Has the pandemic accentuated India’s packaging faultlines?

Abhishek Muralidharan and Noel D'cunha look at the packaging trends in India and how the industry is trying to cope with the pandemic blues

19 Dec 2020 | By WhatPackaging? Team

Kirit Modi of Indian Corrugated Case Manufacturers' Association (ICCMA) cautioned the delegates during a webinar by saying, China is the X factor in 2021. His rationale, China is the largest consumer and importer of containerboard in the world; it is the largest exporter of manufactured goods, which need packaging. Modi is quite right. China is the first nation to recover from the virus' impact and notch a positive GDP. How 2021 unfolds for the corrugation industry (and indeed packaging) will depend on this X factor.

Curiously enough, a similar sentiment was echoed by packaging veteran Suresh Gupta. He looked at consumption during the pandemic and tried to "reintroduce into the debate" our helter-skelter style of ops that dominate the packaging industry. For years, the packaging fraternity has been seeking the right balance, but somehow, the industry leaders lack "the conviction for big ticket reform on the shop floor."

The Indian packaging industry is at crossroads. Even when bigwigs met during a food and beverage webinar, there were huge concerns about China's import ban on "waste". Many governments around the world are seeing mixed paper grades, unfavourably since "perception about mixed paper having contamination has become a reality". In the containerboard segment, this has resulted in a demand and supply imbalance due to the Chinese decision to "establish specifications for imported recyclables".

Uncertainty prevails

Whenever the governments of the world are on a collision path, economics has taken a back seat. Collateral damage: packaging.

Consider China. The country's paper and paperboard production grew to 120 mn MT in 2015 from 10 mn MT in 1990. Now there has been a 30% shortage in waste paper for containerboard due to restrictions. This has resulted in the spurt in domestic cardboard prices and a deficit for boards in China. There were two downsides to this. Indian paper mills could not import waste paper during the Covid lockdown. This resulted in their inventory drying up. Also, the global restriction on the waste collection expected to keep waste paper prices at elevated levels in the near future.

Kirit Modi of ICCMA

There were other problems, too. Kirit Modi says, "The time to dwell on kraft paper prices, plus input costs such as manpower, freight and other overheads, have witnessed an increase of 60-70% in the last few years."

Supply chain concerns

Flashback to March 2020. The nationwide lockdown brought the entire packaging supply chain to a grinding halt. The government made efforts to sustain a steady supply of essentials across India.

Packaging veteran Suresh Gupta reflected on the lockdown days during his keynote address at the ProPak India Virtual Expo on 15 October. He said, "Some of our colleagues in the industry have done extremely well. Some have performed mechanically, while others have been forced to close down."

He felt, "After the lockdown was announced by the PM, the government issued a notification that organisations, which provide essential services would be allowed to function. And so, flexible packaging, mono cartons, became an essential service since it packaged pharma, foods, hygiene products and so on."

Gupta says, "The problem with this lockdown - with no notice - there was absolute chaos and supply chain logistics were disrupted. Even though packaging is a critical component of essential services, it took time to get the permissions to open the factories, which had been shut down. Now, the larger more established companies, which were present geographically in our country could open much faster."

Packaging veteran Suresh Gupta

This chaos had an impact on almost every industry sector. For instance, the dislocation of container movement and the supply chain disruption due to the Covid-19-induced lockdown led to a huge spike in recovered paper prices. Sandeep Wadhwa, the president of ICCMA, explains, "The time to dwell on kraft paper prices, plus input costs such as manpower, freight and other overheads have witnessed an increase of 60-70% in last few years. The domestic and imported wastepaper prices have gone up by Rs 4,500-5,000 per tonne in the last couple of months."

However, the major FMCG brands and food business operators were able to steady the ship amid an array of challenges. Ashutosh Sinha of LT Foods said they faced challenges in terms of the arrangement of logistics and supply of packaging materials. But their business was not disrupted in a big way during the pandemic, as it had a robust supply chain and distribution network with a structured procurement policy.

Suresh Gupta says, "Converters were under tremendous pressure to supply goods into the retail market. Meanwhile, the end consumer was desperate for essential products. The interesting thing is – the end consumer has an average of 10 days of stock in his or her household. Due to the uncertainty, he or she was willing to stock over a month's requirement. So, households, which normally purchased 200g packets opted for 2kg or 5kg packets." There was pent-up demand. This resulted in a huge shortage since essential goods vanished from the shelves.

Rural spending should go up

Simultaneously, another story was unfolding; rural India was the backbone to the economy. But, the pandemic has created new opportunities for businesses to develop hyperlocal delivery models in a rural market, and technology collaborations to ensure last-mile connectivity.

As Dilraj Singh Gandhi, chief digital officer, Tractors and Farm Equipment (TAFE) shared with WhatPackaging?, people are moving towards digital. The rural buying behaviour has changed. His company could resolve tractor purchase problems by simplifying tech solutions instead of talking tech jargon. Sinha concurs and says, "Everyone talks about eCommerce. But the techniques about how to access this market is changing. It's not only tech platforms but also phone and video calls."

