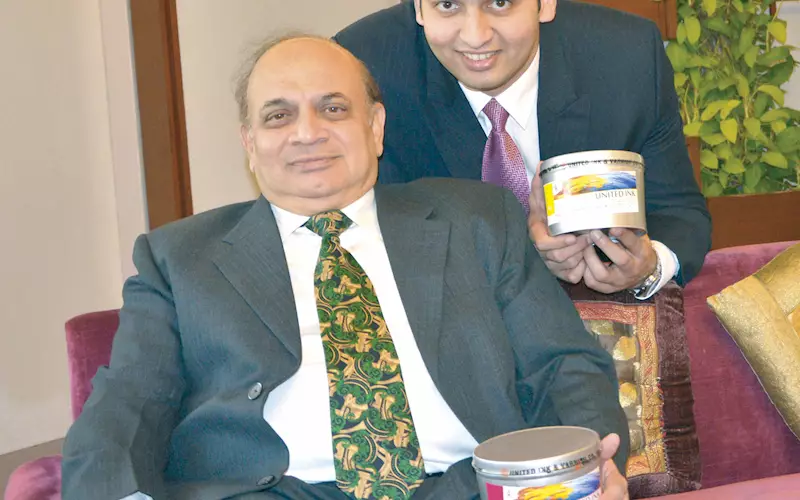

It’s not an old-fashioned battle for dominance. “Whoever brings the product and services that suits its print customers, is the best,” say the Sathayes in a conversation with Noel D’cunha and Tanvi Parekh

Noel D’cunha (NMD): Kudos on your 75th year in the industry, What has the United Inks journey been like ?

Dhananjay Sathaye (DS): Thank you. It all began in 1939, when my grandfather, a chemistry graduate, took a stand against serving the British. He did that by establishing United Inks, manufacturing oil-based products like varnishes, phenyls, double boiled oil, stand oil, etc.

After 1951, more letterpresses came into operation, increasing the demand for inks. That’s the time my father too joined the business and we started producing single-colour inks, predominantly black, for letterpresses. The ink and equipment quality got a fillip in the 1960s.

In 1966, we entered into a technical collaboration with a leading British ink manufacturing company, Ault & Wiborg (A&W), which manufactured a wide range of inks, resins and had many manufacturing units in different parts of UK. With the backing of this combined knowledge repository, we strengthened our ink-making activity, and pioneered and specialised in the production of metallic inks like gold and silver inks.

By 1973, offset printing, primarily sheetfed, started to spread in India. I returned to India in the same year, after completing my post-graduation in printing ink technology at the London School of Printing and with work experience at A&W’s plant in UK. To address the offset trend, we launched our first four-colour ink set in 1975. Vakil & Sons, which was one of the top print firms in India then, was the first to approve the set. Thomson Press, a major print firm then, also procured gloss ink supplies from us.

In 1977, we crossed the Rs 1-crore annual sales figure, and since then, it’s been a vertical growth path for United Inks.

My son, Gaurav, joined the company in 2007, after topping in both Surface Coating Technology from ICT (formerly UDCT) in Mumbai and MBA from SP Jain. He is the fourth generation in our inks business.

NMD: There was a blip in 2005?

DS: Yes. By 2004, we were running a plant in Mumbai, and also had plants at Taloja and Essambe. Running the plant in the heart of Mumbai was getting unviable on account of pollution control and operating costs. We thought moving to an external location will eventually benefit the organisation and enable us to look after our teams better. This move did not go well with a section of our labour force, leading to disruption of work.

It took us almost a couple of years and a huge amount of learning to get the operations back to normalcy. In the interim, some ink production did continue from our centres at Taloja and Essambe, albeit at limited market penetration.

NMD: Around the same time, the MNCs entered the Indian market in a big way and have, since then, stayed. What was United’s strategy to combat this?

DS: Yes. In around 2005, the MNCs marked their entry in a big way into Indian market, using their deep pockets to take on short-term losses for long-term entry and market share, which they managed to gain. We, however, continued to fight the challenge and remain one of the largest privately-owned Indian offset ink company.

NMD: So, since 2005, has there been a status-quo in your operations?

Gaurav Sathaye (GS): Quite the contrary. We have overhauled our portfolio, introduced customised products, developed a service approach, etc, all under the banner of United Group of companies.

We repositioned ourselves from the dominant market leader that we were prior to 2005, to a niche and speciality manufacturer with products aligned to the customers’ requirement. We shifted our focus from bulk sales to value-added customisations. Whoever brings products and services that suits their print customers, is the best.

NMD: The price wars in the industry is crippling growth, squeezing margins. Beginning with consumables to the printed product, there is a price war everywhere. How has the United Group tackled this?

GS: Honestly, for a printer, ink constitutes only 3–5% of the production cost. So how does selling ink at a lower price, say less by 10%, make any difference to the printer’s life? I would rather take a premium of 10% by delving into the means by which I can help him improve margins on overall revenue by 5%. For example, when we propose to provide brand protection, we do tie-up with the printer’s client, where required, and develop a unique product or design, such that the value chain benefits. The outcome is three-fold, we add value, build loyalty and increase margins; at the end of which, everyone prospers.

