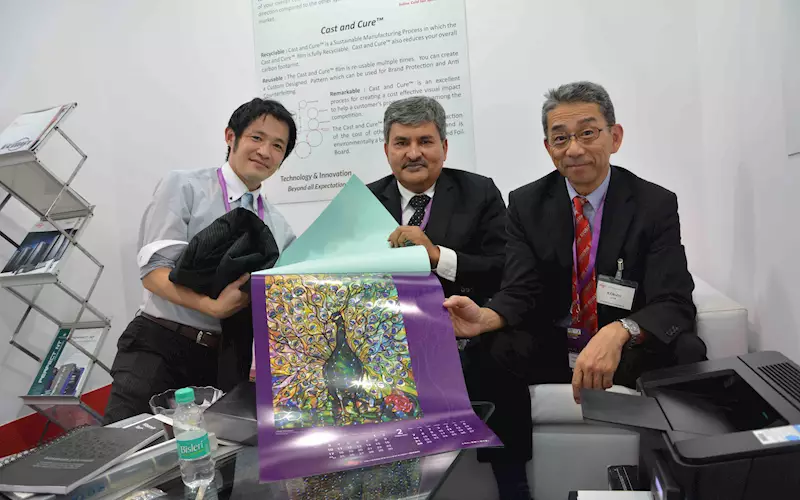

Speaking to PrintWeek India during Pamex 2015, Vinay Kaushal, managing director at Provin refrained from naming the customers, but said, two of the 9-series four-colour presses will go to North India, while the third, a 7-series four-colour press will go to Central India. “It’s been a solid nine months for us. We have 19 so far, and I am talking in terms of number of machines arrived and installed. By March 2016, we expect to take the number to 25 machines.”

So if we consider a minimum ratio of 1:7 between new and pre-owned printing presses, that these industry experts quoted, we will have no less than 590+ pre-owned printing presses coming to India, which should be around 2,350+ units.

The other thumb rule is: Publication and commercial printing which for eons, has been the mainstay of the printing market, is declining, while packaging and inkjet are gaining ground.

Smaller B and C category towns have started investing in brand new machines. Meerut and Surat are prime examples. Kerala is another state - where Insight (who represent Komori) have installed many presses. Kerala has more than 70 second-hand presses but now "a phase of new presses has begun”, Ajay Agarwal of Insight says, "More and more use of HUV / UV and coater-based value added printing was visible in the commercial segment which is slowly advancing from standard four-colour printing.” With the recent slew of installations, and acquisition of Southern territory a few years ago, Insight now has an install base of around 150 brand new Komoris in the past five years.

All this means, more investments by the big daddies. Upal Roy said Flint is adding to its operations in India. Likewise Toyo Ink.

“India is a strategic growth region for the Toyo Ink Group,” Kampani noted. “India’s packaging market is growing at an annual rate more than 10% in line with the rise in the number of shoppers at supermarkets. To keep up with demand, Toyo Ink India installed a second gravure ink line at its Delhi factory, raising our production volume at this location to two and a half times the current level.”

Meanwhile the Hubergroup celebrated its 250th anniversary this year. A move which went unnoticed was the combination of its operations of Michael Huber München and Hostmann-Steinberg.

“Two hundred and fifty years of operation and it was all about ink and colours from the beginning – that makes us incredibly proud,” RY Kamat said. “We had a worldwide celebration in all our companies on Sept. 29, 2015. All our employees were invited for food, drinks and a celebration with music and memories. Those were the most special moments in this year.”

The one company to watch out for is: Electronics For Imaging, Inc. (EFI) who made a bold move into inkjet textile printing through the acquisition of Reggiani Macchine, a water-based inks industrial inkjet print specialist with customers in more than 120 countries. EFI Reggiani is what the new branding will be called.

The textile market is 10 times the size of the graphics segment, and less than 10% is printed digitally. At PrintWeek India, we see this as a high potential market.

Meanwhile, as Sam Gulve informed PrintWeek India, EFI has acquired Matan Digital Printers, with a “focus on superwide-format display graphics and other industrial printing applications”.

Two trends for 2016 which print firms should keep an eye on.

Today, crude oil is trading at $44 per barrel. In July 2008, it hit its peak at more than $145 per barrel. This has had an impact on key feedstocks, although senior members fo the ink body in India, IPAMA have said to PrintWeek India that crude oil is not “the only cost that impacts ink manufacturing”.

One top official said, “Crude oil is cheap and printers are asking for price reductions. This is because in the past we were claiming high crude oil prices would make the products expensive. Today’s market mechanisms are complicated than a simple one-figure-does-it-all explanation would be able to explain what is going on. We are dealing with artificial raw material shortages, with political influence on markets, adverse weather conditions for re-growing raw materials, currency fluctuations, plus crude oil costs being volatile.”

