thrilled about is the four years head-start that we have against anyone who is talking B2 digital. Our smaller format is still a thriving business – and it is growing in double digits in India. Page growth for the analog printing market has been projected to increase by a much lesser CAGR as compared to that of digital printing.

RR: What according to you is the HP roadmap for label and packaging in India?

AA: As you know, HP has been boosting the digital revolution in both labels and packaging markets with the HP Indigo 20000 and 30000 digital presses. Since their commercial availability in May 2014, HP has sold more than 80 of these presses to the packaging customers producing flexible packaging and folding cartons. The HP SmartStream Mosaic has helped global brands like Bud Light and Oreo, both in the USA, to produce millions of one-of-a-kind designs for their bottle labels and packaging. The proprietary software has won awards at Labelexpo Brussels and GraphExpo 2015.

RR: Bud Light and Oreo are good. What about targeting Indian brands?

AA: On a similar line to the unique Coke campaign, we are doing a massive project in India on the packaging side. Once that story is shared with the markets after approvals, two things will happen. One: A lot of brands would step in because there is a big brand in India which has done it. And the PSPs will start thinking it as a main business. This is because one project will recover the entire investment of a company in digital print. As you know, this has been a challenge. For quite some time there was no Indian success story. Now, the Indian success story will coincide with Drupa.

RR: Are you worried at the pace at which the flexo and inkjet manufacturers have entered the arena?

AA: We are actually thrilled about it. At Labelexpo 2015 there were 48 digital players with inkjet devices on show. That is staunch conventional companies showing pure digital presses.

RR: That is, 48 industry competitors…

AA: … Or colleagues promoting digital. However, I believe, the market leader will take his share when the overall industry transforms. For decades, we have led the market and have experience in understanding media, application and finishing. We are going beyond this and building a solid engagement with the brands. Digital printing technology is enabling brands to break through the crowded market and engage consumers in a new and exciting way. From producing customised labels to creating smart packaging with linked content and expiration date, the technology delivers mass customisation in a short period of time. The number of campaigns of these brands done on the HP indigo digital press is the proof of our penetration in the market.

RR: Which segments will HP target?

AA: In India, there are two top markets for us. One is the pharmaceuticals market, which has huge short run and ultra-short run requirements on exports and variable data printing for fighting counterfeits. And the other one is the cosmetic markets, which again demands very high value short run printing and uses a wide variety of special medias. Then comes all type of innovation in packaging like the unique designs and the personalised ones.

RR: Your view on the buzz around inkjet?

AA: Any buzz on digital is good, we are happy in terms of competition coming in. Ours is the technology which has matured over the last 12-15 years. With over 7000 HP Indigo presses in 120 countries, HP is the world’s number one supplier of digital presses. We have 65 percent market share. I feel, inkjet will take a few years to catch up in terms of the quality requirements of the label industry. When I say quality, I mean, in terms of talking about a converter who wants to print on a label along with metpet and foils.

RR: Any HP offering in the inkjet space?

AA: From the overall perspective, more than 50 percent of the world’s inkjet is owned by HP, whether you use it for home, office, enterprises or commercial printing. Commercial and label printing is the same technology, so we own a massive chunk of the technology which is deployed the world over. Our belief is, this market will need liquid electrophotography which will deliver the highest quality on the broadest range of substrates. For the low coverage and low value labels, inkjet technology may be a fit. Having said so, we want to stay closer to our mission statement capturing the high value pages.

RR: In the commercial print space, what are the trends you are seeing?

AA: Drupa is going to be a turning point for us in India. And this is based on our inputs from the commercial printers. Today, commercials printers have moved on from discussing print quality, applications, and sizes to serious ROI. We also see some large printing companies diversifying into packaging, lot of them are consolidating commercial offset and investing in finishing for packaging. Another important change we see is on the quick print (jobber) space. This market which has constantly seen price erosion is now waking up to the fact of high value application to stand out of commoditised market.

RR: HP is looking at the jobber market seriously?

AA: Yes. In the last three months, we have had three brilliant installs in the quick print space alone. In Delhi, we have entered the Naraina market through Indonet and Mehul Printers. In Chennai, we have had a very large player Speed Print installing the 7800. We have always been focused on this market with large players like Print Xpress in Bengaluru who have four Indigo presses.

RR: The other thing is the good news with the HP 10000 where you have a big-ticket installation at Surat. In a way, this must be a vindication for you?

