FMCG, spending and the pandemic

A WhatPackaging? report about the prevailing market trends

27 Nov 2020 | By WhatPackaging? Team

As the Covid-19 virus spreads across countries, World Advertising Research Center (WARC), the agency which provides latest evidence, expertise and guidance to make marketers more effective, released a global advertising trends report on the possible effects of the pandemic in the FMCG industry.

According to the report a deep recession is now highly probable in the short-term. This is likely to lead to an advertising recession in the first half of 2020. The report highlighted that during the last recession in 2008/09, ad money moved into paid search, though Google is not immune to a downturn. Other online players such as Facebook, Twitter and Baidu are vulnerable; digital channels are the easiest to switch off.

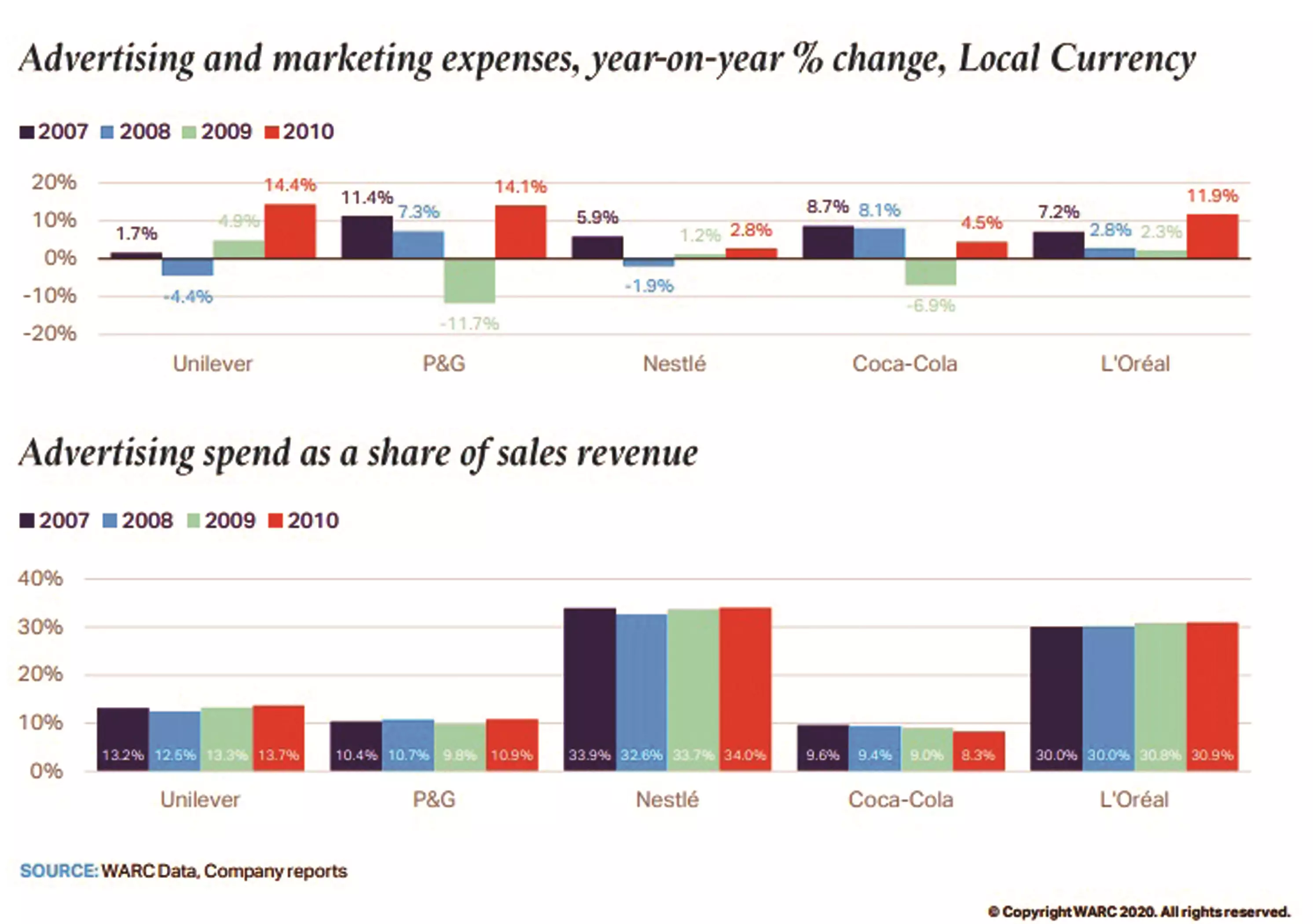

The food and drink sectors reduced spend at a far softer rate than the wider market in 2009 and they are also less exposed to today’s downturn than sectors such as travel, tourism and entertainment. Major FMCG advertisers lowered advertising investment in 2008 but held it as a share of sales revenue.

