Sheetfed offset: Looking back at 2016 - The Noel D'Cunha Sunday Column

A bullish Drupa, plus a plethora of crisis triggers marked 2016. But 81 presses with 421 units installs was an impressive run over the previous year.

This Sunday Column delves deep into how the past year has been for the sheetfed offset market.

03 Mar 2017 | By Noel D'Cunha

An eventful year 2016 was. To begin with Drupa, 2016 loomed large on the Indian print horizon. Then there were non-print events like Brexit, Donald Trump’s victory in the US Presidential elections, a volatile Yen and finally the Indian PM’s 8 November demonetisation announcement, and the aftermath. In between, we also lost music greats like David Bowie, Glenn Frey, Leonard Cohen, Prince, among others. It’s a year that you will not forget in a hurry.

And like every year, co-author Rushikesh Aravkar and I did a little bit of recap of what happened in the imported machinery – sheetfed offset segment of the print industry.

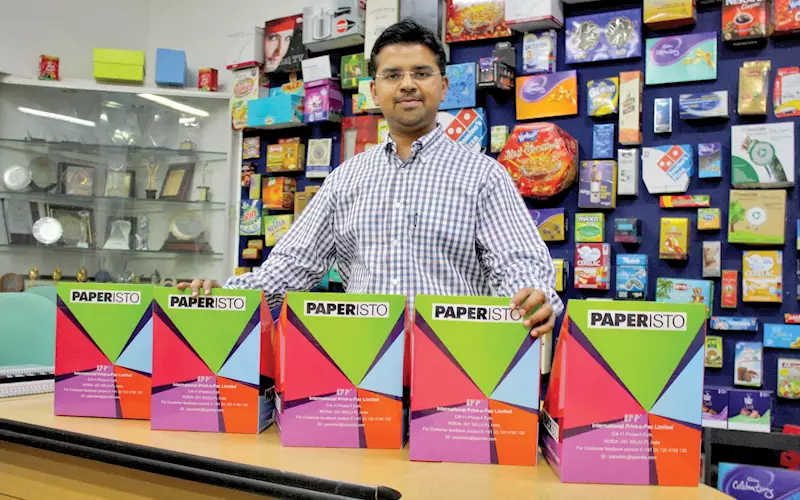

Indian printers flocked to attend the industry’s biggest print exhibition in Dusseldorf, and many vendors announced marquee orders at the show. Heidelberg India announced its biggest Drupa order with Parksons Packaging – two Heidelberg CX 102 multicolour presses. Indo Polygraph Machinery sold six machines, three of which were signed by TCPL. The seven-colour plus double coater Rapida 106 combi UV press has also been installed at TCPL’s Silvassa unit.

The numbers in 2016

When we met Vinay Kaushal, managing director at Provin Technos, the Indian representative for RMGT, Japan, he had said, “My expectation is we will have 75 new machines in 2016.”

Kaushal was not off the mark by much. From the information we have gathered, there are around 81 presses or 421 units of presses that have been installed in India. In terms of units – Komori installed 142 units (31 presses), RMGT 68 units (14 presses), Heidelberg 140 units (we estimate it to be 25 presses), Shinohara 16 units (4 presses) and KBA 55 (7 presses). Manroland Sheetfed, like last year, did not open its account for the year.

| Manufacturer | Installations in 2016 |

| Heidelberg | 25 presses* / 140 units |

| KBA | 7 presses / 55 units |

| Komori | 31 presses / 142 units |

| RMGT | 14 presses / 68 units |

| Shinohara | 4 presses / 16 units |

| *estimated | |

There was positivity leading to Drupa and the announcements during Drupa. It reflects in the numbers, which are marginally higher than last year’s 70+ presses and 320 units.

| CN Ashok, Autoprint |

|

The year 2016 began on a very positive note and the entire printing industry was looking forward to Drupa. At Autoprint, though we did not display any products, there has been excellent response to the print inspection system we launched - the Checkmate-50. We have installed six of these machines post-Drupa.  I draw your attention to the import and export figures. For the period from 1 April 2016 to 22 November 2016, there were around 1,488 imports of printing presses (single to eight- colour) from countries like Japan, Germany, United States, China, Czech Republic, UK, South Korea, Italy, etc. On sheetfed offset, the going has been slow. So far, we have closed 150 orders. We are expecting to close the year with 250 numbers, including both single- and four-colour Dion series. Unlike China, in India, there is no ban on secondhand imports. No big printing manufacturer in the world is interested in collaborating with an Indian manufacturer due to the availability of cheap imports.On the other hand, Indian manufacturers cannot manufacture without collaboration and transfer of technology in the areas of sheetfed due to the advancement in technology that has happened in the recent years. |

Could have been better

“2016 was the Drupa year, and this added to positivity before and after. But with Brexit, the toll was on the Japanese Yen (JYP), which saw an increase of 10%. This has resulted in cancellations of many orders signed during Drupa,” says Kaushal.