It's not as simple as it seems. If the packaging industry can crack the rural code, the opportunities are huge.

According to Raahil Chopra, the managing editor of Campaign India, the country's rural population will remain the backbone of the country over the coming years, accounting for 63% in 2025 compared to 67% in 2015. Rising rural incomes, improved education, and greater accessibility to services thanks to increased investment in rural infrastructure are driving consumer demand across a range of categories. Hence, during the pandemic, the savvy and informed rural consumers aspired to own branded products and services used by their urban counterparts.

Case in point, FMCG major Jyothy Labs. Ullas Kamath, joint managing director, Jyothy Labs expects the rural-to-urban contribution to see a change. "Normally, the rural to urban contribution is 40:60, which may change to 45:55 this year," he said.

The age of a village

A key point discussed during the Rural Market Summit India event was "big spending on small packs". Case in point, a Kirana store in Ronvel village, South Gujarat - stocked with small-size packs. When WhatPackaging? spoke to the store owner, he said purchasing pattern in rural India has altered during the pandemic.

Dr Dinesh Tyagi, CEO, CSC during the Messe Frankfurt's Rural Market Summit India, Virtual Edition 2020 talked about how CSC has been revolutionising rural communities in India. He said, CSC thrives on two things: Trust; since every panchayat is different from the next panchayat. And the second thing is job empowerment of women at the local level.

The leading FMCG brands are devising new strategies to cater to these lucrative rural markets. Kamath told WhatPackaging? during an online interaction, "We have smaller SKUs, for all the products, be it Maxo, Margo, Exo or Pril, we have smaller schemes. The prices range from Rs 5-20 and that's how we position ourselves. The changes can be seen only in the packaging, but otherwise, pricing will be more or less the same per litre or per kg rates. Apart from that, advertisement is something, which we usually spend to reach the rural market."

And so, there was a significant pent-up demand in the economy, especially from tier 2 and tier 3 cities. A new set of buyers, especially from tier 2 and tier 3 towns, were buying. According to Gupta, the larger converters and the smaller, well-organised converters delivered to this segment.

Sachin Agrawal, the co-founder and CEO of Bizongo

Sachin Agrawal, the co-founder and CEO of Bizongo said in his packaging column for a leading business daily, "In an ordinary market situation, the challenges differ. While the fragmented nature of the industry adds up to a large segment of the problems, that's just one part of the puzzle. One commonality that can be mapped across businesses and industries though is the chaos that these challenges lead to. Chaos in terms of failed packaging design, packaging stock-out, erroneous artwork, product recalls - it's a long list; at a broader level, resulting in a loss of business and revenue. And that's where the bigger problem lies."

The market revival

Meanwhile, looking at the pent -up demand, an order issued by the Consumer Affairs Ministry allowed companies to use by March next year inventories of packaging material or wrappers with manufacturing dates already printed, which is a big relief for the FMCG sector that suffered during the lockdowns.

Manufacturers will have to stamp or paste stickers declaring details of the correct month and year of manufacturing and packing. Without this relaxation, packaging material would have been wasted because they are not allowed to put stickers to change the details.

Suresh Gupta says, "If you look at the consumable numbers, you can see May and June were extremely good months. July and August saw stability. What started happening is the typical entrepreneurial spirit of the Indian entrepreneur was ignited. This Indian entrepreneur returned to his business. This was business that had vanished. Now, he wanted it back." And so, by early September, the market became fiercely competitive.

Gupta analysed the situation. He said, "It started in the latter half of April and flowered in all its glory in May, when the consumer was increasing household stocks. Basically, imagine that in an average of 10 days, the stock goes to 30 days. It's a significant percentage of annual sales. Therefore, new sales are required, the retailers are stocking up. Simultaneously, they want to carry excess stock. So, to cater to the stock in the pipeline, it created a whole new demand."

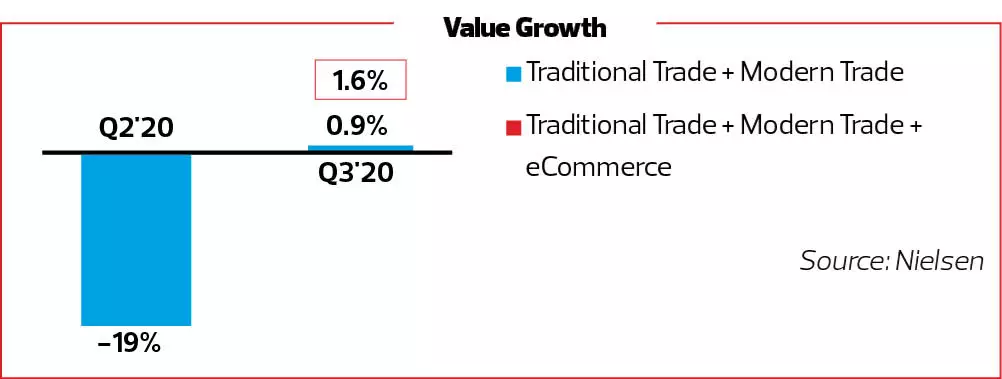

FMCG Industry - At a glance

According to a Nielsen survey, the FMCG sector displayed signs of recovery in the September quarter with a 1.6% growth as compared to 2019. It was a huge revival as the industry saw a 19% decline in growth in the April-June lockdown period. The survey report said that close to 9,700 products were launched in the FMCG industry between April and September - the highest ever in a six-month period and up by 35% as compared to the previous year.