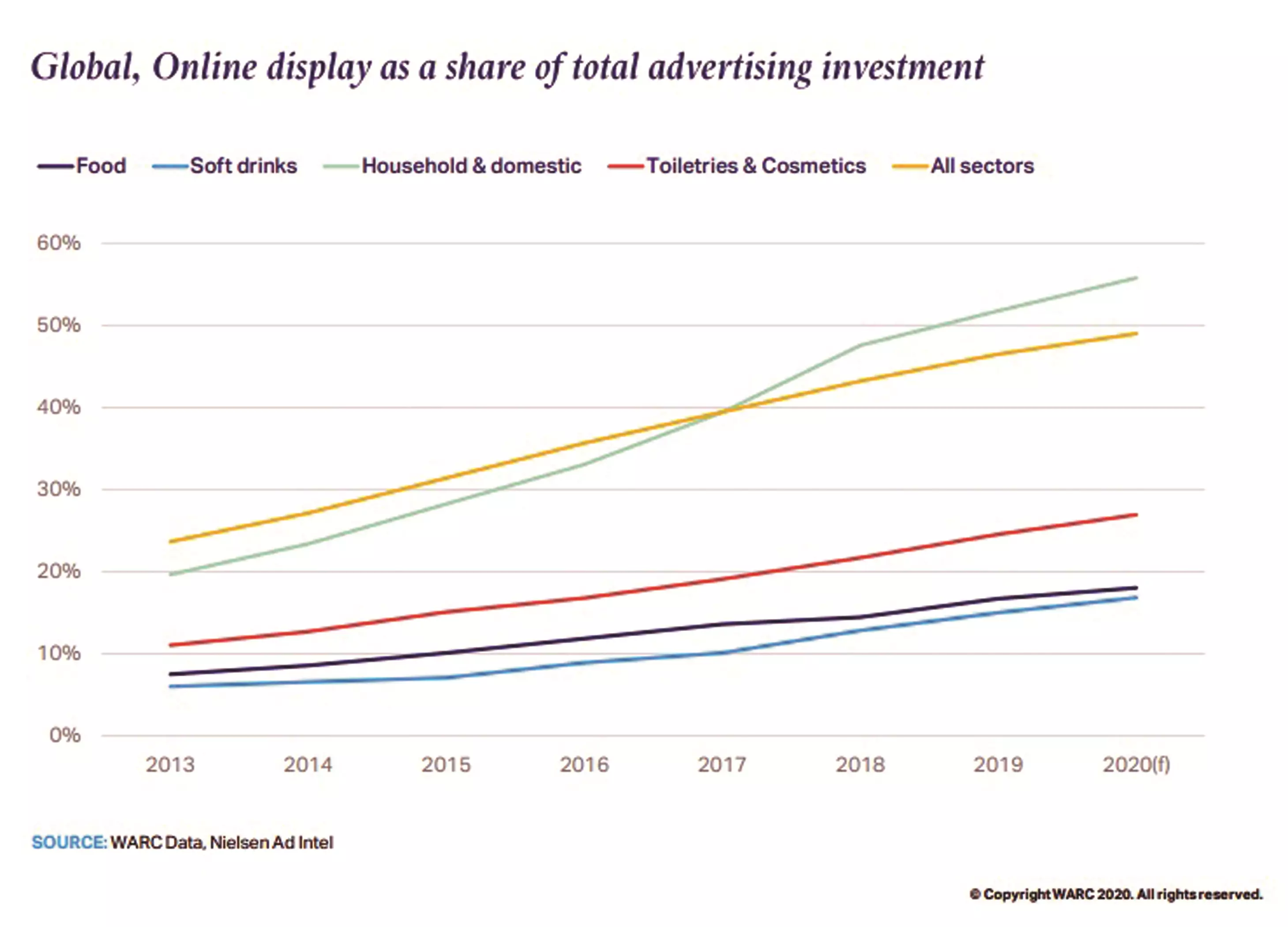

FMCG advertising money is moving online, but brand building is still important while selling via third party retailers and not directly to customers. FMCG sales on Amazon have boomed. The upshot of this is that online players may become more significant as gatekeepers to FMCG shoppers. This may increase the importance of DTC or subscription offers.

