Prosper is Kodak's iPhone moment

Philip Faraci, the president and chief operating officer at Eastman Kodak talks to Ramu Ramanathan about digital print in the 21st century and his company's investment policies.

08 Oct 2010 | By Ramu Ramanathan

Philip Faraci: I would not say so. Certainly, consumer and commercial inkjet technology are big drivers for us in terms of growth, and we are doing very well in those businesses. We are also doing well with our other core investments in packaging and workflow solutions. Kodak also continues to be a leading supplier of digital capture devices, pre-press solutions and entertainment film. So, while, inkjet is a key driver for us, we have a portfolio of businesses that will collectively drive Kodak's success.

RR: You introduced inkjet at Drupa in 2008. And you have been working on it for more than five years.

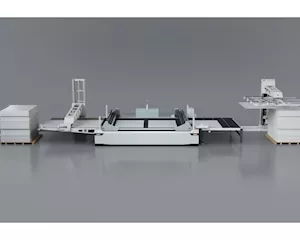

PF: Our Stream inkjet technology is the first technology which produces offset class performance in most attributes. Such as: offset class in terms of speed (at a speed of 1,000 ft/min). Without an eye-glass you'd not be able to distinguish between a Prosper print and an offset print. It's a big enabler for short-run printing and a one-to-one communicator. This could be transpromotional communication or a transaction statement or a magazine or newspaper publishing or short-run customised packaging. In this, Prosper has become a viable alternative to a CTP operation.

RR: Kodak has forecast a loss of $150 million from continuing operations this year. That includes $102 million in costs for the extinguishing of debt. Is Kodak doing much better than last year; or losses are much less, today?

PF: I think you need to look at the company in two different ways. We have the traditional business which is in decline. Then we have the digital business which is growing. We were growing at a high double digit rate until we got into the recession. 2008 and 2009 saw significant negative impacts, but 2010's earning from operation has seen a dramatic improvement over 2009. We do have debt that we pay off. Also we have early extinguishment of debt as you mention. As a result, the debt cost which is not from operations, brings down the earnings. At the end of the year, if you look at it from the cash stand point, we expect to achieve positive cash generation before modest restructuring payments. We also expect to end the year with a cash balance of $1.8 billion to $2.0 billion.

RR: Kodak got a financial lifesaver from KKR in 2009. The way the deal is structured, KKR gets a 10% rate on its loan of $700Mn. This means KKR gets a 10% income stream and the best protection available on the balance sheet.

PF: No, that is not correct. In September 2009, Kodak issued to KKR $300 million of 10.5% Senior Secured Notes and warrants to purchase 40 million shares of Kodak stock at an exercise price of $5.50 per share. In February of this year, Kodak announced an agreement with KKR to repurchase all $300 million aggregate principal amount of the 10.5% Senior Notes due 2017 previously issued to KKR. KKR continues to hold warrants to purchase 40 million shares of Kodak common stock. Overall our balance sheet is in phenomenal condition. Our net cash position in the balance sheet gives us more leverage. We have an aggressive investment portfolio, we have a relatively conservative balance sheet which puts us in a solid position.

RR: But is the cost of cash extremely high due to funding partners like KKR?

PF: I think the best way to lower the cost of cash position is – as we continue to see our strategy play out and as we move to break-even, or cross-over to a neutral position associated with earning in 2011 through consumer inkjet. In 2012, we go to net positive earnings position in both consumer and consumer inkjet. What that's going to do for us is raise our operational earnings. As we raise our operational earnings, we are going to see our cost of capital go down and that's going to enable us to look at financing options and reduce cost of capital further. And so, the cost of capital might be a little bit on the higher side, but as we operationally grow earnings, that's going to help us.

RR: Does this mean that the range of inkjet earnings has to offset these IP values?

PF: For consumer inkjet we said that we expect to break-even in 2011, and in 2012, it will be earnings positive. For commercial inkjet we expect to be earning positive in 2012. Today we are in a situation where we have a large number of letters of intents and customers who want to reserve slots and buy units. We are ramping up our operations and final touches associated with the colour presses. We have started shipping the B&W presses.

RR: This is your first visit to India. Any announcements?

PF: The reason is simple. We see three primary objectives: one, we believe we can strengthen our partnership with a set of companies in Asia, so that we can grow more in Asia; second, we see ourselves partnering with Asian companies that enable us to expand our portfolio not only in Asia but rest of the world, because development, manufacturers and other capabilities has grown so much in Asia that now is the time for us to work with these companies to leverage their capabilities globally. The third is, we are looking for companies who are developed and have solid company positions in a given country and they need help in globalising. In order to accomplish these three objectives, we are in Asia for a six week's period going through a set of meetings, assessment, contacts and dialogues. We intend to turn those into growth opportunities for Kodak.

RR: Has the response been positive.

PF: Yes. I am in Asia for six weeks, and in India for nine days. Very soon, I'll be spending six months in Asia.

RR: Following the deals to buy Intermate (transactional) and NuPro (chemistry), which I assume were aimed at buying in 'expertise' are you looking at any other purchases? If so what areas?

PF: I am not opposed to buying technologies that we need to leverage. Intermate was very important to us in terms of securing language communication so that we can be more significant in the transactional space. Clearly if you see how the Prosper technology followed Versamark's capabilities, it enabled us to do a range of things.

RR: Will Prosper be Kodak's iPhone moment?

PF: I think you may have a little bit of a wait before you get the same kind of consumer response for a Prosper press that you got from an iPhone. I don't think that's going to happen very soon. But from an industry standpoint, the analogy of an iPhone is a pretty good one.

