Raising capital the biggest challenge for women-led MSMEs: Study

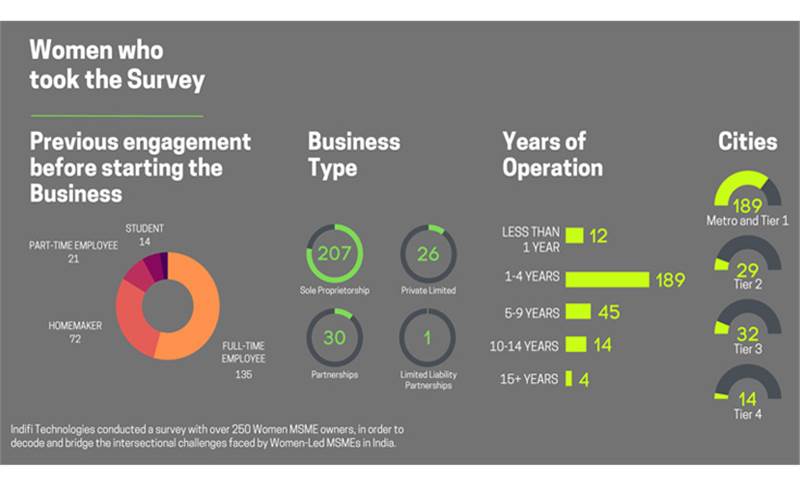

Indifi Technologies, India’s leading ecosystem-lending platform for MSMEs, has released its findings from the survey titled, Understanding what women-led MSMEs want. The number of women-led MSMEs in India has jumped from 2.15 lakh to 1.23 crore in just a decade. However, they face a finance gap of USD 158-bn and largely rely on informal sources. The survey was launched to understand needs and challenges of women-led businesses and enable greater inclusivity in the lending space for them to flourish and scale.

28 Mar 2022 | By Rahul Kumar

The survey that received participation from over 250 women entrepreneurs discovered that securing capital remains the biggest challenge that they face in terms of running a business, followed by managing business operations and securing a credit period from vendors/suppliers. Expanding further on these roadblocks, respondents were of the opinion that starting and scaling their business is difficult for women SMEs, with raising the requisite capital being the common denominator in each stage. 61% of respondents also believed lack of business and finance experience is a contributor to this.

To address some of the challenges, most entrepreneurs said they still rely on banks for their financing needs; but years of business operation, insufficient credit history, and lack of property ownership are the big hurdles when it comes to getting their loans sanctioned.

To bridge some of the gaps and drive inclusion of the creditworthy yet underserved businesses, Indifi has been enabling accessibility to credit through its verticalised and ecosystem-based approach by partnering with leading tech aggregators such as Amazon, Flipkart, Zomato, Swiggy, Google Pay, FirstData, and Banks & NBFCs as lending partners. By leveraging alternate data sets available in these leading tech aggregators, Indifi mitigates the underwriting challenges and enhances access to capital for micro MSMEs.

The survey further uncovered that in terms of exploring digital lending alternatives, respondents believe that the lack of awareness and technical knowhow is the reason why digital loans are not commonly explored as avenues for credit amongst other women entrepreneurs.

Further decoding the intersectional challenges through the gender lens; 45% of the women entrepreneurs believe that having a male co-founder makes running the business easier. They also shared that the top three attributes that a male co-founder brought to the table in a business is, managing a team, interacting with vendors and clients, and securing capital/funds.

Women entrepreneurs displayed a fair sense of comfort in using digital tools and the top use of digital technologies in their businesses was for internet banking, followed by social media marketing and using online marketplaces. In Indifi’s own findings from its customer base, 50% of the loans for women SMEs come from eCommerce, travel, and restaurant segments which heavily rely on digital technology for their operations.

The survey received participation from a diverse set of entrepreneurs at different stages of their businesses. A majority of the respondents were between the ages of 31 and 50, and a large portion of respondents have been operating their businesses for the past two-four years.

See All

See All