It is a process of transformation, which is eventually being adopted by the industry. At the end of the day, rate should be the last factor to be blamed for lower sales if the customer is getting his value’s worth.

NMD: Do you partner with the printers to produce the ink? If so, how?

GS: Yes, we do. Through various initiatives– shade development in ink kitchens and matching centres; customisation of inks for best machine performance; tweaking inks to suit the particular water type and machine condition etc, of a specific unit; identifying speciality that can be used to add value and margins for the printers. For example, children’s magic books and anti-copying features for a book printer, among others.

In most cases, we try to restrict the developed products only to that printer for that brand or job so that there is complete interdependence in the channel. Wherever possible, such as in case of security product, we can then indirectly or directly control the requirement that comes up from a different printer. In such a case, we would rather not supply to the other printer, thus disallowing the brand to take advantage of the printers by switching between vendors. Additionally, it also makes duplication difficult.

As it stands today, India has zero-level brand protection, and a printer who sees an opportunity, tries to downplay the importance as he may not be in a position to provide a solution to the client. With our repositioning, we have a natural advantage over bulk players.

NMD: As an ink producer for the offset segment, does the talk of digital overtaking offset pose a threat to you?

GS: Though digital is the preferred choice for very short-run jobs, the technology is still not competitive or profitable to completely replace offset as the current per print cost is high.

Within the existing capacity of offset machines installed, a printer prefers to cut margins, and print anything beyond 500–600 sheets or impressions on an offset machine rather than go for a new digital press – the value of which depreciates to scrap within five years because it becomes obsolete quickly, as the technology is still being developed, unlike a robust offset press which returns substantial value even after 10 or 20 years. The advantage of digital printing, which more than compensates for this higher per print cost, is variable data printing, which in turn allows for better margins and more focussed content.

In reality, digital printing and variable data printing can increase the offset print demand as more VDP implies more focused content and so more business and print. As a result, you need more of offset – as you can’t profitably print the entire job on a digital machine due to high cost. A printer will hence be most profitable if he can combine the strengths of both by moving towards a combination of the two – an offset press with a digital inkjet head installation or a offset press with an offline digital unit just for VDP. There are printers, I know, who are doing their own jugaad to fight the technology. If one tries to fight it head-on with any specific technology, it is in vain.

The technologies need to be collaborated and incorporated into a business plan or game plan. The same is true with screen print, which though slow, can be combined beautifully and profitably with offset to give highest margins and return on investment. Lot of offset printers claim they do not have the set-up to handle screen, but in reality it is the easiest capacity to add. We aim to bring such awareness and concepts to our customers to allow them better margins.

NMD: Do you have an R&D setup?

NMD: Do you have an R&D setup?

GS: Yes. At the centres in Essambe, Taloja, and Mumbai. We do research on the speciality, security and also UV-curable front. In addition to this, we are also doing great amount of research on resins, which is our independent business-line alongside inks.

NMD: So, you say manufacturing resins is an added advantage? Does it help you reduce the price of your ink?

GS: Definitely. But rather than just the competitive advantage, we believe that if we are sure of the raw materials that we are using for our inks, we can approach the market even more confidently.

DS: It gives us better control and hold over the inputs. It also means a longer operating cycle.

NMD: What about other raw materials? Is there an issue when there is a price hike in pigments, etc.?

DS: Increasing costs is one of the biggest pain-points facing the ink industry. Wild fluctuations in raw material pricing right from pigment, resins, oils, etc and efficiencies in procurement through scale need to be balanced on a regular basis for the customers benefit. We have adopted a dynamic pricing policy to address this issue.

The lowest price of a four-colour ink set for webfed is Rs 550–800 basic, and that for sheetfed it is between Rs 800–1600 basic, depending on the quality level, and it can go up to Rs 3000 too.

NMD: What advantage does the Rs 3000-worth set give to the printer?

GS: The one who is willing to buy the Rs 3000-worth set probably knows the “cost of poor quality”. Composition of the ink, when not fit for an application, can cost the printer a lot in other areas. He may, for example, have to exert stringent control over the equipment, or stack lesser sheets or have a job rejection and so on. Even if one job gets a set-off problem then it impacts the complete production cost – 70% being the paper, it will be a loss if the job is rejected. And this could be much costlier than the little savings he has made by opting for cheaper ink.

So, by buying good quality ink, a wise printer chooses to close the window for one of the variables that can possibly go wrong. The same logic applies to fount solution and IPA, as the main costs for a printer are paper and plates.

We have matched the performance of such a set in our portfolio, which costs about Rs 3000, one in which our customer has put faith in. They have bought it earlier and will continue to buy. On the other hand, there are some customers, who will buy this set only for certain high-end jobs, where the customer is willing to pay the price.

DS: The printers today are aware and do understand, but again, one cannot control the entire market.

NMD: Consider a small-sized printer, who doesn’t want to compromise on the ink quality, comes to you and asks for the best at a certain price. What kind of solution will you be able to provide him with? Have you come across such examples?