Consumers are now adjusting to ‘living a new normal’, and crisis-buying habits may prompt permanent shifts in behaviour.

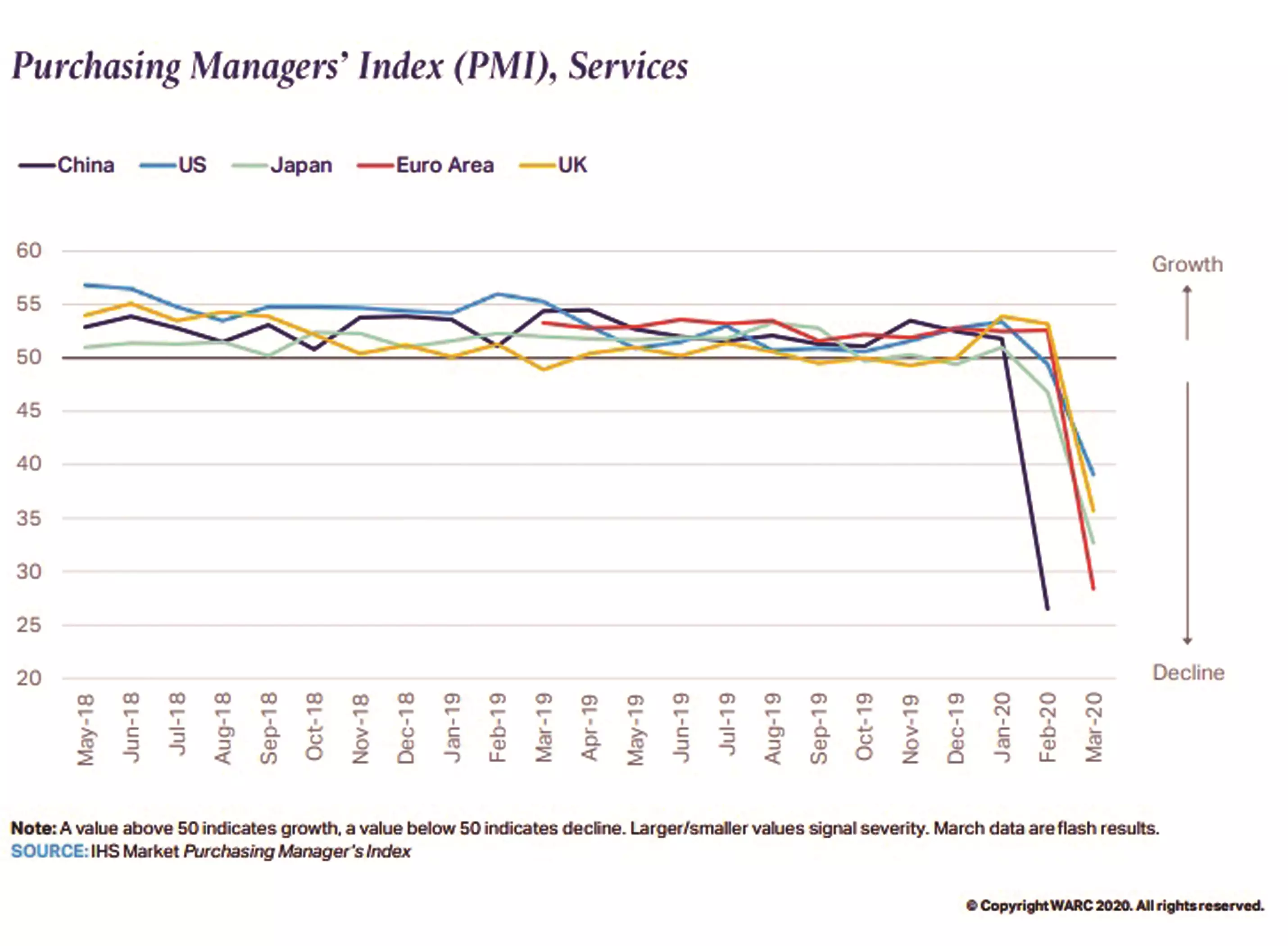

Major economies dip into recession

Revised economic growth projections from Moody’s, Goldman Sachs, JP Morgan and Deutsche Bank, among others, suggest a sharp, imminent downturn. The current consensus is for a ‘V’ shaped recovery: growth will return in the second half of the year following severe contractions during the first. Central banks have announced a swathe of stimuli to keep economies afloat. But the pandemic is not like a normal recession – Purchasing Managers' Index (PMI) data show a far steeper fall in services activity than would usually be expected.

