Paper dominates conversation at PrintPack

For the second year in a row, India’s exports of paper, paperboard and newsprint have outstripped imports, in volume terms, in 2021-22. Most of the visitors at the show are talking about how paper exports have grown four-fold from 0.66-million tonnes in FY17 to 2.85-million tonnes in FY22. Print business owners have reported price increases, as consumer inflation rises to its highest point in 40 years. Dibyajyoti Sarma reports.

29 May 2022 | By Dibyajyoti Sarma

As per the Directorate General of Commercial Intelligence & Statistics (DGCI&S) data, paper and paperboard exports from India have grown by 80% in FY 2021-22 to touch the highest ever figure of Rs 13,963-crore.

A statement from Indian Paper Manufacturers Association (IPMA) said, the export growth is across different grades of paper. Pandit added that exports have seen a boost because of capacity expansion as well as technological upgradation which have been undertaken by the Indian paper mills. As per an industry estimate, the past five years has witnessed an investment of Rs 25,000-crore in new capacities and clean-green technologies by the paper majors.

In value terms, the exports of coated paper and paperboard have increased by 100%, uncoated writing and printing paper by 98%, tissue paper by 75% and kraft paper by 37%.

Presently, India is exporting papers to UAE, China, Saudi Arabia, Bangladesh, Vietnam and Sri Lanka.

The IPMA statement said, “In volume terms, paper exports from India have gone up four times from 0.66-million tonnes in FY17 to 2.85-million tonnes in FY22. Similarly in value terms, the figures for corresponding years rose from Rs 3,041-crore to Rs 13,963-crore.

Meanwhile, Association of Pulp & Paper Technical Alumni (APPTA) which has sourced MOCI data said, "Paper exports have outperformed overall exports of India (that is, 65% against 45%). Paperboard continues to lead the growth this year. This is followed by uncoated graphics paper.

The biggest uptrend can be discerned in Kraft paper exports that showed the highest growth of 240% over last year. An industry veteran shared with PrintWeek that there is no surprise that recently added new capacities are either in kraft or paperboard.

As WhatPackaging? magazine reported last year, “The exports of kraft paper from India to China have surged as China has banned import on waste paper from 1 January 2021. As a result, there has been a surge of exports from India in the form of recycled kraft paper pulp rolls. This has created a huge shortage of raw material for the domestic corrugated industry.”

Meanwhile, a newsprint crisis has impacted an already beleaguered newspaper sector. which has opted for slim editions, high cover price, and cost-cutting of personnel. The data on the website of the Indian Newsprint Manufacturers Association (INMA) show that India’s demand for newsprint is 2.2-million tonnes per annum. Of which 68% demand (1.5-million tonnes per annum) is met by imports. Most of it is sourced from Canada and Russia.

PrintWeek’s paper special in 2021 highlighted the fact that paper mills in India were unable to optimise their newsprint capacity. This was primarily due to “lack of regular orders as well as scarce availability of raw material availability. Due to the low demand for domestic newsprint, plus irregular supply of waste paper, Indian paper majors have opted for manufacturing of packaging boards.

Meanwhile, IRPTA, which is the All India Waste Paper Dealer Association, is pointing to the 25% rates of recovered paper cut down in the packaging paper segment in the past month or so. Naresh Singhal, president of IRPTA said, there is a hope for the revival of domestic waste collection from April onwards, after which the market will get stable. He said, “After the availability of the imported waste by May or June, the prices for waste paper will reduce.”

During PrintPack, the market for waste paper was “a hot topic and matter of concern”. The main reason is: how the prices of waste paper have doubled. In the last five-six months, the price of corrugated waste doubled from Rs 17-18 to Rs 31-32. Similarly, writing and printing grade material has notched the Rs 51-52 range. The price for notebooks has reached Rs 42-43. This crisis began because the consumption of paper dipped due to the Covid pandemic. In 2020, the consumption of writing and printing paper was reduced by 56-60%. It was reduced by 35% in 2021. At the same time, newspaper consumption was reduced to 17-18% in 2020 and 28% in 2021.

Naresh Singhal said, “In the last two years, only packaging grade paper has performed well. Its consumption has been 55-60%, and almost 90% corrugation waste was recovered. This paper hardly goes for dumping and gets recovered at many conversation stages,” he said.

As a result, waste paper input has been poor in these two grades. As opposed to Europe which deploys virgin pulp, India relies on recycled paper. The European Union (EU) has withdrawn the ban on exports of waste paper to India, from April. Singhal shared with PrintWeek that things are looking up now.

A print business owner from Indore who visited PrintWeek’s stall at PrintPack told this scribe, “Whatever the industry leaders may utter during conferences and conclaves about the India growth story and the boom in the industry, the fact is, print businesses across the country are under a lot of pressure.”

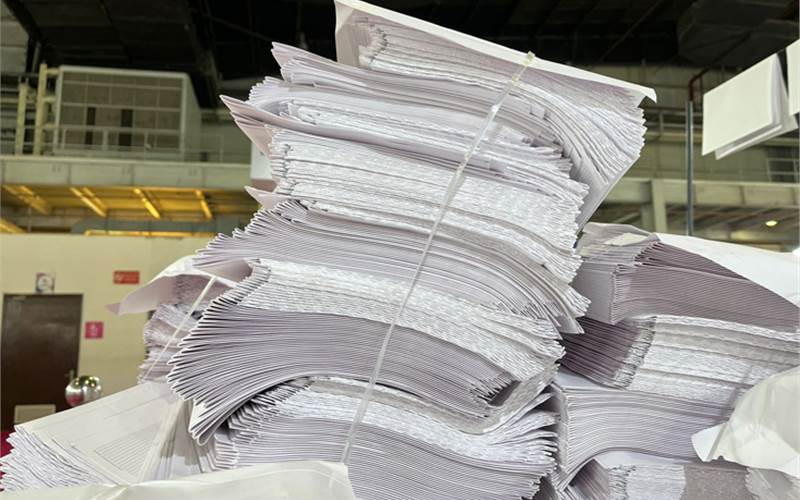

He shared with PrintWeek how his firm has to buy paper in advance and “store pallets of paper for our mainline clients, so we can get a semi-hold on paper prices, at least for a couple of months. The price increases have been scary. And there is no light at the end of this dark tunnel.”

The author is associate editor, PrintWeek. If you want to share your insights or solutions (firms could purchase collectively to bring supply prices down) about the paper industry, you can write to Dibyajyoti Sarma dibyajyoti.sarma@haymarketsac.com

See All

See All