Rising input costs, shrinking margins trigger ink hike fear - The Noel D'Cunha Sunday Column

The ink market size is valued at approximately Rs 5,000-crore, which is under 5% of the size of the Indian printing industry, which is pegged at approximately 1,90,000-crore (The NPES/PRIMIR World Wide Market for Print study, by the Economist Intelligence Unit, estimated the Indian print industry size to grow to US$29.3 billion in 2017).

The Indian printing ink industry is bearing the brunt of the changing market scenarios, a major reason being rising cost of raw material, which the ink

28 May 2017 | By Noel D'Cunha

The going has been good, with some really good investments post-Drupa. And with GST in the offing, the mood generally is buoyant, though the GST rollout methodology still remains uncertain. But, there’s one industry that has been reeling under the impact of the raw material hike, and as a result, there’s an insistent buzz that ink prices may be on the rise.

There’s a steep rise in raw material prices, and it’s getting difficult for us to sustain, says KS Murthy, director at Toyo Ink India. “We are trying every bit to accommodate the impact before pushing our customers. But since the last couple of months, the cost of the product is constantly increasing resulting in a bare minimal or minus margins.”

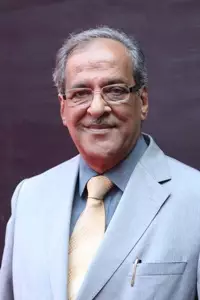

Ashish Pradhan, CEO, Siegwerk India

At Siegwerk, we are concerned about the rising input costs and the effects on the market. TiO2 is one of the major components in producing White Ink. There has been a significant increase in TiO2 and solvent prices in the last quarters of 2016 and this is continuing in 2017 as well. The major reasons attributed are due to the capacities going off-stream and forced closures of capacities in China. Siegwerk has been absorbing the RM price escalation so far. Our commitments to quality ensure that we buy raw material from the best sources globally and these industries have been steadily increasing their prices. We have been exploring alternatives without compromising on quality and compliance. Siegwerk has been transparent in communicating all these facts to our customers and trying our best to limit the impact on both our and the customers business.

Vimal Mehra

Vimal MehraVimal Mehra, director for sales and marketing at Sakata Inx, says, demonetisation has impacted the printing industry greatly and led to a very low demand for inks. “In some segments, the drop in demand for inks was close to 30%. Such market scenario is not the ideal time to approach for a price increase and hence the industry has absorbed these increases.” Mehra is also the president of the All India Printing Ink Manufacturers’ Association.

It’s just not Sakata Inx, other ink companies like Siegwerk, DIC, Toyo Ink, Toyo Arets, have confirmed that they too are facing rising costs. “This time there’s a sharp increase in raw material prices, especially due to the closure of plants on account of environmental issues. Ink companies have a little scope but to increase the ink prices,” says Prashant Atre, managing director at Toyo Arets.

Few companies have already gone ahead with price hike announcements globally, others will follow soon. “It is a matter of time, and is based on raw material inventories they have,” says Atre.

The packaging and digital printing have maintained a growth rate of 12% to 14% by volume and value growth averages 11% to 12%. And though commercial, books, screen, metal decorating haven’t hit the roof, the growth is steady. The overprint varnishes, both aqueous as well as UV, have seen a phenomenal growth. These are the signs which the ink manufacturers think makes their chances of price rises stick. “It’s just not possible to hold the prices for too long and one should expect price increase soon,” says Mehra.

And the ink manufacturers say the increases are justified in all sectors of print.

The triggers for hike generally are – rise in the cost of raw materials like resins, solvents, intermediates, pigments and crude prices. The product cost gets higher due to the implications of various price rises in the raw material, where we all know that the base effect is due to the increase in crude, in addition to tighter environmental regulations and some shortages in supply. “The raw material prices have been going up since November 2016,” says Mehra.

But does hike in any one warrant a hike or it’s a cumulative effect? “Prices of all major raw materials are going up in different percentages,” says Mehra. “Organic pigments are going up by 3% to 8% and carbon black by 15%. Solvents, resins, oils etc, are all going up by 5%-12%.”

The last time one saw an increase in the price of ink was in July/October 2014. “But for almost three years since, the prices have been going down, firstly because the raw material prices came down in 2015, and currently due to market and internal competition,” says Mehra.

