Mumbai Mudrak Sangh’s series of seminars on GST

Uday Dhote, a member of Mumbai Mudrak Sangh (MMS), a CA, and a director at Mumbai-based Dhote Offset conducted the first of a three-part series of seminars on GST (Goods and Services Tax) titled – On your mark, get set, go…

04 Jul 2017 | By Noel D'Cunha

The series on GST is an effort to simplify and understand GST in the context of printing.

The first session held on 28 June 2017, titled – Getting Started, delved on whether the delegates were ready to kick-start GST, touted as one of the biggest tax reforms, which came into effect on 1 July 2017.

Anand Limaye of MMS, said, “After the first eye-opener conducted on 4 March 2017 during the Lifetime Achievement event, MMS was silent on the topic of GST. First, we were waiting for all the council meetings to end so that at least the GST rates could be sealed as per Harmonised System of Nomenclature (

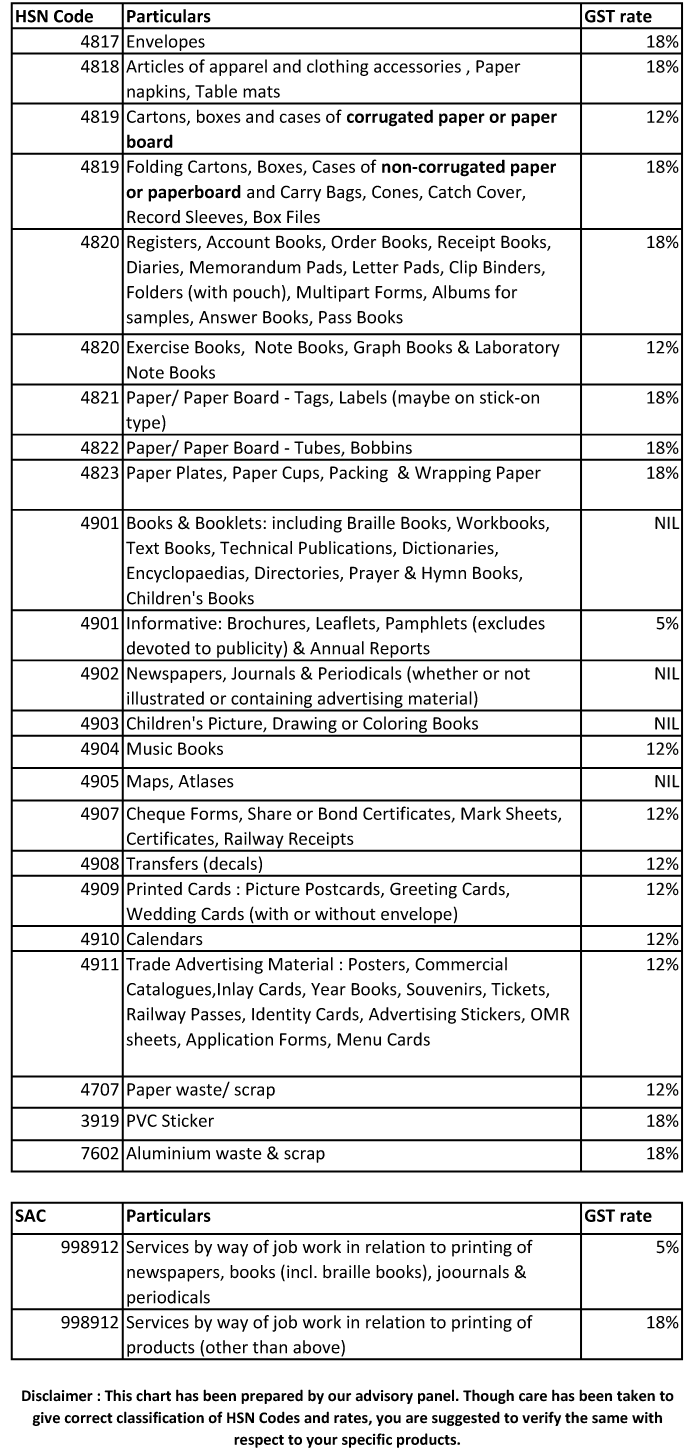

Dhote unfolded the mysteries hidden in the HSN Codes, to a focused audience of 60+ in a session that spanned over two hours. “We invited print samples from our members so that the HSNs of their products could be deciphered. The endeavour of the taxation team at MMS was to draw up a list of widely manufactured products among the printing industry,” said Dhote.

He added, “During the session, we discussed the print samples, drew up a common list, which can be circulated and adopted pan India, and prepare a level playing field for the print industry.”

The list prepared during the seminar is given below, but Dhote said, some clarifications are awaited from the Finance Ministry on the issues of GST relating to the printing industry.

The next two sessions on GST titled Resolving Problems is scheduled on 14 July and Full Throttle on 28 July 2017.

See All

See All