GS: Everyone, given a choice, wants the best ink for free. On a serious note, a customer would like to pay only for the properties he/she requires. We have three types of four-colour sheetfed ink sets – high-end is Speedset Plus, universal is Pearl, and economical is Aster Plus. Normally these cover the requirements of the general printer who does not want to engage with an ink manufacturer. There are also alternatives to these segments such as Chromo, which is between Pearl and Aster Plus segments, for quality and pricing.

However, we encourage customers that engage with us, seeking a win-win solution. We would have such a customer classify the parameters of an ink, such as: strength, gloss, setting, etc. into what can best be categorised as must-haves; nice but not a must; remove, if costly. This gives us clarity on what can be eliminated and how the cost can be controlled, and hence we can work out the most cost-effective ink for such a buyer.

NMD: Brand owners are demanding green products from the printers. Are there pressures to develop a green ink?

GS: We have chosen not to be into manufacturing of solvent-based inks. We manufacture oil-based inks and also UV-curable inks, which replace the gravure and the solvent-based inks. Hence, we are “green” to a large extent.

DS: We have adopted lead-free production for the last 20 years.

NMD: Do you monitor what your suppliers send you?

GS: Yes, each supply of all raw materials is tested for important properties. Relating to environment, the suppliers certify that their products are heavy-metalfree and are ROHS (Regulation of Hazardous Substances) compliant. An industry-wide awareness has already been created for primary measures like lead-free, heavy metal- free, etc.

NMD: What can a printer expect from United Inks?

GS: We focus on a printer’s applications, focussed markets and type of jobs, rather than just asking him about his equipment and consumption. We would like to move a step forward and collaborate in a way that his success results in our sale. It may include suggesting the right kind of substrates, the perfect ink sets, and special elements / anti-counterfeiting features, among others, all within his budget constraints, or a slight justified increase.

So, a fair price, a great product and providing any kind of customisation within that product line, is what we are keen to offer, and wherever possible we will impact the printer’s margins positively. We believe customisation helps him build and maintain his market share.

NMD: Are you catering to the packaging segment, also?

GS: Yes, we are – in fact, packaging is easily the largest growing segments in printing industry in this last decade. But it does not mean a commercial printer can, one fine day, simply decide to cater to this segment.

DS: An example here is Parksons. They did not wake up one day and enter the packaging segment. They had a plan and have built around that.

GS: Packaging is an entire industry in itself and has its own demands and requirement, which are unique and which is where the ink kitchen concept has evolved. The printers have to use a lot of special shades and also conduct proofing for the end-user, so the ink kitchen allows them quicker response times and the lowest stock levels and best operations. We are also providing turnkey solutions of ink kitchens for packaging printers, as we have a ready working system.

NMD: A lot is spoken about standardisation / differentiation. What does this mean to you?

GS: Standardisation and differentiation do not necessarily clash with each other.

We must achieve standardisation for print processes and ink parameters once the job is designed, to ensure that repeat jobs are of the same consistent quality each time – especially true for packaging segment. But to standardise the complete set of consumables, including the four-colour process set for all jobs, eliminates any amount of differentiation allowed between printers.

Our theory is, if there is a YMCK standardisation, any printer across the globe can print any job to the same level of quality, thereby creating a commoditisation of print, since a quality differentiator or uniqueness no longer exists. The more we standardise, the more commoditised the product becomes, and the more we kill the industry. ISO also says, write what you do and that is the new standard. So why not write a new story altogether?

For packaging, the differentiation factor is to introduce one element, which will be difficult for any other printer, and more importantly any duplicator, to produce, and this product can then be standardised as the product for that brand/commodity. The link between the brand, the designer, the printer and finally the ink maker, is missing today. There is a big gap there, which is an opportunity.

NMD: United Inks has been a standalone firm ever since it was set up. Has the company not considered any mergers or JVs in the course of time?

DS: We did have a technical collaboration initially, with Ault and Wiborg. We were evaluating a partnership or a joint venture to upgrade either on technology or market presence in the country and overseas. However none of the options seemed to be viable. In 1996, we had discussions for a joint venture with Sun Chemicals, but we decided not to go through with the agreement. We were very clear; exiting the business was never our plan. We stayed in the game, and dominated it too.

NMD: Are you happy that you are holding the tag of an Indian manufacturer? Has it leveraged your business?

DS: We are proud of being an Indian manufacturer, but we haven’t really marketed ourselves as ‘Indian’ manufacturers. Even today, for the Indian industry, anything foreign is always better. I hope the faith in an Indian company and brand gets stronger each day.

GS: It gives us a sense of pride, of being titled as the only Indian player, but it also feels lonely at the same time. I would like a lot more Indian companies to give the MNCs a tough fight. Even though the belief prevails that imported is better, one should know that these products are manufactured right here. Some of the materials that these MNCs use are also local, as they cannot afford to import the raw materials. And, beyond a point, there is only a bit of difference on the technological front that can exist between a good ink and a good ink. If you cannot provide a certain minimum level of quality, you are bound to be out of the market.

NMD: Do you have an R&D setup?

NMD: Do you have an R&D setup?

See All

See All