IDC report: Large-format printer market posts 38.5% YOY growth in Q1 2018

The large-format printer (LFP) market in India grew 11.7% quarter-on-quarter and 38.5% year-on-year in Q1 2018, with shipments reaching at 2,954 units, reported IDC Asia/Pacific Quarterly Large Format Printer Tracker, 2018Q1.

25 May 2018 | By Rushikesh Aravkar

Pankaj Chawla, research manager, IPDS, IDC, said, “With the growing environmental concerns, new media and increasing applications graphics market in India is moving towards environment friendly products even if they are priced high. This quarter witnessed more installation of UV and other high-end large-format printers as compared to previous quarters.”

According to the report, shipments in the large format CAD/technical printer market segment grew 17.7% quarter-on-quarter and 55.2% year-on-year, driven by strong growth in single-pass CAD inkjet printers in the large-format aqueous-based printer segment. The shipments in the graphics segment were up by 7.6% quarter-on-quarter and 28.3% year-on-year. “Though solvent printers dominate the total graphics market but aqueous, UV and Latex were key driver of this growth,” added Chawla.

Demonetization, GSTs and RERA have affected the real estate market in 2017. As market is stabilizing in 2018 and further government has announced various infrastructure projects, this has fuelled shipment of CAD printers in India. HP remained market leader with unit market share of 68.5%, followed by Canon and Epson.

Though solvent market dominates the graphics market in India by capsizing over 40% share in the market because of their low acquisition and running cost, however during the quarter high-end aqueous and UV market helped the overall graphics market to grow.

“While Aqueous market posted quarter-on-quarter growth of 72.8% and year-on-year growth of 227.5%, on the other hand UV market posted quarter-on-quarter growth of 48.9% and year-on-year growth of 84.2%. Among other offerings aqueous/dye-sublimation market posted strong year-on-year growth but declined sequentially,” said Chawla.

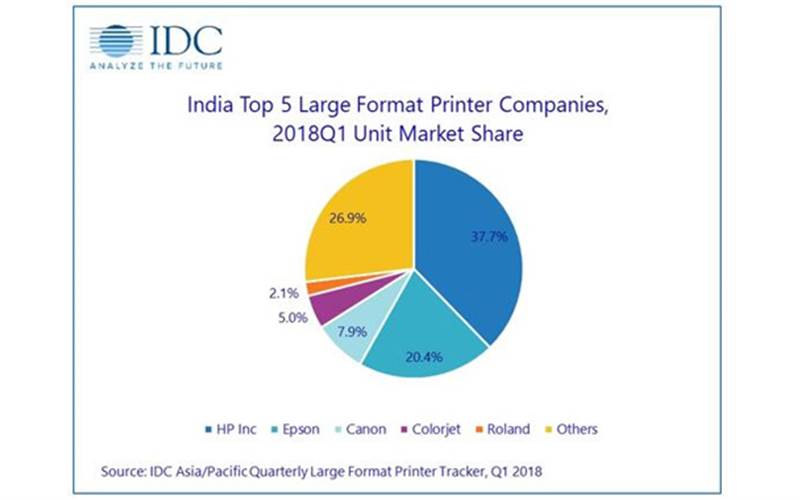

In terms of vendors' ranking, according to IDC, Epson remained overall market leader in graphics segment, followed by HP. “Among local vendors Colorjet maintained its market leader position followed by Astrojet and Monotech. Colorjet is also leader in UV segment followed by Monotech and Fujifilm,” concluded Chawla.

See All

See All