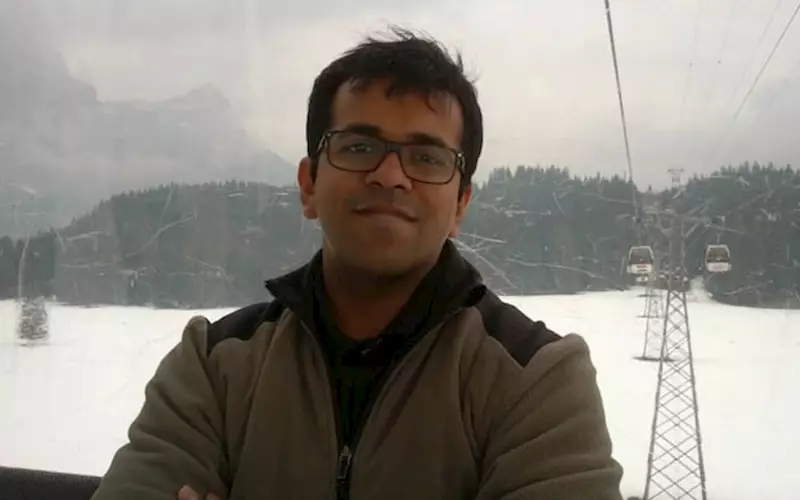

Pratik Shah: Real impact will be visible once eWay bills are implemented

Pratik Shah, director, Printstop, says product categorisation under HSN seems to be a more logical choice

08 Nov 2017 | By PrintWeek India

What has been the impact of GST on your customers? How are your customers coping with multiple GST slabs, tracking of invoices and movement of goods across state borders?

Except for the initial period, where we faced difficulty in getting the tax breakups in our invoices there is no other real issue that we have faced until now. Also, movement of goods across state borders has infact become a lot easier. We will understand the real impact once eWay bills are implemented.

Do you believe it’s in our best interest that all our (printing and packaging industry) the tangible products are covered under HSN (Goods) so that there is a greater chance of coming under the manufacturing sector and acquiring industry status?

Certainly. HSN seems to be a more logical choice. However, I am not in a position to comment on the acquiring industry status part.

The Ministry of Finance issued a Notification No 31/2017-Central Tax (Rate) dated 13 October 2017, which formalised the decisions regarding the GST rates at the 22nd Council meeting on 6 October 2017. Is there clarity, finally? Please name one thing on your wish list for the government.

Yes, there is more clarity but it still defies logic. How can you physically ship or export a service. However, at least the latest AIFMP circular talks of more standardised rates even if it is SAC. For the time being, we will have to be content with that.

Latest Poll: GST hopes to change the indirect tax structure in India. Is GST working thusfar?

GST will be beneficial in the long run: 27%

Good law, poorly implemented: 30%

Small firms face a compliance burden: 15%

Multiple slabs, invoice matching and glitches in the GST Network are a pain: 20%

GST is a uniform and simple tax regime for India: 8%

See All

See All