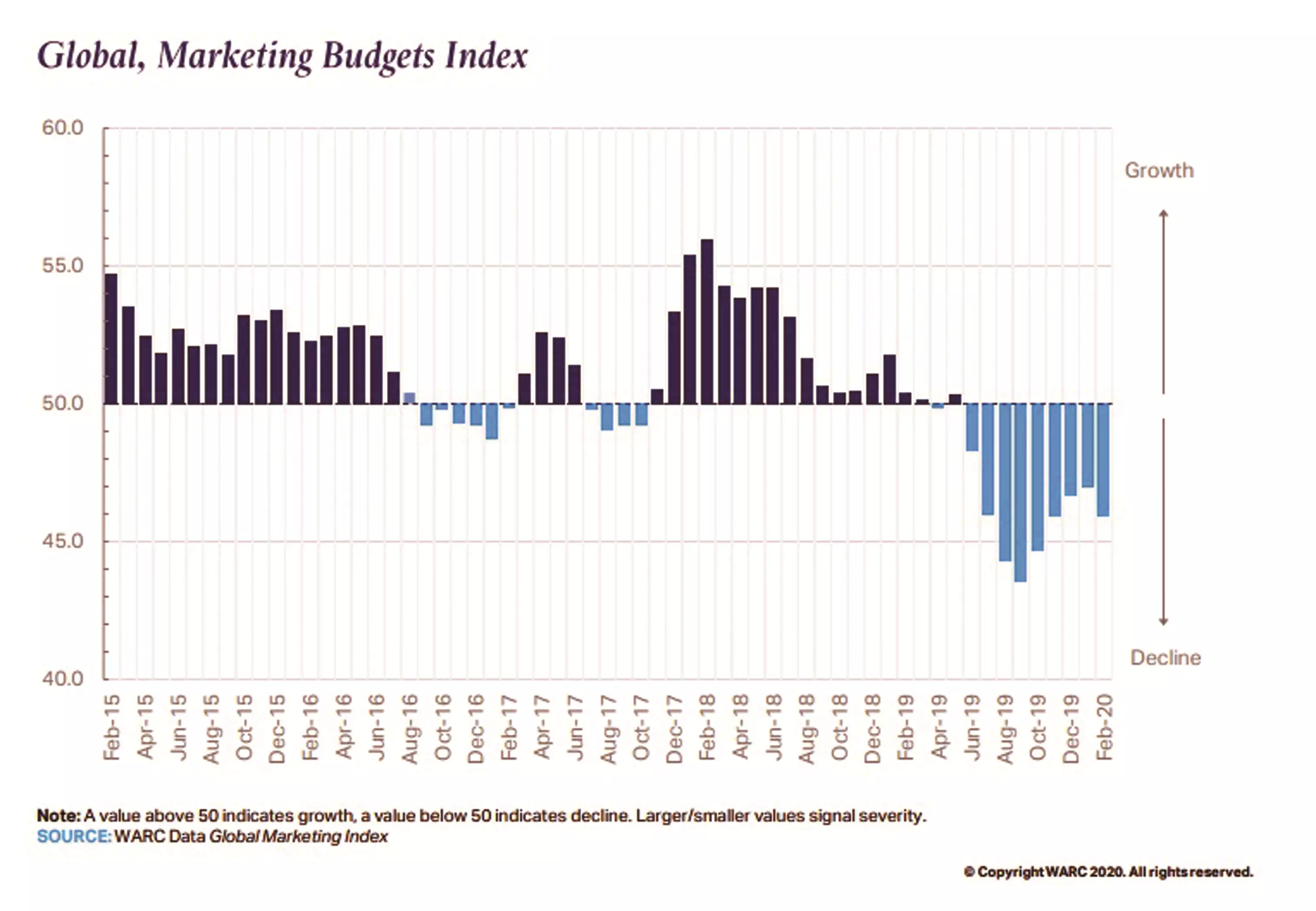

The probability of an advertising recession is high

RTL, Europe’s largest commercial broadcaster, has stated that Covid-19 is now hitting advertising bookings, while NBC Universal will also expect a material impact – its Olympic coverage – worth USD 1.25bn – has now been postponed. UK broadcaster ITV reports the same impact on bookings, most notably within the travel sector, and expects growth to be down 10%. JCDecaux also anticipates a 10% dip. Baidu advises Q1 revenue will be down by as much as 18%. Facebook and Google are exposed – digital channels are the easiest to switch off.

Advertising investments dip among key players

Sales revenue was down among five of the largest FMCG companies in 2009, though only P&G and Coca-Cola cut advertising investment. This is interesting to note as today’s downturn is different –consumers are stockpiling food and drink, and this may lead to a short-term boost in sales income. Evidence from previous recessions shows longer periods off-air will weaken brand health and damage market share due to a reduction in the share of voice.

FMCG ad money is shifting online

This is true across all 19 product sectors monitored by WARC, though some FMCG sub-categories have been slower to shift budget than others, in part because they are not selling directly through digital channels. Brand building is important for food and soft drinks. While online spend is rising in line with the wider market, TV spend is still 4.5 and 3.8 times higher, respectively. The disruption of activity caused by Covid-19 creates the opportunity for brands to build lasting relationships, but communications need to be positive and proactive.

