JM Financial invests Rs 600-mn in Canpac

JM Financial Private Equity, a sector-agnostic growth-capital private equity fund, has finalised an investment of Rs 600-million in the Gujarat-based folding carton and packaging solutions company, Canpac Trends, to fund the company’s current expansion plans.

27 Mar 2021 | By Dibyajyoti Sarma

Founded in 2010 by Nilesh Todi, a first-generation entrepreneur who has successfully scaled the business over the years, the company has manufacturing plants in Ahmedabad (Gujarat) and Tirupur (Tamil Nadu).

Todi said, “Canpac has emerged as a fast-growing packaging player in the country with a key focus on folding cartons and corrugated boxes. This growth capital infusion and partnership with a seasoned investor like JM Financial Private Equity will help us accelerate our current expansion plans and market share.”

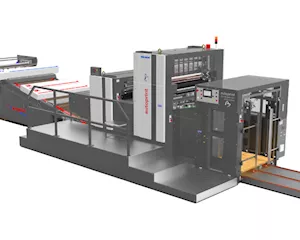

Canpac manufactures folding cartons, corrugated boxes, paper bags, flexible laminates and luxury boxes. It supplies products to a diverse set of marquee customers across industries and offers a wide range of products and design solutions catering to multiple needs of its customers, making it a one-stop packaging solutions provider.

Darius Pandole, managing director and CEO, PE and equity AIFs, JM Financial, said, “We believe that the packaging sector is poised to continue its growth trajectory. Increased consumption of packaged goods, growth in organised retail and eCommerce and increasing premiumisation will drive growth for organised packaging players and Canpac is well-positioned to capture this growth spectrum. With its in-house manufacturing facilities and R&D, Canpac offers superior quality products, in a timely manner, to its customer base, thus emerging as a one-stop packaging solutions provider for its customers. The fund infusion will help the company scale up its business and expand its market share.”

See All

See All