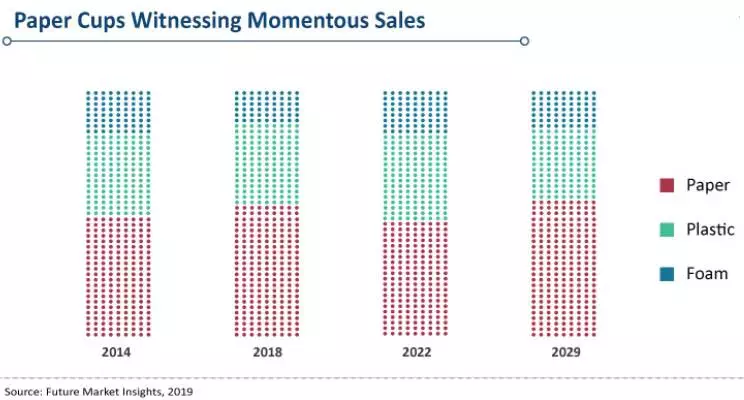

FMI study says - 600 billion units of disposable cups in 2019

According to a 255-page report from Future Market Insights (FMI), the global sales of disposable cups will total ~600 billion units in 2019. This represents a 3.3% increase from 2018. The disposable cups market is projected to grow at ~4% CAGR during the period, 2019-2029, driven by affordability and availability along with increasing consumption of non-alcoholic beverages, which led to proliferation of café retail chains and international coffee shops, especially in developing countries.

22 Aug 2019 | By Aultrin Vijay

While North America (28%), Europe (25%), and East Asia (17%) remain leading markets for disposable cups, South Asia is set to exhibit relatively high sales of disposable cups in 2019. In leading markets, strong establishment of end-use industries continue to drive the sales at steady rate, while rapid expansion of QSRs and food service outlets lined with increased income levels of consumers will provide potential growth prospects of the disposable cups market players in South Asia.

According to the FMI study, disposable cups have long been an ideal promotional or branding tool for beverage companies such as The Coca-Cola Company and PepsiCo. Companies like McDonald's in the UK have installed new collection stations in 150 of its 1,250 UK restaurants, with more to come. This translates into recycling of anything from 30 million to 100 million cups over the next 12 months. The partnership with top brands signifies an important step in recycling used paper cups and, ultimately, reducing waste going to landfill.

According to the study analyst, non-alcoholic beverages, including both carbonated and non-carbonated, will remain the largest and fastest-growing application category for disposable cups. As the use of plastic as a raw material continues to face excessive scrutiny from consumers as well as environmental organisations, manufacturers are focusing on increasing the production of paper disposable cups. As paper cups contributed half of the total sales of disposable cups in 2018, manufacturers are specifically focused in this category.

While the beverage sector continues to influence the growth strategies, manufacturers are targeted towards capitalising on dairy sector. The report analyst forecasts that the consumption of disposable cups in the dairy space for ice-creams, yogurt, and others will show an increase of 3.3% year-over-year in 2019.

"As aesthetics drive desirability among consumers and fulfil marketing quota, manufacturers are placing their focus on adoption of digital printing technology to introduce both aesthetic and informative labels in their products," said the report analyst. "Nearly eight in 10 disposable cups sold in 2018 were printable, and will continue to gain relatively high traction as compared to non-printable disposable cups."

Meanwhile, the consumption of disposable cups across various food retail sectors continues to be on an upward swing, representing a revenue share of ~60% in 2018. Within the food retail industry, the adoption of disposable cups by convenience stores will account for ~37% in 2019, while growing application in supermarkets is likely to result in increased market shares.

According to the study, disposable cups worth ~USD 5 billion were sold in food service sector in 2018. As both ‘dining out’ and ‘takeaway’ cultures gain prominence worldwide, on the account of rapid shift toward urban living and fast-paced lifestyles, disposable cups sales are set to remain high across the food service industry.

Trends in disposable cups

Be it getting coffee, smoothie, or fountain soda, plastic, paper and Styrofoam disposable cups are everywhere. Proliferation of coffee shops lined with increasing use of single-use packaging across food service chains to facilitate ‘on-the-go’ sales models has potentially raised the demand for disposable cups over the years. Moreover, single-use and functional packaging have become a defining feature of consumer culture as well as the nations’ economy; dominating the retail shelves, dictating how products are produced, and transforming the way these products are provided.

Within beverages, new technologies and subculture elements are widely used on labels, making the products more attractive to the consumers, while disposable cups served in international coffee shops gained significant attention for their aesthetics. With the rapid rise of delivery-optimised restaurants and consumer inclination towards out-of-store dining experience, manufacturers of disposable cups are hard-pressed to up their innovation game to fulfil takeaway and delivery packaging needs.

Disposable cups, especially made from plastics, have become a cause of growing waste crisis, thereby compelling manufacturers to adopt recyclable and sustainable solutions. Although there is no immediate panacea for the single-use plastic epidemic, innovations have been forthcoming for using biodegradable and compostable materials to manufacture disposable cups.

Consumers’ demand for clean-labels and transparency of products has led to significant transformation in the packaging industry, and disposable cups are no exception. Manufacturers are directing their investments towards digital printing technology to enable the introduction of heat-sensitive label and Quick Response (QR) code on their products. Realising the ban of plastic use in several countries around the world, manufacturers are putting emphasis on biodegradable materials such as plant-based plastics, bagasse, and seaweed, as a strategic move toward entirely plastic-free packaging. Fibre-based and compostable paperboard solutions are further adopted for cup liners. As the jury is still out on the environmental impact of reusable cups, disposable cups of biodegradable, compostable, or recyclable materials are here to stay for the foreseeable future.

See All

See All