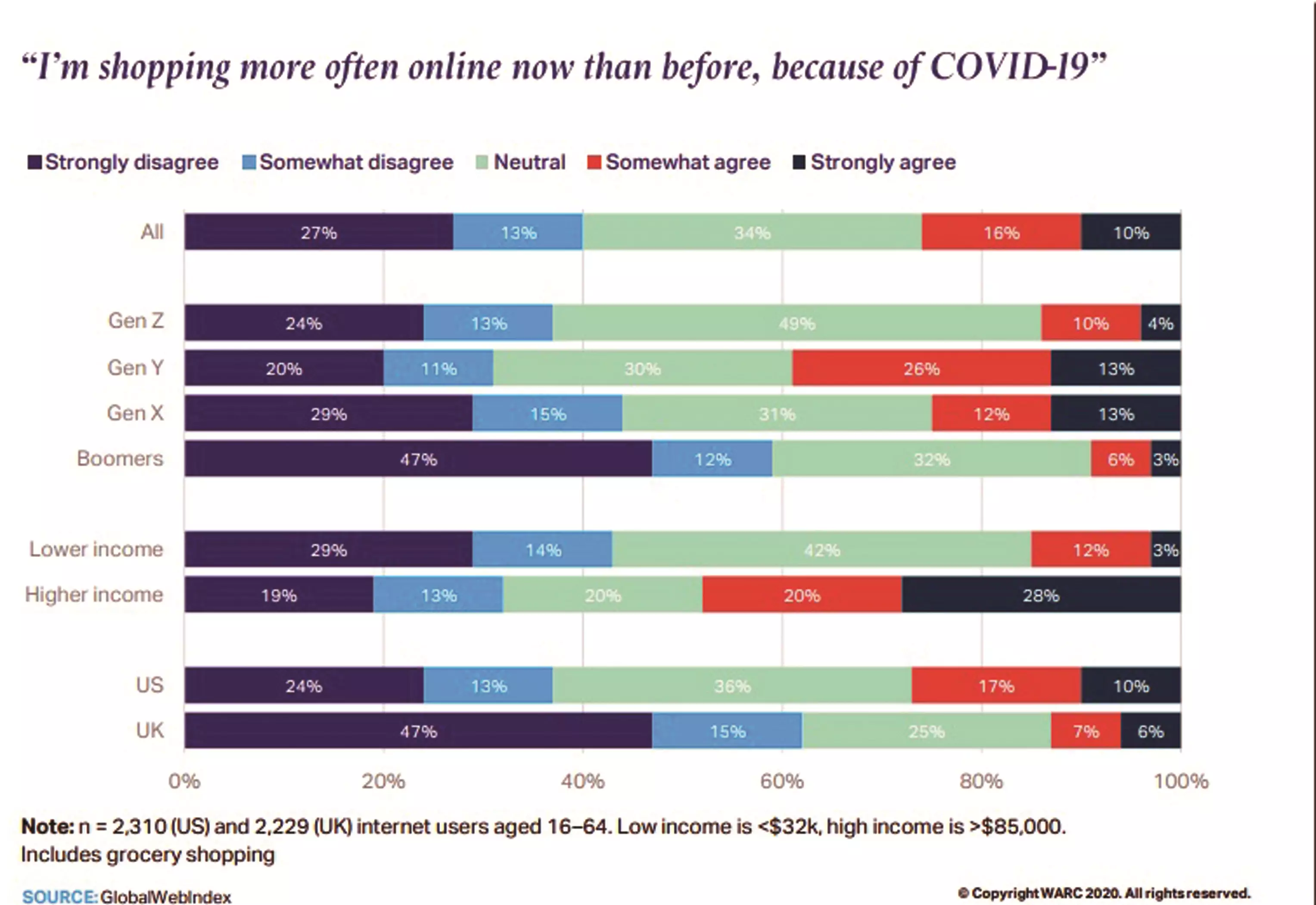

One in four is now shopping online

Millennials (39%) are more likely to do so, followed by Gen-Xers (25%). Higher earners are also significantly more likely to than lower earners (48% versus 15%). Half (46%) of those who say they are worried about the impact of the virus on their finances say they are still shopping more online. Data shows that the majority of online shopping is happening at the expense of visits to physical stores.

