Printo to implement wealth management programme for its employees

Printo is set to implement Kaleidofin, a wealth management programme for the under-banked, which will provide financial planning solutions to all of Printo’s employees. Kaleidofin is a wealth-tech platform that aims to extend the benefits of wealth management to a first-generation working population with small savings.

10 May 2019 | By Noel D'Cunha

Printo employees will enrol for Kaleidofin solutions that combine the right amounts of savings, investment, credit and insurance to achieve their life goals. The company will absorb the enrolment cost on behalf of their employees. The employees have the choice to link the Kaleidofin remittance to their Printo salary account, which according to Kaleidofin, will make it simpler for them to manage the monthly payout.

Manish Sharma, the founder of Printo, said, “A large part of Printo workforce is first-generation skilled corporate job holders. They are often not deemed eligible for typical financial products offered by banks. Irrespective of how little or how much you can save, Kaleidofin offers a simplified yet, a powerful financial tool that inculcates a discipline of saving towards a goal.”

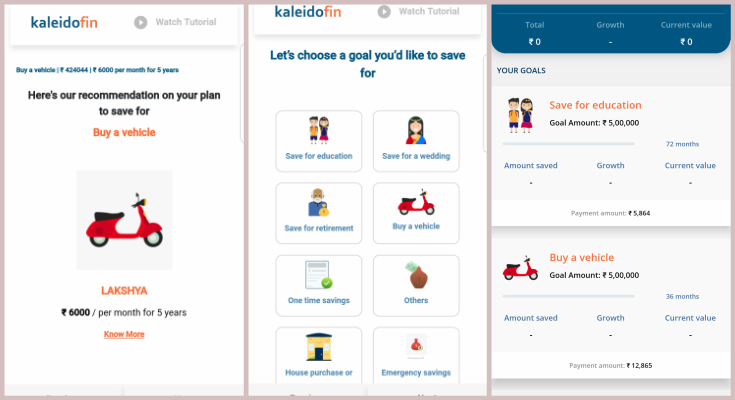

Each Kaleidofin solution is a unique combination of savings, credit and insurance products, which is mapped to each individual’s persona, life goal and risk capacity. Kaleidofin uses its proprietary asset allocation algorithms to choose the most appropriate mutual fund in line with customer risk capacity. To provide support for any unforeseen needs, a customer gets a pre-approved credit line. Kaleidofin further strengthens the offering by providing life, accident and disability insurance for the amount the customer was aiming to save.

“We believe this will help many of our employees in achieving their life’s aspirations. Employee’s welfare and well-being is an important part of our organisation and we are happy to be associated with Kaleidofin,” Sharma added.

At Kaleidofin, the process starts with capturing individual data through a customised questionnaire on their app. The questionnaire aims to capture the individual’s income and other socio-economic details to create a holistic risk and aspirational profile for the customer. The Kaleidofin App then matches the income to the ideal savings goal within the ideal duration and suggests the best possible solution for the customer. A pre-defined structure ensures that there is no cognitive load on the customer.

Sucharita Mukherjee, co-founder of Kaleidofin said, “By virtue of being part of a formal economy, most of the employees in organisations like Printo have access to financial products like insurance or investment. However, the cognitive load of choosing the right proportion of product mix can be daunting for many. At Kaleidofin, our aim is to empower people to use financial planning to achieve their aspirations and uplift their goals. By providing simple ‘life-goal’ based financial solutions, we empower our customers to achieve more through their limited savings.”

Mukherjee claimed, Kaleidofin has partnered with significant customer networks such as Sewa Bank, Cashpor, Sonata, Samasta, DSNL and Sewa Bharat as well as financial institutions such as ICICI Prudential AMC, Bharti AXA, ICICI PruLife and Blue Marble to deliver the optimal financial solutions to its customers. It is operational in Tamil Nadu, Gujarat, Rajasthan, Bihar, UP and Maharashtra.

See All

See All