Paper industry asks for import monitoring system

The Indian paper industry represented by Indian Paper Manufacturers Association (IPMA) has expressed concerned over continued growth in paper imports in the country. In a communication to ministry of commerce and industry, IPMA has asked for implementing a Paper Import Monitoring System for all grades of paper and paperboard to curb the indiscriminate import of paper in the country.

26 Feb 2020 | By Rahul Kumar

“Notwithstanding adequate domestic capacities, growth in domestic paper manufacturing is being hit hard in view of the continued surge in import of paper at low or zero rates of import duty enjoyed by some of the largest paper manufacturing countries in the world,” IPMA has stated.

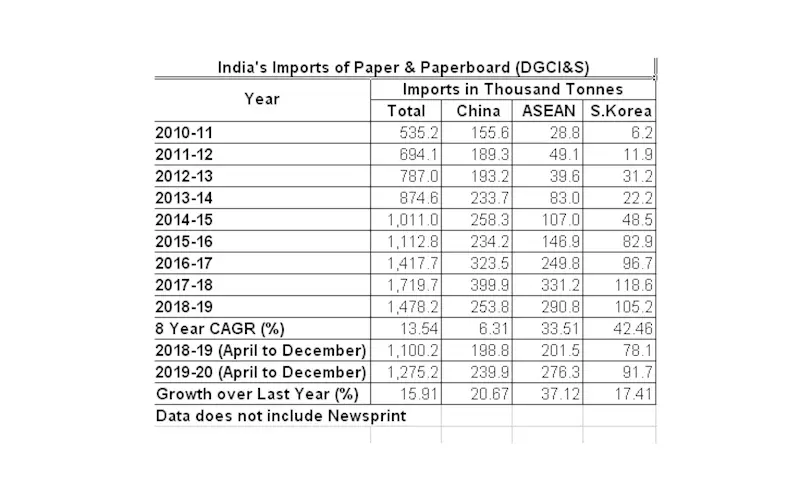

Paper and paperboard imports in the country have gone up by 16% in volume terms in Apr-Dec 2019-20 against the corresponding period of 2018-19. From an import of 11-lakh tonnes in April-December 2018, paper imports have risen to 12.75-lakh tonnes in April-December 2019. Import of paper from ASEAN region has risen at a faster rate of 37% during the nine-month period. ASEAN has come to account for the largest chunk of paper imports in the country.

“In view of excess capacities in some of the paper manufacturing countries in the world, paper and paperboard is being diverted to India which is arguably the fastest growing paper market in the world. Growth in eCommerce, wider spread of education and increase in quality of life is leading to an increase in consumption of paper and paperboard in the country. However, the demand is being increasingly met by imports depriving Indian manufacturers the growth opportunity,” said AS Mehta, president, IPMA.

IPMA has asked for putting all grades of paper and paperboard in the negative / exclusion list of existing and future free trade agreements (FTAs). “No import duty preference should be offered and a level-playing field should be provided to domestic industry,” IPMA has stated.

Paper manufacturers in Indonesia and China enjoy substantial amount of export incentives and other advantages like easy access to cheap raw material and energy, thus denying Indian manufacturers a level playing field.

IPMA has also called for imports of paper and paperboard under the ‘others’ category should be allowed only on actual user basis, that is, the import policy for these items should be changed from ‘free’ to ‘restricted’ and subject to import licensing.

“Further, a complete ban on import of stock lot of all grades of paper should be imposed as recently done by the Government for stock lot of coated paper and paperboard,” said Rohit Pandit, secretary general, IPMA.

Citing import data from the Directorate General of Commercial Intelligence & Statistics (DGCI&S), IPMA has stated that in the last eight years, imports have risen at a CAGR of 13.10% in value terms (from Rs 3,411-crore in 2010-11 to Rs 9,134-crore in 2018-19), and 13.54% in volume terms (from 0.54-million tonnes in 2010-11 to 1.48-million tonnes in 2018-19).

Both under the India-ASEAN FTA and India-Korea CEPA, the import duties on paper and paperboard have been progressively reduced and currently stand at 0% on almost all grades. Under the Asia Pacific Trade Agreement (APTA) too, India has extended import tariff concessions to China (and other countries) and has reduced the basic customs duty from the existing 10% to 7% on most grades of paper.

The government should support the paper industry as it has strong backward linkages with the farming community and is contributing handsomely to the national objective of bringing 33% of land mass in India under tree cover.

See All

See All