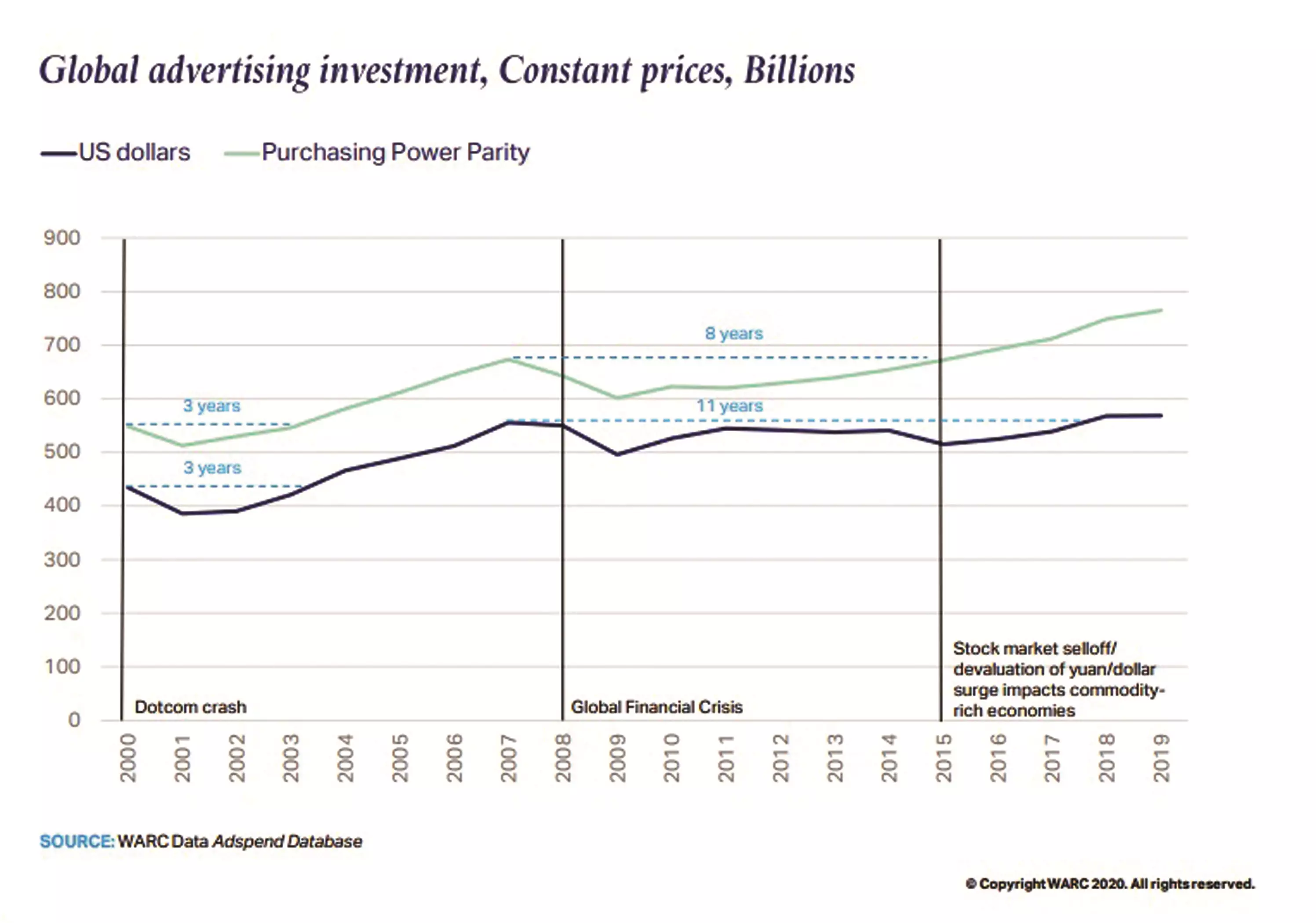

Advertising spend during the last recession

It took the advertising market about eight years to recover from the last crisis. A full 12.7% – USD 60.5-billion – was removed from the value of global advertising trade during the last recession. In nominal terms, the market had recouped this loss within two years. But after accounting for inflation and currency fluctuations, the market took eight years to recover. This extends to 11 years in dollar terms, owing to a surge in the greenback which hit commodity-rich nations in 2015.

Even Google was not wholly immune to the last crash. Advertising income growth eased to 8.5% in 2009, equivalent to USD 1.90-billion in absolute terms. This was down from almost a third (+31.3% – USD 5.2-bn) in 2008 but was still well ahead of the wider market. It is conceivable that large brands will shift budgets online to focus on short-term goals during uncertain times. But much of Google and, indeed, Facebook’s advertising-income is drawn from a long tail of SMEs – those most exposed to a downturn. This explains, in part, why Facebook is now offering these companies USD 100-million in advertising credits.

Will newer marketing trends affect print?

Similar to WARC’s report, a survey by Influencer Marketing Hub, 69% of the multinational and domestic brands of both developed and developing countries have announced to decrease the advertising spending for the year 2020 due to the economic slump caused by the Covid-19 outbreak.