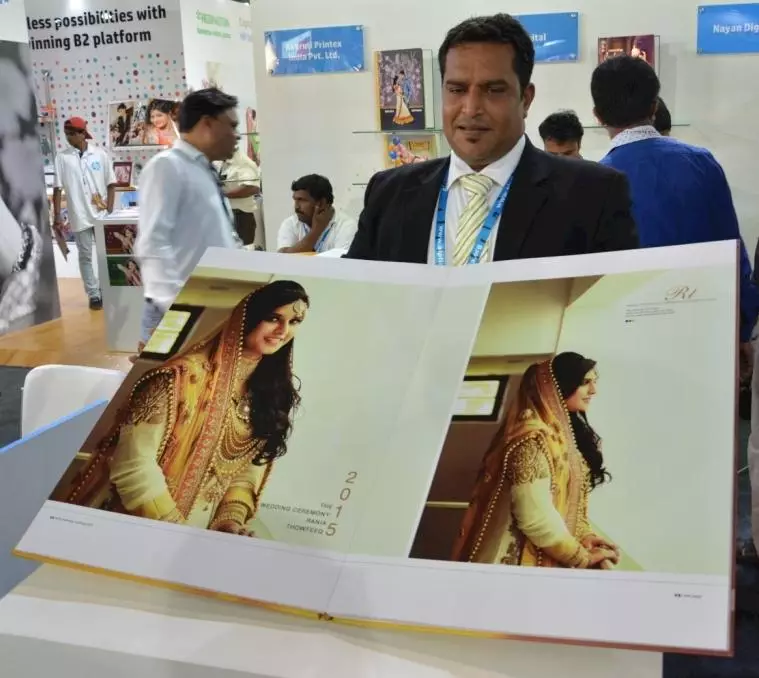

AA: We are happy that Klick Digital, one of the finest photo printing player, has installed the HP Indigo 10000 for capturing the high-value, big size photobook market that was tightly held by the silver halide technology. My understanding is, India was at its peak in 2008-2009 with 75 million sq/m of paper. Now with hundreds of Indigo presses in the photo industry the volumes have come down from 75 million sq/m to 45 million sq/m. This means we have a huge opportunity. We will break into the large prints, enlargement and the lay-flat books that were held by silver halide.

RR: Will Gujarat be a big story for HP in 2016-17?

AA: Gujarat is a huge opportunity. We feel we should have tapped the market place much earlier. The commercial print application like the posters and the catalogues for the textile industry is a massive market with very different quality and standards. Our customers are striving to garner a significant business in the high-value space.

RR: Kerala has been a successful model for HP with 25-26 Indigos. If you combine Kerala, Karnataka and Tamil Nadu, it’s a fair chunk of your overall installed base. Why is Indigo not successful in other parts of India?

AA: It is true that South India has a big install base, but we are quite successful in the North and the West of India. One of the fastest growing markets for us is North India.

RR: What about Mumbai?

RR: What about Mumbai?

AA: Mumbai is where our foundation was built. We have some of India's finest printing, pre -press and photo companies who have endorsed the Indigo. All our Mumbai customers are lighthouse accounts.

RR: What happened to the print vertical of billing, transaction, and the Adhaar project. It has gone quiet.

AA: Our customer Manipal did quite a share of Adhaar project. We continue to do the election card projects through our customers. A good chunk of the Tyvek certificates happen with multiple Indigo users annually. The big monochrome transaction printing market has evolved into a high-end full-colour transpromo. I guess the absence of strong data capture and analytics are the primary reason for this slow growth. The monochrome transactional market is highly commoditised and we are not in that space. As the advertising clutter grows more and more, the high quality focused transpromo will find its way. People will want to stand out. I hope it happens sooner than later.

RR: What next?

AA: In inkjet, we are looking at progress in 2016. By end of this year, we hope to get our first unit in the country, the T-series. Finally, the publishers are waking up to the fact that digital print holds the key, and they are willing to pay a bit more.

(This interview was transcribed and copy edited by Krishna Naidu)

RR: From a products perspective, will HP be launching anything new?

RR: From a products perspective, will HP be launching anything new? RR: Will digital print replace offset print in the B2 space?

RR: Will digital print replace offset print in the B2 space? RR: What about Mumbai?

RR: What about Mumbai?

See All

See All