Inkjet to reach USD 128.9-billion in 2027

The Future of Inkjet Printing to 2027 market data study has been authored by Smithers print consultant Sean Smyth.

21 Jul 2022 | By Charmiane Alexander

Technology advancements in digital print – and inkjet in particular – is expected to see growth for a global market worth USD86.8 billion in 2022. A compound annual growth rate (CAGR) of 8.2% for 2022-2027 will drive this value to USD128.9 billion in 2027.

The outlook of inkjet printing has been profiled in a new market data study – The Future of Inkjet Printing to 2027 – authored by Smithers print consultant Sean Smyth.

In contrast to competing analogue processes, the report says, "Inkjet is forecast for strong future growth for a global market worth USD86.8 billion in 2022. A compound annual growth rate (CAGR) of 8.2% for 2022-2027 will drive this value to USD128.9 billion in 2027."

While inkjet is in some lower-run applications, faster presses mean that it is becoming more cost-competitive for longer print runs, even as many customers have revised their print buying strategies. This is reflected in the volume of inkjet prints, which will rise from 1.0 trillion A4 print equivalents (2022) to 1.7 trillion (2027) – equivalent to a 10.0% CAGR for 2022-2027.

The report looks at packaging applications with installations of the latest dedicated presses for corrugated, cartonboard and flexible substrates. Inkjet is also broadening its market with a double-digit growth forecast across the same period in commercial print, books, catalogues, magazines and directories. As the technology suite for inkjet improves it is pushing electrophotography (toner) print out of some core markets.

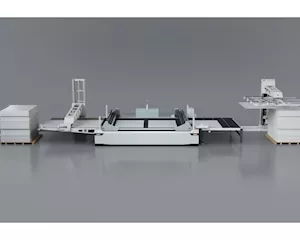

Another interesting trend is about press speeds and resolution which will continue to increase. Over five years, the 200m/min presses and printheads offering 1200dpi in 2022 will improve to a standard of 300m/min and resolution of 2400dpi in 2027. The segment will benefit from greater integration of robotics using smart monitoring to minimise downtime, and improving precision in direct-to-object print. This productivity will be available in a wider range of press formats, including more large format sheet-fed machines, able to produce up to 10,000 A4 impressions per hour

The wider uptake of inkjet will see ink prices fall from their current premium. The market will be bolstered by an improved range of UV-curing and water-based inks; and the steady evolution of more specialist whites, metallic effects, fluorescents, varnishes and security inks.

The arrival of additional embellishment and tactile finishes, will allow further diversification into segments like home décor, transport, garments and other textile applications

This report is based on primary and secondary research. Primary research consisted of interviews with material suppliers, converters and experts drawn from key markets. One key finding in the report is, "In the industrial sectors there may be specialist functional fluids used to print bio-medical or electronic products."

With Inkjet offering economic advantages over analogue print for short runs, as well as an increase in demand; as higher performance presses are used this economic crossover against analogue seeing an increase, the Smithers study The Future of Inkjet Printing to 2027 provides a comprehensive market data forecast.

See All

See All