Print: The digital debate continues

Despite the threat of digital media looming large, and with traditional players still struggling to find a way to integrate digital to the traditional business model, in 2016, the Indian print industry grew at 7.0%. This growth was driven by regional language newspapers, explains the Indian Media and Entertainment Industry Report, 2017 published by KPMG India-FICCI.

19 Apr 2017 | By Dibyajyoti Sarma

The Indian print industry witnessed many ebbs and flows in 2016. While factors such as steady revival of the consumption cycle driven by better monsoons, the 7th Pay Commission payout and productive festive season gave the industry much needed impetus, this growth was counterpoised by demonetisation towards the end of the year.

In 2016, the Indian print industry grew at 7.0%. This growth was driven by regional language newspapers, followed by Hindi and English at 9.4%, 8.3% and 3.7%, respectively. While English newspapers struggled, Hindi and other regional language newspapers continued their growth story. The readership for English newspapers is concentrated largely in Tier I cities with approximately 10% of Indian population speaking English, leaving 90% of the population to be catered by regional dailies. The switch to digital platforms continued rapidly in Tier I cities, this further dented the growth of English newspapers.

The revenue landscape for traditional newspapers saw familiar trends — advertising dominating circulation revenue, local advertisers increasingly contributing to ad spends and ad revenue in English newspapers continuing to lead Hindi and regional language newspapers. Except for a few magazines with niche content, the print magazines segment continued to struggle during the digitalisation era.

Most traditional Indian players have embraced a two-fold approach by investing in digital news to explore new opportunities presented by digital disruption. Also, while digital news is bourgeoning, the struggle to get the business model right and monetise the segment intensifies.

Globally, over the past decade, the industry continues to reinvent itself to be relevant in a market continually threatened by digital medium which has resulted in a swing in consumption habits of readers. While the industry in India faces similar challenges, it continued to grow at a steady 7.8% from 2011 to 2016 and this trend is expected to continue over the next five years.

First, over the past decades, there has been an increase in literacy levels in India (from 64.8% in 2001 to 74.0% in 2011) which has expanded the target market for the industry. Second, India being a multiculture and multi-lingual country, there is strong depth in language readership, particularly, Hindi, Marathi, Urdu, Gujarati, Malayalam, Tamil and Telugu, among others.

Last, Indian newspapers are priced significantly lower than their global counterparts to enable a wider reader base; annual subscription for an average Indian newspaper is less than Rs 1,000.

The increase in affluence and consumption levels in regional markets has been the key growth driver for print over the last decade. This trend is likely to sustain.

Newspaper advertising

The worldwide share of newspapers in the overall ad spend in 2015 was 19%, and across geographies was averaging from 12% to 25%, with Western Europe being the highest at 25%.

In India, unlike other countries, newspapers are relatively low-priced, including various subscription schemes (effectively the average price paid for a newspaper by a reader averages less than Rs 2); thus, revenue is skewed towards advertising. This dependency makes a newspaper more vulnerable to market forces as was witnessed during the demonetisation phase where decline in ad revenues resulted in de-growth for the industry.

In terms of the split between national and local advertisers or advertising in English and Hindi/other regional language newspapers, two trends emerged. There was a shift to regional language newspapers with advertisers increasingly looking at opportunities in Hindi and other language markets due to their direct connect with readers in prospering Tier II and III cities/regions of the country. This was demonstrated by the fact that Hindi and other regional language newspapers managed to retain all key sectors as their customer source. With growing focus on these cities, the industry expects the ad premium gap between English and Hindi/other regional language newspapers to narrow as the value proposition of a strong and expanding regional readership base gains momentum. In 2016, the split between national and local advertisers was 80:20 for English and 60:40 for Hindi and other regional languages.

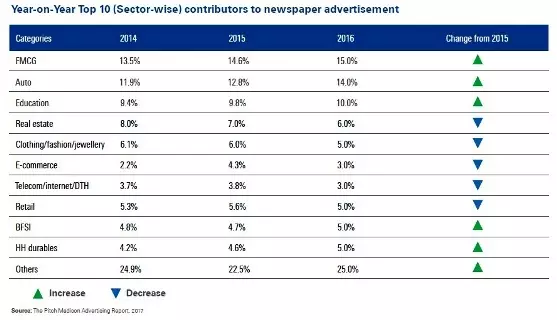

The FMCG sector is one of the largest contributors to ad spent across media and competition among existing players has further stepped up since the entry of a new player in the market (Patanjali).

Automobile sector’s ad spend in 2016 was driven by new launches and increase in education sector’s ad spend is in line with growing literacy levels in Tier II and Tier III regions.

The Real Estate sector has been struggling over the past few years and it was further impacted by demonetisation. Contribution of eCommerce sector declined as players reduced their ad spends across all traditional mediums.

The newspaper industry got the much needed boost to ad revenue with the intervention of the nodal agency, the Directorate of Advertising and Visual Publicity (DAVP), responsible for advertising on behalf of various government units. The agency rolled out its new policy for fixing the rates for ads by government in newspapers after three years.

Demonetisation in November 2016 had an adverse impact on the advertising sector. Both local and national advertisers pulled back pre-planned campaigns due to the intense negative effect of demonetisation on primary sales and consumer off-take. Large FMCG companies with shorter sales cycles were among the first to be impacted. Urban demand and rural demand also abruptly crashed on the back of shortage of cash. In sharp contrast, activation of mobile wallets increased and m-wallet ad spends grew by 32%, but the base was too low to offset other losses.

