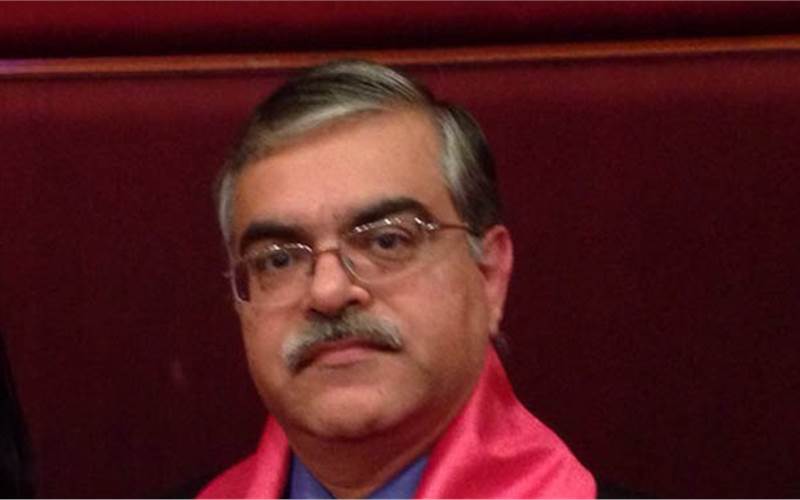

Rajeev Jagga: There has been some confusion regarding HSN

Rajeev Jagga, Ample Graphics, says some dealers are importing same item under different HSN and thereby charging different GST rate

08 Nov 2017 | By PrintWeek India

What has been the impact of GST on your customers? How are your customers coping with multiple GST slabs, tracking of invoices and movement of goods across state borders?

GST impact is quite positive, especially in our case. Earlier, we had to resort to direct billing of machines sold by us from our principal companies to customer since we were unable to pass on the CVD benefits as a trader. Now, after GST, we can import and resell. Thus the entire turnover is added to our top line. Also, earlier the commission would attract service tax which we were unable to recover. Now, we are able to get full ITC of the GST paid on import. Our cash flow has also improved a bit since we do not have to wait to receive our commission. Another factor is earlier the supplier would demand complete payment upfront since they did not know each and every customer. Now most billing is to us so we are able to get some amount of credit with our payment track record. There has been some confusion regarding HSN. Some dealers are importing same item under different HSN and thereby charging different rate of GST for the same item. Movement of goods has not been impacted as yet since the eWay has been postponed.

Do you believe it’s in our best interest that all our (printing and packaging industry) the tangible products are covered under HSN (Goods) so that there is a greater chance of coming under the manufacturing sector and acquiring industry status?

Yes, this is definitely a positive factor. Also, it gives a lot of relief in terms of final billing which would earlier vary depending on who supplied the paper for printing.

Now all are categorised as goods, so it's better.

The Ministry of Finance issued a Notification No 31/2017-Central Tax (Rate) dated 13 October 2017, which formalised the decisions regarding the GST rates at the 22nd Council meeting on 6 October 2017. Is there clarity, finally? Please name one thing on your wish list for the government?

As far as the products that we deal in the HSN is quite clear. Total 85% of our items come under 18% so hopefully when median rate is lowered this will automatically benefit.

Latest Poll: GST hopes to change the indirect tax structure in India. Is GST working thusfar?

GST will be beneficial in the long run: 27%

Good law, poorly implemented: 30%

Small firms face a compliance burden: 15%

Multiple slabs, invoice matching and glitches in the GST Network are a pain: 20%

GST is a uniform and simple tax regime for India: 8%

See All

See All