As brands are forced to deploy new marketing strategies with conserved budgets, the question will be how the advertising campaigns, product launches and customer engagement activities will roll out. Instead of long-term returns, marketers might look at quick fixes in lesser budgets. These tightened budgets will lead brands to closely monitor the changes in consumer behaviour and reflect on newer digital marketing trends to boost consumer engagement and acquire instant data and returns.

What digital strategies will the brands eye to deploy? This re-think set to affect mediums such as print and what will be the new normal?

Ajay Bapat, Packaging Concepts

The brand value may not alter post the pandemic. However, because of the demand and supply changes, we might see volume alterations and minor budget cuts to sustain profit margins. But the overall impact on marketing will be marginal and that too for a shorter span.

Brand owners will have to change their marketing strategies with relevance to the current crisis. Those who have never claimed to have developed products to keep a virus away are trying to relate to this pandemic. For instance, even a piece of fabric is being advertised with anti-viral advantages.

Changes in consumer behaviour have leaned towards digital marketing. Thus, the budgets for print media might reduce to 40% of the overall marketing spend.

Amyn Ghadiali, Gozoop

As far as I am aware of the statistics, digital spends will go up from 20-30% of the current total media spends to as high as 50-60% in the post-Covid-19 era. Extrapolating from it, a major chunk of the rest of the pie will be towards above the line activities such as TV, Print, OOH, and Radio.

It is imperative to keep in mind that packaging and designing, both of which are an integral part of the print, will have a great contribution to the industry. To ensure that the brands stand out, not just on digital but also, in reality, packaging design will play a big role.