Do keep an eye on crude oil and the occurrences in Syria. Also keep an eye on the US dollar performance during the presidential election year in the US.

To conclude, most players in India see opportunities in the Drupa year of 2016.

When PrintWeek India spoke to the top digital players, they said, “We are forecasting continued increases in our digital markets, as well as strong sales in the traditional sectors of our business.”

Likewise four ink majors said, “The market for UV inks and highly performance UV inks continues to grow. This is being driven by a high growth packaging market with a wider range of base substrates. Even the commercial printing market has been attracted by UV’s superior resistance and cost-saving benefits. We see new investments in UV printing kit to progress and the rate of conventional oil-based printers switching to UV technology on the rise.”

The ink majors are consolidating their gravure ink production capacity in the region and the establishment of a quality system for water-based flexo inks. This is based on improved sales in the India market.

Three niche segments which are being boosted is: high performance screen inks, water-based inkjet inks and hard coating agents for electronics.

Some numbers to crunch

Anil Agencies: The Sweden-based Lamina, a supplier of sheet-to-sheet laminating/mounting and gluing machines is represented by Anil Agencies in India. Till date, there have been 15 machines installed in India. There are another five machines in the pipeline.

Canon: Today, the Imagepress enjoys 160+ install base in the country. With the new upgrade on view at Pamex, notably the C10000 VP, the numbers are likely to move upwards. To begin with, the C10000 VP launched at the show is going to Mumbai's Bharat Copier.

Excel Machinery: During 2015, the Ahmedabad-based company has installed 30 Maxima Exb-35 machines, taking the total numbers of installation to 114. The company has also received one order from Nepal for its automatic die cutting machine.

Grafica Flextronica: The Vasai-based Grafica had a good outing at Pamex. It closed orders for two cylinder press with inline UV and complete screen making set up, six sets of Nano Print with full screen making set up and UV, and nine Nano Print Plus with screen making set up.

Insight: By the end of Pamex, Insight clinched orders for six Komori presses and three Kodak CTP platesetters. As per the official government data, Insight has installed 52 new Komori presses in India in the last 18 months and they are likely to install another 20 machines by year end.

Line O Matic: Satyam's Palghar unit installs the SHS 104 from the stable of Line O Matic. The automatic reel to sheet, super high speed ruling / flexo printing machine is ideal for notebook manufacturing.

Monotech: Chennai-based Monotech has a total of 19 Scodix installations, 15 of which are S75 model and four are S74 model. There are three more in the pipeline, excluding a deal which was sealed by a Hyderabad-based firm.

Provin Technos: It’s been a solid nine months for Ryobi. Provin who represents Ryobi in India said, they have 19 machines which have arrived and are been installed. By March 2016, Provin expect to take increase its tally to 25 machines.

Welbound Worldwide: The WB 2000, Welbound’s signature six-clamp perfect binding machine had live demos at the stall. The six-clamp WB 2000 has seen more than 1000 installations pan India.

Xerox: In 2015, Xerox has installed more than 100 units of C60/70 and hope to replicate the success with all its other devices in 2016.

Smaller B and C category towns have started investing in brand new machines. Meerut and Surat are prime examples. Kerala is another state - where Insight (who represent Komori) have installed many presses. Kerala has more than 70 second-hand presses but now "a phase of new presses has begun”, Ajay Agarwal of Insight says, "More and more use of HUV / UV and coater-based value added printing was visible in the commercial segment which is slowly advancing from standard four-colour printing.” With the recent slew of installations, and acquisition of Southern territory a few years ago, Insight now has an install base of around 150 brand new Komoris in the past five years.

Smaller B and C category towns have started investing in brand new machines. Meerut and Surat are prime examples. Kerala is another state - where Insight (who represent Komori) have installed many presses. Kerala has more than 70 second-hand presses but now "a phase of new presses has begun”, Ajay Agarwal of Insight says, "More and more use of HUV / UV and coater-based value added printing was visible in the commercial segment which is slowly advancing from standard four-colour printing.” With the recent slew of installations, and acquisition of Southern territory a few years ago, Insight now has an install base of around 150 brand new Komoris in the past five years. The one company to watch out for is: Electronics For Imaging, Inc. (EFI) who made a bold move into inkjet textile printing through the acquisition of Reggiani Macchine, a water-based inks industrial inkjet print specialist with customers in more than 120 countries. EFI Reggiani is what the new branding will be called.

The one company to watch out for is: Electronics For Imaging, Inc. (EFI) who made a bold move into inkjet textile printing through the acquisition of Reggiani Macchine, a water-based inks industrial inkjet print specialist with customers in more than 120 countries. EFI Reggiani is what the new branding will be called.

See All

See All