Regional circulation on the rise

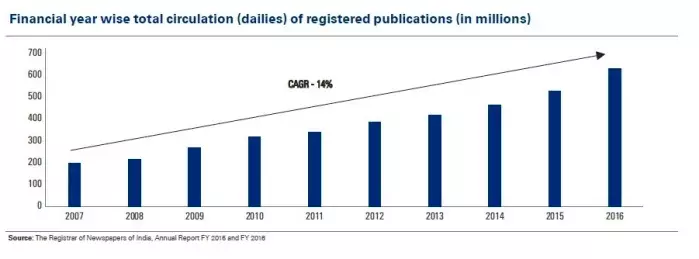

As per the Registrar of Newspapers of India (RNI), there were approximately 16,136 registered newspaper dailies as of 31 March 2016; however, none has a national circulation.

There are over 16,000 newspapers and about 94,000 periodicals listed with RNI, an increase of nearly 5,400 publications in Financial Year (FY) 2016.

Further analysis of RNI data for FY 2016 shows that Hindi newspapers continue to dominate the circulation pie with 51% share while share of other regional language newspapers increased to 38% and English newspapers continued to decline, its share was pegged at mere 11%. English and Hindi together account for more than 62% share of the newspaper media market and the balance 38% is shared among the other regional language newspapers — Urdu, Marathi, Gujarati, Telugu, Odiya, Malayalam, Tamil, Kannada, Punjabi and others, in that particular order. However, if we include Hindi in the other regional language newspapers, the share increases to staggering 89%.

In 2016, the average cover prices for English newspaper saw a minimal increase in the range of 2 to 5%, for Hindi newspapers the increase was in the range of 10 to 12% and for other regional language newspapers was 14 to 18% depending on the market.

Roadblocks for newspapers

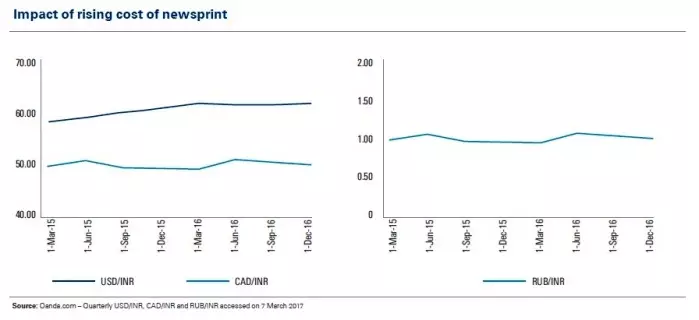

The Indian newspaper industry imports more than 50% of its paper consumption, mainly from the US, Russia and Canada. Being a significant component of cost, players are sensitive to price fluctuations. Crude oil prices are the major drivers of the newsprint prices as they influence the shipping rates thereby affecting the cost of production. Rising prices and depreciation of the Indian rupee are therefore a cause of worry for the industry, especially for players with a higher import ratio.

Further, in the current year, the Directorate General of Foreign Trade (DGFT) allowed newsprint imports only for actual users holding registration certificates from RNI. Since a large portion is imported through independent traders, DGFT’s notification has posed a threat on its availability as most newspaper houses (other than few large publishers) require traders’ services due to their inability to import container loads of the material. Also, local newsprint manufacturers have raised their product prices by Rs 1,000 to 2,000 per tonne. Added to this, availability of domestic newsprint is also not guaranteed to feed the entire industry due to closure notices issued by the National Green Tribunal (NGT) to many Indian mills owing to pollution and also due to closure of many loss-making Indian paper mills.

The industry is also uncertain about applicability of the Goods and Service Tax (GST). The industry hopes for newspaper to be under the ‘zero’ tax bracket. Further, industry also expects the news reel to be exempted from GST as currently it is exempt from Excise Duty and from VAT in most states. However, if under the new regime news reel is subjected to tax, it will result in additional cost.

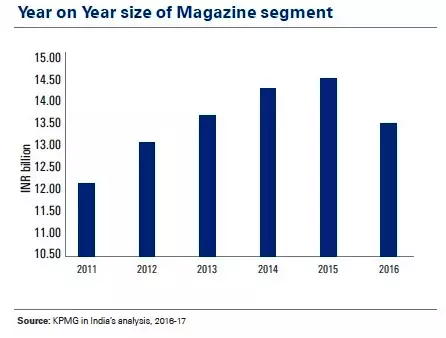

Magazines

The traditional magazine segment is waning in India just like its global counterpart. In 2016, magazine segment accounted for 4.4% share of the India print industry as compared to 5.1% in 2015. The magazine segment continues to compete with other mediums as most of the content is always available on the television or internet. However, niche magazines continue to enjoy loyal readership and regional magazines continue to attract readers based on factors similar to those driving regional newspapers.

Over the past couple of years, players are increasingly transforming themselves from pure magazine players to content players. They are investing heavily in alternative revenue streams such as digital content, eMagazines, videos, events, live streaming, etc. The aim is to create niche content and monetise the same through either a subscription model or through advertising/sponsorship fees.

Further, they are increasingly selling combined subscription for hardcopy and online version.

Road ahead for print industry

See All

See All