Aditya Surana, managing director at Indo Polygraph Machinery, the Indian representative for KBA, says, “We were well on target but post 8 November, there was a slight setback. Last year, we turned eight presses. This year, we could ship only seven. At least five or six presses are on hold, but we expect it to be cleared by January-February 2017.”

TP Jain, managing director at Monotech Systems, the Indian representative for Shinohara, says, the market for offset presses, with a bias towards packaging applications, will have good growth momentum. For Monotech, it’s a beginning in the offset market and the company has enjoyed selective success with one installation pre-Drupa and three post-Drupa, with three more in the coming months.

For Heidelberg India though, 2016 was an exciting year. “Our sales are up more than 40% compared to last year,” says Peter Rego, general manager sales at Heidelberg India. “Compelling price-performance ratio has worked in our favour. Favourable Euro exchange rates have also helped to an extent.”

Technology direction

Heidelberg fired on all cylinders at Drupa, says Rego. “The ‘push to stop’ demonstrated fast changeover, and how the press makes decision for itself, with quality control systems,” he says.

KBA showcased a major revamp to its B2 Rapida 75 press, the Rapida 75 Pro. Maharashtra-based newspaper and commercial business group Sakal ordered this new six-colour plus coater UV press.

Komori’s eight-colour GLX series also with H-UV, auto-plate adjustment was faster at 18,000sph with fast makeready and non-stop start-up functions. And RGMT unveiled its new look presses, including a RMGT 10 B1 six-colour with LED-UV curing, a RMGT 9 SRA-1 eight-colour perfector with twin LED units.

At Drupa, Industrialisation 4.0 was hot. While Industrialisation 4.0 is happening in Western and developed countries, this is not the case in an emerging market like ours. “We will be sucked into this trend by 2020, or even earlier, whether we like it or not,” says Rego.

Will inkjet sheetfed be a threat to sheetfed offset? No. There’s no visible threat from inkjet technology, at least in the near future. This will make people confident about investing in offset technology. We are new to the offset market but have achieved selective success.

TP Jain, Monotech Systems

However, Kaushal says, sheetfed market in India is different from the rest of the world. “We are in the modernisation phase which will see many printers vanish but those who upgrade will sustain.”

Who are buying and why

Currently there are two types of purchases taking place in the industry. One, those who are upgrading their existing systems; two, those who are replacing their outdated equipment, that is, users of secondhand machinery buying their first brand-new machine.

As far as the trend of users of pre-owned machinery buying new machines is concerned, I think it will continue for a few more years. Used machines will soon become the second choice in the times to come. Our sales to first time new machine buyers is over 35%.

Sangam Khanna, Insight Communication

“On the commercial print side, people are buying new presses to replace a couple of old ones. The production rate in these new machines is amazing and the quality is good,” says Narendra

Paruchuri, chairman at Pragati Offset. “Today space, power, people, and maintenance, cost a good percentage of earning. So changing to a new machine makes sense, especially if you are a tax payer.”

In the breakup of presses, according to our calculation, of the 81 presses installed, 57 are in the commercial segment with a big chunk of this going to first-time buyers of a brand-new machine. This was also the case in 2015.

Rego says 30% of Heidelberg’s sale was generated from this segment.

Heidelberg made the SORDZ (25x37-inch) years ago. Global markets have moved away from this size. Nevertheless, we do understand the importance of this segment, especially in the Asian markets. So we launched the CS 92 press and it has met with success too.

Peter Rego, Heidelberg India

Sangam Khanna, director at Insight Communication, Indian representative for Komori, says, the Indian print industry is heading for the Darwinian theory of survival of the fittest. “The trend of new machines with used equipment users will continue for few more years. Used machinery will become the second choice in times to come.”

