Opinion: Opportunity in crisis

The author explains how consumers reacted to FMCG companies launching new products in 2020

16 Jan 2021 | By WhatPackaging? Team

While there is some popular misconception about the Chinese word for crisis meaning both danger and opportunity, the post-pandemic crisis that unfolded in consumer lives did see this construct playing out in our lives. The lockdown plunged our lives into crisis, and we also saw several FMCG organisations seeing this as an opportunity to launch several new products, and also infuse new life into their existing product portfolios.

Characteristics and trends

2020 saw a record number of new product launches and repurposed positioning of existing portfolios. Some characteristics:

- The largest chunk of new launches was in the preventive healthcare space.

- eCommerce emerged as a channel for launch for many and was used both strategically and opportunistically.

- A lot of media spends shifted from the traditional to digital.

- Rather than launch completely new brands, the norm was line-extensions from existing, trusted trademarks.

- Indian FMCG giants have taken the lead over global players, as evident from a plethora of launches by Dabur, ITC, Marico, Godrej to name a few.

While these launches would have seen differential levels of success in-market, this is a good opportunity to look back at what we know about consumer choice, and especially in times of crisis. Two questions become pertinent:

- Which of these launches have a greater chance of success?

- Which ones are likely to be short-term wins? And which ones more sustainable?

Consumer adoption of new options, during normal and not-so-normal times

In the emerging normal before the pandemic struck our lives, consumer lives were flooded with choice. Decisions were made in split seconds, and consumers often chose the comfort of a familiar option over risking the new.

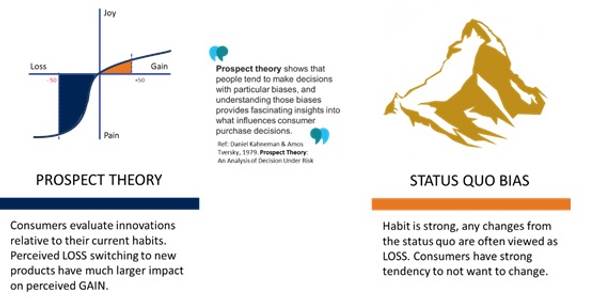

Using Ipsos’ understanding and R&D on how innovations are chosen or rejected, and recent advancements in the same using Behavioural Science principles, we notice that the following heuristics and biases typically play an important role.

So, do these strong levers of consumer behaviour change during a crisis, or do they predominantly remain the same? Well, the truth is somewhere in between.

Again, turning towards extensive research on innovations by Ipsos, and splitting them up into 'normal' times and 'crisis' times, we come across the following interesting nuggets.

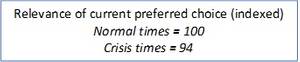

1. During a crisis, clients evaluate their current choices more stringently.

2. More new propositions show higher than average trial performance during crisis times.

So, then does crisis indeed indicate opportunity? It does, however, the following caveats need to be held in consideration.

- Our R&D also indicates that the chances of 'premium' innovations launching with success drops significantly, while the chances of 'value' propositions succeeding go up, during crisis times when compared to normal times.

- Prospect Theory and Status Quo Bias are still at play, and the higher than average trial performance is usually reserved for 'line-extensions' of trusted brands, and not entirely new trademark launches

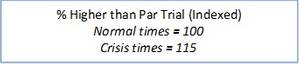

- It is important to assess both the immediate potential and the sustainability of innovation, as the crisis will end at some time.

What are the key questions around sustainability?

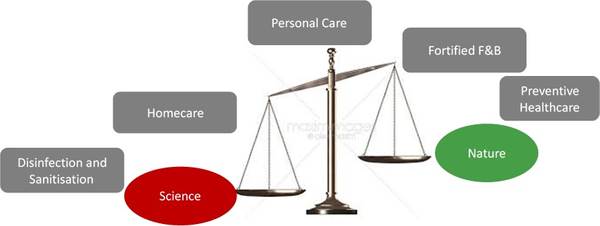

The Nature vs Science Conundrum

During these times, the 'Nature vs Science' question is an interesting one. Our learnings at Ipsos point out an interesting balance in the context of the category or a space in which an innovation launches - the below graphic brings out this point.

Natural offers and benefits often succeed by providing consumers with a familiar weapon to fight an unknown enemy.

Can packaging play a role?

Syndicated trends research across multiple countries by Ipsos provides an interesting perspective in this context.

Compared to our global counterparts, Indians put a higher emphasis on 'hygienic' packaging and products manufactured and packaged in India (Atmanirbhar sentiments at play).

Concluding and summarising thoughtsCrisis indeed equals opportunity, with a few points to ponder on.

- 'Value' works better than 'premiumisation', as consumers look for empathy from brands they choose.

- Line-extensions of trusted brands likely to work harder than completely new launches.

- Important to consider sustainability beyond the 'crisis' period. 5. Consider 'Nature' vs 'Science' in the context of the category.

- Environment friendliness of packaging should not compromise on hygiene or value to the consumer.

- 'Make in India'/Atmanirbhar provides an added edge.

- eCom an immediate opportunity but omni-channel better for sustainability.

(The author is group service line leader, innovation and market strategy and understanding, Ipsos India.)

Source: Campaign India

See All

See All