Finally, the pipeline was filled up. And therefore, there is a slackening of this huge demand. The pent-up demand has started to cool down. The Society of Indian Automobile Manufacturers believes automobile sales across segments will fall by 25-45% this fiscal year, despite the bonanza sales in September and October. Bharat Petroleum, the nation's second-biggest fuel retailer, said its sales in urban pockets had almost halved, prompting it to quickly focus on the rural and highway segments to contain the market share loss. FMCG major Hindustan Unilever has been eyeing rural markets as well as smaller towns. The company sells its products through eight million outlets in the nation.

According to a report in Bloomberg, "Business leaders are pinning hopes on the rural sector as bountiful rains have set the stage for another year of record crops. Higher disposable incomes with farmers are expected to boost demand from automobile to cement to gold jewellery."

Supply chain digitisation

The question to be asked is, we have witnessed the disruptive role of the 'ICT Revolution'. This has enabled multinational corporations to arrange the global value chain in geography most favourable to their profit considerations, exacting a toll on existing production communities. As Suresh Gupta queried, is the packaging converter ready to innovate? Customers are seeking innovation. The demand profile is changing. The packaging industry needs to create things, which suit the demand profile. The question to ask is, are you the one who can make those?

Rajesh Voruganti of ITC highlights the uniqueness of the packaging industry is in its complexity, variety and non-standardised assembly lines. He says, "With rising complexity and proliferation of the number of SKUs, there is also a huge opportunity in automation, simplification of artwork creation, reproduction, approval and archival. With the vast reach of the internet through affordable smartphones, RPA and IoT together can provide transparent, real-time information of the shipment. Packaging and printing industry can be greatly benefitted by evaluating the use-cases and implementing it where relevant.

Voruganti adds, "Activities such as continuous feeding of material to machines, continuous collection of output from machines, sorting of defects, picking, placing, conveying, packing, labelling so on and so forth – there are innumerable non-complex activities that can be automated in printing and packaging industry."

Meanwhile, Tetra Pak in its Chakan plant has unveiled 'Smart Packaging'- with unique QR codes placed on every package, giving it its own unique identity. This allows a juice carton to be a full-scale data carrier and a digital tool. This digitisation is helping producers, retailers and consumers in ways that were once unimaginable.

A company press note shared with us stated, "Smart Packaging offers end-to-end traceability, which can help the manufacturers improve their production, have effective control over the quality and make the supply chain process as transparent as possible.

A producer is equipped with tools such as the ability to track and trace the history or location of any pack, thus making it possible for them to keep a check on the product's market performance."

Sachin Agarwal of Bizongo concurs, "The industry has immense potential in terms of manufacturing capacity. This combined with an automated supply chain system can create a sustainable ecosystem that can be used by generations to come. Digitisation of the supply chain is what will enable the packaging industry to operate at full potential." And that's a mission every individual in the packaging industry should aspire for.

The past few pandemic months; the industry view

Tejas Tanna, director, Printmann

Until August, due to the fear of another lockdown, customers pent-up the demand by pre-stocking. The order books were full. Now, with the excess inventory and lesser actual demand, the orders have certainly decreased. The SKUs shrunk and only the actual required material was ordered. The current situation prompted us to establish a leaner workforce; we are training our teams to achieve operational excellence. During the pandemic, I have learned the importance of shifting towards automation from labour-intensive processes.

Anuj Bhargava, founder, Kumar Labels

The reduction and increase in the workload have been sector-specific. Overall, we do see a minor dip in the numbers in the past few weeks. On the basis of increased household consumption patterns, we have noticed that larger packs are performing better than smaller packs. At our shopfloor, keeping our staff safe has been our first priority. And we have been continuously reminding our team members not to be complacent with safety precautions. The need for digital operations was my key learning from the pandemic.

Jatinder Shroff, managing director, Nutech Packagings

The workload has been more or less the same in the past few weeks. Also, nothing much has changed in terms of SKUs or the packaging formats. However, our shop floor has been busy and most of our machines were occupied with jobs, which indicates there is substantial market demand. The most important lesson we have learnt during this Covid-19 pandemic is the need to be more flexible in our operations. In addition, we have understood the importance of cross-training our staff to perform different operations.

Aaditya Kashyap, director, Marks Emballage

There's a reduction in demand from FMCG and personal care business in the last few weeks. The growing business segments such as health and hygiene also slowed down. Overall, the market demand was significantly impacted. However, we are seeing brands focus more on small towns and rural markets due to better demand. The consumption of small and affordable packs in these non-metro markets have surged as FMCG companies are trying to get onboard new customers; while the urban markets prefer large pack sizes and seem to shop less often.

See All

See All