Specialty carbon black market to reach a value of USD 3 bn by 2027

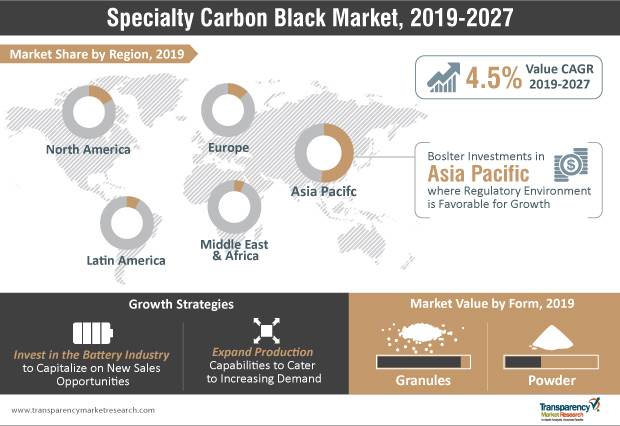

The global specialty carbon black market is projected to exhibit a CAGR of 4.5% during the forecast period of 2019 to 2027.

08 Jan 2021 | By Aultrin Vijay

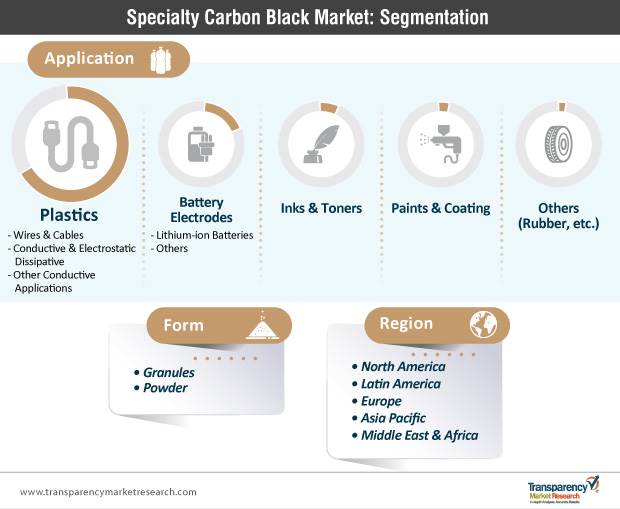

A market study conducted by market research firm Transparency Market Research has shed light on the growing specialty carbon black market due to the rising demand in several industries, including the print sector, where carbon black has remained a key ingredient, especially in printing inks. The majority of the furnace black used in printing inks is for newspaper inks, with the remainder divided among lithographic/offset, gravure, letterpress, flexographic and other inks.

According to the study, however, an increasing demand for high-tech products has paved the way for customers asking for more innovation in the global market. And the requirement for specialty carbon black is growing with the constantly changing consumer preferences. It also found that the global specialty carbon market is presently dominated by the Asia Pacific region.

In 2018, the regional segment accounted for around 45% of total share of the specialty carbon black market. This trend is projected to continue from 2019 to 2027. The development of the regional segment of Asia Pacific is mainly due to the developments occurring in the developing economies such as China, Indonesia, and India.

The report found that the global specialty carbon black market has been experiencing a tremendous development with respect to both volume and value. Back in 2018, the overall sale of the global market was nearly 1,000 kilo tonnes. The total value of the record sale was worth USD2 billion.

With an increasing number of companies operating in the global market such as Cabot Corporation, Orion Engineered Carbons, and Himadri Specialty Chemical, the market is expected to witness an increased competition. These companies are now planning to expand their production facilities which in turn will help in boosting the specialty carbon black market.

For instance, in recent development, Himadri Specialty Chemicals announced that it is thinking of setting up a brand new manufacturing line for specialty carbon black at its present integrated production plant at Mahistikry, West Bengal, in India. This move will help Himadri Specialty Chemical to improve its existing manufacturing capacities.

Carbon black is a form of paracrystalline carbon that contains 95% of pure carbon. It is produced by the incomplete combustion of heavy petroleum products. Carbon black can also be defined as paracrystalline carbon, which has a high surface-area-to-volume ratio. The surge in the use of carbon black in manufacturing tires, plastics, mechanical rubber goods, printing inks, and toners is expected to drive the growth of the market.

Channel black has been used for rubber reinforcement and as a pigment. With the smallest particle size, channel black gave high colour intensity when used as a pigment in paint, ink and plastics.

Over 95% of the carbon black in the rubber industry is produced by the furnace process, and furnace black is also used in printing inks, plastics and paints. Furnace black is also used as a colourant in alkyd and acrylic enamels, industrial finishes, lacquers and a variety of other paints.

Though the demand for specialty carbon black is surging, the environmental impact of its manufacturing continues to be a concern. Complying with stringent regulations can add to the overall cost for specialty carbon black manufacturers, while delaying the product’s time to market. Thus, the expansion ambitions of manufacturers can be stymied due to the complexities and investments involved in meeting environment regulations.

Many manufacturers, in a bid to recover regulation costs, have introduced an environmental compliance surcharge to prices of carbon black.

See All

See All