But will buying entry-level four-colour machines help? No, says Surana of Indo Polygraph Machinery, adding, it will make more sense for a commercial printer to pick up a machine where they can provide lots of value additions. “The talk of the industry is that the commercial printing is dying, but I am of the opinion that one of the reasons for this is that they have taken a long time to adjust to the needs of the hour. They need to move out to bigger places, look for more value additions. Only then they will be able to survive.”

Indian print industry is clearly segmented. Only the packaging and book printing segment is growing. We do see the Indian print industry strengthening in smaller cities while the large cities seem to be bursting in the seems in infrastructure, costs of production and other issues.

Neeraj Dargan, Manroland Sheetfed

Kaushal says this trend is across manufacturers. Even for RMGT, 90% of sales are from first-time buyers and balance 10% are repeat buyers. “But the difference between RMGT and others is that RMGT did not sell entry-level machines. We sold fully-loaded machines.” says Kaushal.

Earlier, no one looked at 36-inch press but today everyone is understanding the importance of size. Few years back, there was only one manufacturer in the 36-inch segment but today we have three. We have designed this size to save on plate cost.

Vinay Kaushal, Provin Technos

High-end kit for packaging

There was a time in India when printers were just trying to upgrade themselves by selling off their old machines and putting up one new machine. Now what we are seeing, particularly in the packaging segment, post 2010-11, a trend of replacement coming up. “In the packaging side, I think growth has been there and newer machines are coming in. Also, replacement of older machines is important and necessary,” says Paruchuri.

Surana agrees. “In India people used to buy a machine and keep it for 20 years. Now, we are seeing replacement of five to eight-year-old machines with newer ones with higher flexibility/productivity. There’s more automation because of labour and skill issues.” He adds, “It’s an area where KBA has really seen an upsurge in their market share. The machines coming to India are of the same quality as the machines going to an American or European printer.”

Today no manufacturer is developing machines keeping in mind the needs of a commercial printer. Whatever has been developed is being continued with, with small tweaks. This is because market for everyone has shrunk. Digital is a different story. They may be developing it.

Aditya Surana, Indo Polygraphy Machinery

Packaging the growth area

Packaging continues to be a growth area. When the world started changing in 2007, some people thought book was the future, some packaging. What happened is: print players from commercial segment started diversifying into either book or packaging segment. “Unfortunately, there are not many success stories of commercial printers moving into packaging or book segment,” says Surana.

He points out the reasons. “Both packaging and book printing are specialised line and people need to evaluate what they are buying and how are they marketing themselves,” he says. “Those people who have brought in the right technology, and have approached the market in an organised way have continued to do well.”

Surana cites the example of a print CEO in Delhi who has installed a six-colour press with a coater, a die-cutter and folder-gluer, thinking that it will make his company a packaging printer. He mentions another packaging printer in Delhi who has invested in a cold-foil press, without really evaluating the market. It was supposed to be his third press, and now the company isn’t doing well. “Now you can’t blame the packaging industry for such unreasonable thinking,” says Surana.

What’s in store for 2017

There is no doubt that the 8 November 2016 demonetisation has slowed down the economy, with some print companies claiming a 50% reduction in print orders. “We can see a significant slowdown in order intake and order execution. We expect this to continue at least until the first quarter of 2017,” says Jain.

But Kaushal predicts that 2017 will be a better year, where he says, we will see 100+ offset presses. “A very positive outlook for 2017, especially the second half. Regular trend of new value for money machines will continue but we expect a surge in demand as the effect of demonetisation and GST implementation. We will witness the increase in investment on the value addition in the coming year.”

Our interaction with printers and machine suppliers at various events suggests that packaging is currently hot. Rego says he would be installing 11 brand new six- and seven-colour coater presses for packaging, while Surana says as his segment is packaging, installing long high-end presses is the norm, reiterates that he is expecting at least five or six presses installed in the next two months.

If the economic uptick helps, we will see the industry head in a direction where brand new four-, five-, and six-colour coater presses will play an important role in the scheme of print-packaging businesses.

But as Surana says, please have a strategy. “The days of father and son shops are over. Evaluate your equipment purchase properly. Just don’t go for name and brand – it’s too big an investment. One can always see how many sheets the machine will deliver on the pallet every hour… Compare an apple with apple.”

Installation highlights of 2016

See All

See All