RR: Will Prosper complement four-colour print in India?

PF: If you are in the commercial print space and you are not looking at digital printing, you are probably in a very unusual high volume production situation. Most commercial printers around the world are looking at it for a variety of reasons – because of the speed of supply chain improvement, ability to do targeted communication or messaging, ability to do specialty product needs ability to do mix and match shorter run . Therefore, for the printing industry, this is a pretty significant capability. If you rewind to 2008, I'd say a normal commercial printer would upgrade to a CTP system or may have just made the upgrade. But if you look post-2008, there is not a single discussion that doesn't involve digital printing – how do we utilise digital printing, what is the need and the way of workflow changes, need for merged and unified environment operation.

RR: Any real time examples in India?

PF: We visited a printer in Delhi and they are using Kodak's S10 type implementation. They are putting on-press capabilities. This means, with their normal output, they can run lotteries, games and other activities, which are one to one and unique.

RR: We are not seeing much movement with colour toner. What is happening to the Nexpress?

PF: At the recent Photokina, we introduced a couple of capability enhancements to the Nexpress that makes it a great solution in the photobook space. Also, we have introduced additional softwares and extended hardware functionality both in terms of speed and quality standpoint. It's a great platform, a great complement to the inkjet solutions in terms of lower volume, high variability, completely customised products. We have finished photobooks coming out at relatively modest volume, high speed from an electrophotography (EP) standpoint but from an inkjet standpoint relatively slow.

RR: I do not want to compare brand to brand – but HP and Xerox are enjoying tremendous success in India. Why has Nexpress not tasted similar success?

PF: Nexpress was not the first entrant into the high speed EP space. We came in at a later point of time. Moreover, Nexpress was built with the goal of being a broad-based commercial print usage. As a result we could do a lot of things that most of the competition could not do very well. It was also built as a platform that had extendibility. We have continued to improve some of these extendibility features such as higher quality imaging, putting in place calibration system that automatically sense and correct for different media types. This has made the Nexpress a more solid platform. The usage, as a result, has continued to grow. Nexpress is truly a press, it's not just a high-speed colour printer that works on a couple of sheets of media. It is a general purpose application.

RR: From Rochester to Dayton (photography to inkjet printing), all the excitement and activity centre seems to be shifting. What are the challenges that the team at Kodak is facing due to this techno-cultural change?

PF: The shift has been significant. More than fifty percent of our employee-base has been hired or brought in through acquisitions in the last six years.

RR: Based on your share price, your asset value must be multiples of the market capitalisation. Do you believe Kodak will be independent in five years time?

PF: That's actually a good question for the board. I look at it as a driving incremental operational performance.

RR: What happens to Kodak's film business?

PF: From a ubiquitous film and camera company, we are now more B2B as compared to B2C. More than half of our business is B2B, probably closer to 60%. Earlier it used to be 60% consumer.

RR: In terms of digital printing, will we see a termination of traditional toner-based technology?

PF: First of all, technologies don't die off so easily. They are for different characteristic and different capabilities as well as differing needs. If you look at the EP versus inkjet space, EP provides high quality solutions for short and mid-run printing. As you start going to higher and higher speeds, it starts to run out of performance capability. It turns out to be too expensive, and uncompetitive. But on the other hand, it's a very viable low- to mid-speed and durable proven technology for print. Dye-sublimation remains a leading printing technology for walk up, easy to use, simple photo printing. Inkjet technology offers high performance in the drop on demand, which is very strong and solid in the consumer space. We have taken it to some limits in the commercial space with our VL technology and competitors use it with the thermal technologies. But it starts using too much energies and starts running out of performance, simply because of the dynamics of the ink drop formulation. And then you move into high speed which are more offset class, such as Stream technology or the earlier version of the Versamark. When you start doing million jobs, you are talking about very high production presses, that's not something that the EP competes with.

RR: Will one replace the other?

PF: They will strengthen the applications – and areas where they perform well.

RR: A word about your new plant in Goa. Is it essentially a conversion unit that is helping to boost your capabilities in catering to the digital plate market?

PF: Goa has been a success story with good support from our partners and customers in India. It has potential to grow and continue to keep the business growing in the way we expect it to. Whether we are going to see a fully function plate unit, depends on how we grow and how strongly we are supported by the industry.

RR: Right now, India consumes 25 million sq/mtr plates in India? Are we going to see a growth in the number?

PF: I think there will be a natural movement from analog to digital. India has a few key drivers: a growing GDP, a growing middle class and income levels, a growing educated workforce. In fact as infrastructure grows, the consumer of printed products especially magazines, newspapers and other communication, will drive print's growth. Certainly, the printers we spoke to see the demand for print growing. It may not be exponential but it is doubling a couple of times.

RR: The inevitable China question. It seems world manufacturing has polarised into Made in China or Made Elsewhere. My question is: how is Kodak faring against Chinese players like Xingraphics?

PF: You are bound to get competitors all over the world, not only in India. But we have a good handle on the market. We are one of the strong players, driven by capacity and technology. We are quite comfortable with our position.

RR: Which segment do you think will be the last man standing in print after the acceptance of super digital (essentially phones, WiFi enabled other screens- ipads, iPods, Tablets) challenge?

PF: You just listed a whole bunch of products that use printed screen. iPads are actually printed products, as are any other formal screen. I think there's opportunity both ways. There are hundreds of different reasons which will propel different behaviour. I believe both the technologies will co-exist.

See All

See All