Also, considering the lines between digital and offline are blurring, I believe that the industries will complement each other instead of competing with one another. How the spends are divided will vary depending on the marketing objective of the brand, but is print a dying sector? Absolutely not. The new trend will unfold in a manner where marketers and custodians will have to become holistic in their approach.

Ashish Bhasin, Dentsu Aegis Network

English print dailies will continue to feel the pressure. Return to normalcy is a term in question today. There will be things that will never be the same and some will take a long time to return to being 'normal'. The unique thing about the Indian market is that all mediums have been growing. If you look at print overall, (newspaper and magazine advertising), it's been the slowest growing medium in India for the last few years, but it is still growing.

Now, going ahead, we will see that regional print players will do better than the English national print dailies. We're seeing it already, but it will be accelerated in the future. English national print dailies will be under more pressure than before. Having said that, print will remain a strong, trusted medium. It's time for publishers to seriously look at digital. Now, newspapers aren't being delivered in Mumbai and people are consuming the news digitally. That's a trend we could look at in the future too. Newspapers should capitalise on that.

Beena Dharod, Topps India

The marketing spend would gain momentum once the lockdown relaxes. Print – online and offline – will continue well post the lockdown. However, we might experience a renewed thrust on digital marketing spend as it can be managed with better tactile efforts.

We have already seen brands leap on developing digital content in the past two months. We shall see a progression on this front. The approach towards digital engagements will be both organic as well as inorganic. Innovative ways of how brands will invest in this medium would be a game-changer.

Huzefa Kanorwala, CTRL M Print Management India

To be honest no one knows when we will get to the normal. What the new normal will be and when will it be. Brands will very much invest in building trust with the consumer rather than speaking about the product. Print will see a cut as brands will spend more on digital platforms and will continue to increase their advertising spend on online visibility.

However, packaging will be more sustainable and minimum. Budget cuts are already happening in a big way. We are seeing companies cut spending in a range of 20-40% and this will have a direct and more impact on the print sector.

Manas Athanikar, Reliance Jio Infocomm

It's a tricky situation, while you need to curb costs you again need to realign your customers back to 100% interest levels in your product line. Nothing can be compromised on branding or packaging aesthetics, but yes, product developers and buyers can optimise cost by re-engineering the specifications and value additions.

Repositioning of packaging with a version that curtails costs while maintaining a good customer experience should opt. While bug tickets spent on ATL will be looked at for cost savings in an era with loss of production, BTL should have a larger focus as it can create more awareness in booming trends such as Swadeshi vs Videshi and eCommerce. Customer loyalty and buying preferences are set to change and marketing strategies will play a pivotal role in this.

Mukund Moghe, Tata Services

Being home-bound could lead to more than a 60% increase in the video content we watch globally. As each country is at a different stage of responding to Covid-19, TV engagement is varied. But one aspect remains consistent: time spent per viewer watching the news and entertainment is going up due to quarantine. However, the trend is in the exact opposite direction in India. The growth of TV advertising was on the higher side especially for healthcare and medicinal products. Except for pharma, the print industry was worst affected.

Based on the current trend, it seems that companies will invest more in digital marketing activities (including TV). Brands will increase their focus on social media platforms. At least 30-35% of print budget will be divided into social media platforms and 10-15% on TV commercials. Marketers will have to reduce spending while continuing to engage buyers.

Artificial intelligence (AI) will soon be the driving force behind many services. Currently, we already seeing it implemented in basic communication, product recommendations, content creation, email personalisation and eCommerce transactions. Another way of approaching AI will be programmatic advertising – automated advertisement buying to target specific audiences – real-time bidding. Chatbots will strengthen its way in digital marketing. Conversational marketing will also boost as most of the Indian consumers prefer immediate responses.

Rajnish Shirsat, R&S Enterprises

Corporates will be more selective in their marketing spend as budgets are going to dry. The return of investment would hold more importance than ever with the emergence of pay for performance trends.

Digital spend will go up but I will expect payment for performance in terms of leads and conversions gaining more significance. Awareness and brand re-enforcement as a strategy on digital platforms will also be new marketing objectives.

I also foresee more local brands promoting themselves on cost-effective platforms and the established ones in premium platforms such as over-the-top media services. We may see an entire Patanjali sponsored short film with associated offers on their products if signed up on premium platforms.

Courtesy WARC

See All

See All