Rosin resin involves China, and the prices are very high. The increasing labour cost in China is resulting in higher prices for the products. “The situation has reached a point where we are looking for an alternate source for procuring this vital raw material. Certain importing countries like India are getting diverted to Indonesia, Brazil, and Vietnam,” says Mehra.

Prashant Atre

Prashant AtreTighter eco norms

A majority of pigments and pigment intermediates are made in China and India. Tighter regulations are leading to both price pressures, and supply shortage, as they implement necessary change steps. Recently, we saw a government notification banning the use of newspapers for packing food items fried in oil.

If market reports and news are to be believed, yes, the Chinese government is putting a lot of pressure on the industry due to environmental reasons. Atre says, “They are pushing a more stringent law which is correct on their part, as they are looking to better the air quality. But that is leading to shortages in supply as the demand-supply gap is moving prices higher.”

KS Murthy

Murthy says, “This has resulted in limited availability of some intermediates like AAMX, DCB, Tobias acid etc. Both copper and phthalic anhydride prices have increased by more than 20% in the recent quarter. Urea price has also increased by more than 10%, and crude, as we all know, had increased substantially and has stayed there. All this has resulted in a substantial increase in the process colour pigments pricing recently.”

Mehra adds, “All intermediates relating to azo pigments are up, affecting yellow and rubine prices; and cyan is connected with Indian CPC. These intermediates are showing a price increase of around 10%, which in turn triggers these pigment prices to go up correspondingly.”

Besides, there are the normal increaseS in salaries and wages, and transportation cost. “The fuel prices have increased in the last 9-10 months. It has impacted the freight cost by about 7-10%, says Mehra. “On an average, it costs Rs 1-2 per kg extra for transportation based on distance.”

Still mulling price hike?

Despite all the constraints and upward pressure on pricing, a key trend that is affecting the printing ink industry is the excess capacities all ink companies have, and hence they are trying to book capacity by offering lower prices.

Atre says, “For the present, I don’t see any company will be insulated from the raw materials price hike. It will certainly squeeze their margins. It may not be a sustainable business. In past, many such companies have vanished from the map.”

And this could land the ink industry in a very risk situation as ‘no profits will mean no investment’ in technology/product development, says Mehra. “No one can survive by offering a lower price and poor quality. The Indian ink industry had more than 300 ink manufacturers about two decades back. Today it is less than 100. There was only one multinational ink company in India, today there are six and between them, they have around 90% of the ink business.”

While the ink companies have flagged their concerns and insist a price hike is imminent, they are silent on the quantum of increase.

A DIC statement says, “DIC India, in line with the trend and commonly known fact, is witnessing a rise in the price of key raw materials that go into the manufacturing of Printing Inks. Being a global organization, DIC is better placed to tackle this increase in key raw materials both technologically and by securing supply chain to a reasonable extent. DIC team, globally, is working on making best efforts to have a minimal commercial effect on its printing consumables range of products.”

While there is uncertainty about the magnitude and timing of ink price increases, there are steps that printers can take to minimise their effects, after all, ink constitutes only 5-7% of the overall cost. A comparable cost of using good quality ink would result in less waste, increased makereadies and production time.

Atre says, “You hit the right cord, that is what separate good printers from average printers. Good printers always look to these details minutely before seeing the right side of the invoice.” He adds, “Quality always speaks for itself. Better printing quality, less wastage and higher productivity is the way forward for the printers to have a sustainable business.”

Mehra says we are all trying to educate our customers on these lines. “The customer is not willing to accept failures because he was charged less for the price of ink. There is a good awareness among printers and they differentiate between low priced and low-quality inks. We as a nation are going through radical changes and print industry is no exception. I am confident that ultimately quality products will survive.”

So, where ink price hike is unavoidable, can an ink manufacturer and printer partnership minimise the pain? Atre answers, “I think that possibility cannot be ruled out, but to what extent, is a debatable topic.” He adds, “I really hope that the issue of Babri Masjid and the Ram temple is resolved with minimum pain. Will it?”

Mehra says, these are long-term strategies and are implemented on a one-to-one basis. What suits one may not suit others. The bottom line is that we are all in the business to make decent earnings and hence should formulate strategies which are a ‘win-win’ for both.”

See All

See All